Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Payne Boyd is a 24 year old Brisbane born professional rugby league player. He is single and an Australia resident individual for income tax

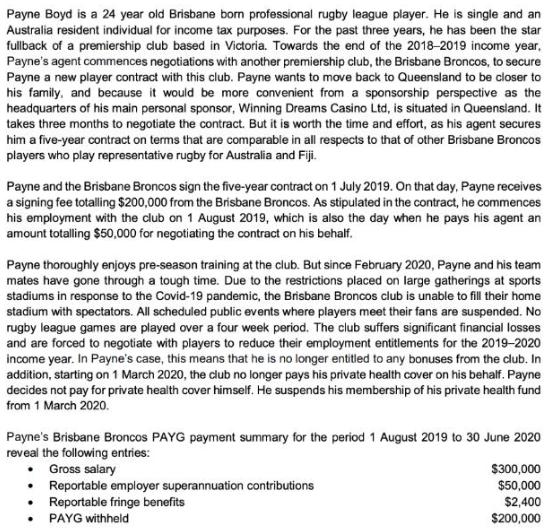

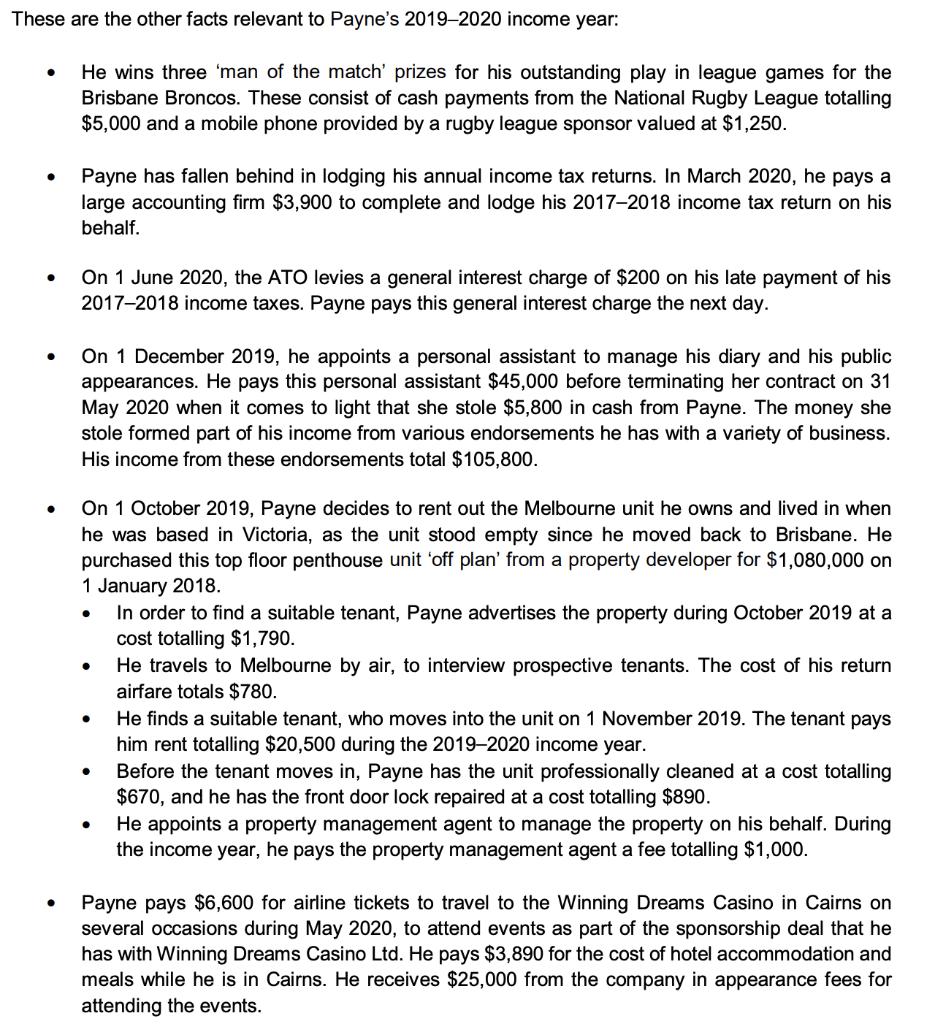

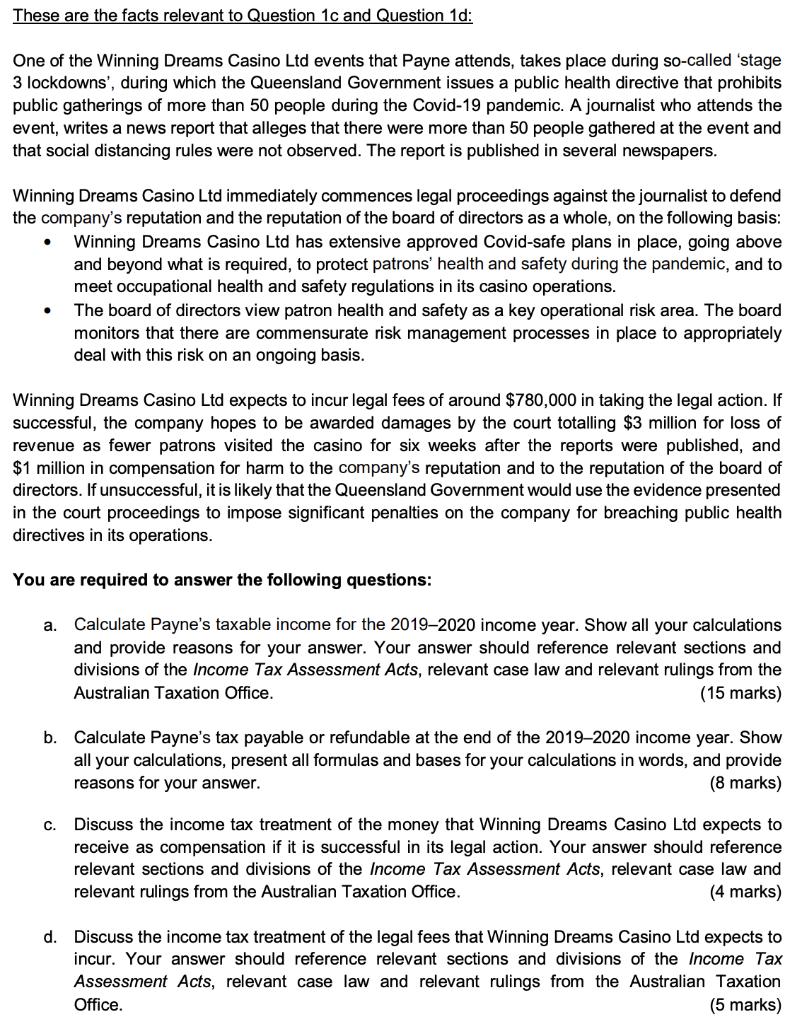

Payne Boyd is a 24 year old Brisbane born professional rugby league player. He is single and an Australia resident individual for income tax purposes. For the past three years, he has been the star fullback of a premiership club based in Victoria. Towards the end of the 2018-2019 income year, Payne's agent commences negotiations with another premiership club, the Brisbane Broncos, to secure Payne a new player contract with this club. Payne wants to move back to Queensland to be closer to his family, and because it would be more convenient from a sponsorship perspective as the headquarters of his main personal sponsor, Winning Dreams Casino Ltd, is situated in Queensland. It takes three months to negotiate the contract. But it is worth the time and effort, as his agent secures him a five-year contract on terms that are comparable in all respects to that of other Brisbane Broncos players who play representative rugby for Australia and Fiji. Payne and the Brisbane Broncos sign the five-year contract on 1 July 2019. On that day, Payne receives a signing fee totalling $200,000 from the Brisbane Broncos. As stipulated in the contract, he commences his employment with the club on 1 August 2019, which is also the day when he pays his agent an amount totalling $50,000 for negotiating the contract on his behalf. Payne thoroughly enjoys pre-season training at the club. But since February 2020, Payne and his team mates have gone through a tough time. Due to the restrictions placed on large gatherings at sports stadiums in response to the Covid-19 pandemic, the Brisbane Broncos club is unable to fill their home stadium with spectators. All scheduled public events where players meet their fans are suspended. No rugby league games are played over a four week period. The club suffers significant financial losses and are forced to negotiate with players to reduce their employment entitlements for the 2019-2020 income year. In Payne's case, this means that he is no longer entitled to any bonuses from the club. In addition, starting on 1 March 2020, the club no longer pays his private health cover on his behalf. Payne decides not pay for private health cover himself. He suspends his membership of his private health fund from 1 March 2020. Payne's Brisbane Broncos PAYG payment summary for the period 1 August 2019 to 30 June 2020 reveal the following entries: Gross salary Reportable employer superannuation contributions Reportable fringe benefits PAYG withheld $300,000 $50,000 $2,400 $200,000 These are the other facts relevant to Payne's 2019-2020 income