Question

Interest Expense on Note Payable On the last day of October, Lake Company borrows $60,000 on a bank note for 60 days at 12 percent

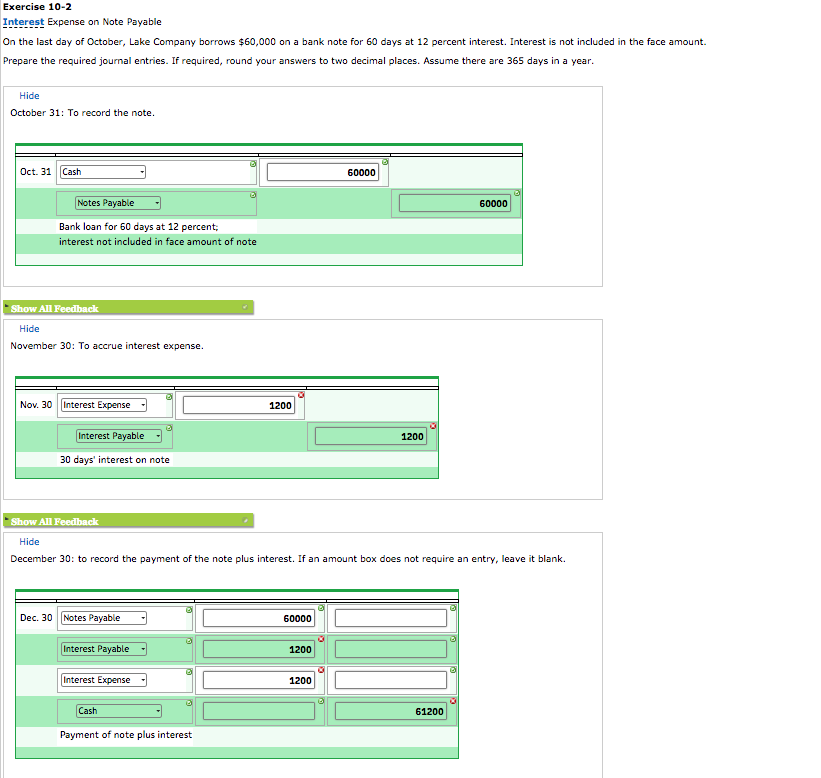

Interest Expense on Note Payable

On the last day of October, Lake Company borrows $60,000 on a bank note for 60 days at 12 percent interest. Interest is not included in the face amount.

Prepare the required journal entries. If required, round your answers to two decimal places. Assume there are 365 days in a year.

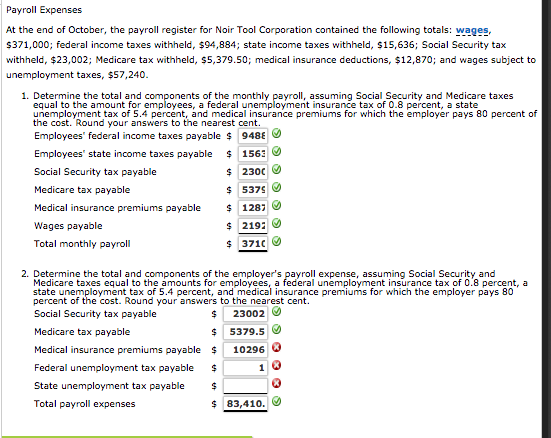

Payroll Expenses

At the end of October, the payroll register for Noir Tool Corporation contained the following totals: wages, $371,000; federal income taxes withheld, $94,884; state income taxes withheld, $15,636; Social Security tax withheld, $23,002; Medicare tax withheld, $5,379.50; medical insurance deductions, $12,870; and wages subject to unemployment taxes, $57,240.

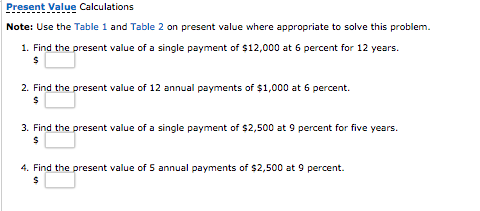

Present Value Calculations

Note: Use the Table 1 and Table 2 on present value where appropriate to solve this problem.

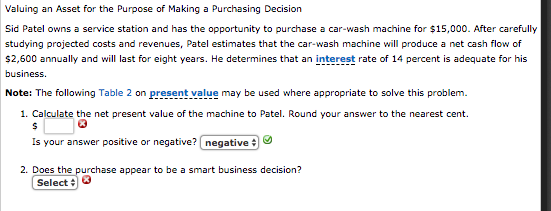

Valuing an Asset for the Purpose of Making a Purchasing Decision

Sid Patel owns a service station and has the opportunity to purchase a car-wash machine for $15,000. After carefully studying projected costs and revenues, Patel estimates that the car-wash machine will produce a net cash flow of $2,600 annually and will last for eight years. He determines that an interest rate of 14 percent is adequate for his business.

Deferred Payment

Alligood Equipment Corporation sold a precision tool machine with computer controls to Kaui Corporation for $400,000 on January 2 and agreed to take payment nine months later on October 2. Assume that the prevailing annual interest rate for such a transaction is 16 percent compounded quarterly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started