year: He wins three 'man of the match' prizes for his outstanding play in league games for the Brisbane Broncos. These consist of cash payments from the National Rugby League totalling $5,000 and a mobile phone provided by a rugby league sponsor valued at $1,250. Payne has fallen behind in lodging his annual income tax returns. In March 2020, he pays a large accounting firm $3,900 to complete and lodge his 2017-2018 income tax return on his behalf. On 1 June 2020, the ATO levies a general interest charge of $200 on his late payment of his 2017-2018 income taxes. Payne pays this general interest charge the next day. On 1 December 2019, he appoints a personal assistant to manage his diary and his public appearances. He pays this personal assistant $45,000 before terminating her contract on 31 May 2020 when it comes to light that she stole $5,800 in cash from Payne. The money she stole formed part of his income from various endorsements he has with a variety of business. His income from these endorsements total $105,800. On 1 October 2019, Payne decides to rent out the Melbourne unit he owns and lived in when he was based in Victoria, as the unit stood empty since he moved back to Brisbane. He purchased this top floor penthouse unit 'off plan' from a property developer for $1,080,000 on 1 January 2018. In order to find a suitable tenant, Payne advertises the property during October 2019 at a cost totalling $1,790. He travels to Melbourne by air, to interview prospective tenants. The cost of his return airfare totals $780. He finds a suitable tenant, who moves into the unit on 1 November 2019. The tenant pays him rent totalling $20,500 during the 2019-2020 income year. Before the tenant moves in, Payne has the unit professionally cleaned at a cost totalling $670, and he has the front door lock repaired at a cost totalling $890. He appoints a property management agent to manage the property on his behalf. During the income year, he pays the property management agent a fee totalling $1,000. Payne pays $6,600 for airline tickets to travel to the Winning Dreams Casino in Cairns on several occasions during May 2020, to attend events as part of the sponsorship deal that he has with Winning Dreams Casino Ltd. He pays $3,890 for the cost of hotel accommodation and meals while he is in Cairns. He receives $25,000 from the company in appearance fees for attending the events. These are the facts relevant to Question 1c and Question 1d: One of the Winning Dreams Casino Ltd events that Payne attends, takes place during so-called 'stage 3 lockdowns', during which the Queensland Government issues a public health directive that prohibits public gatherings of more than 50 people during the Covid-19 pandemic. A journalist who attends the event, writes a news report that alleges that there were more than 50 people gathered at the event and that social distancing rules were not observed. The report is published in several newspapers. Winning Dreams Casino Ltd immediately commences legal proceedings against the journalist to defend the company's reputation and the reputation of the board of directors as a whole, on the following basis: Winning Dreams Casino Ltd has extensive approved Covid-safe plans in place, going above and beyond what is required, to protect patrons' health and safety during the pandemic, and to meet occupational health and safety regulations in its casino operations. The board of directors view patron health and safety as a key operational risk area. The board monitors that there are commensurate risk management processes in place to appropriately deal with this risk on an ongoing basis. Winning Dreams Casino Ltd expects to incur legal fees of around $780,000 in taking the legal action. If successful, the company hopes to be awarded damages by the court totalling $3 million for loss of revenue as fewer patrons visited the casino for six weeks after the reports were published, and $1 million in compensation for harm to the company's reputation and to the reputation of the board of directors. If unsuccessful, it is likely that the Queensland Government would use the evidence presented in the court proceedings to impose significant penalties on the company for breaching public health directives in its operations. You are required to answer the following questions: a. Calculate Payne's taxable income for the 2019-2020 income year. Show all your calculations and provide reasons for your answer. Your answer should reference relevant sections and divisions of the Income Tax Assessment Acts, relevant case law and relevant rulings from the Australian Taxation Office. (15 marks) b. Calculate Payne's tax payable or refundable at the end of the 2019-2020 income year. Show all your calculations, present all formulas and bases for your calculations in words, and provide reasons for your answer. (8 marks) C. Discuss the income tax treatment of the money that Winning Dreams Casino Ltd expects to receive as compensation if it is successful in its legal action. Your answer should reference relevant sections and divisions of the Income Tax Assessment Acts, relevant case law and relevant rulings from the Australian Taxation Office. (4 marks) d. Discuss the income tax treatment of the legal fees that Winning Dreams Casino Ltd expects to incur. Your answer should reference relevant sections and divisions of the Income Tax Assessment Acts, relevant case law and relevant rulings from the Australian Taxation Office. (5 marks)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate Paynes taxable income for the 20192020 income year we need to consider all the relevant income and deductions Gross salary 300000 Reportable employer superannuation contributions 50000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started