Answered step by step

Verified Expert Solution

Question

1 Approved Answer

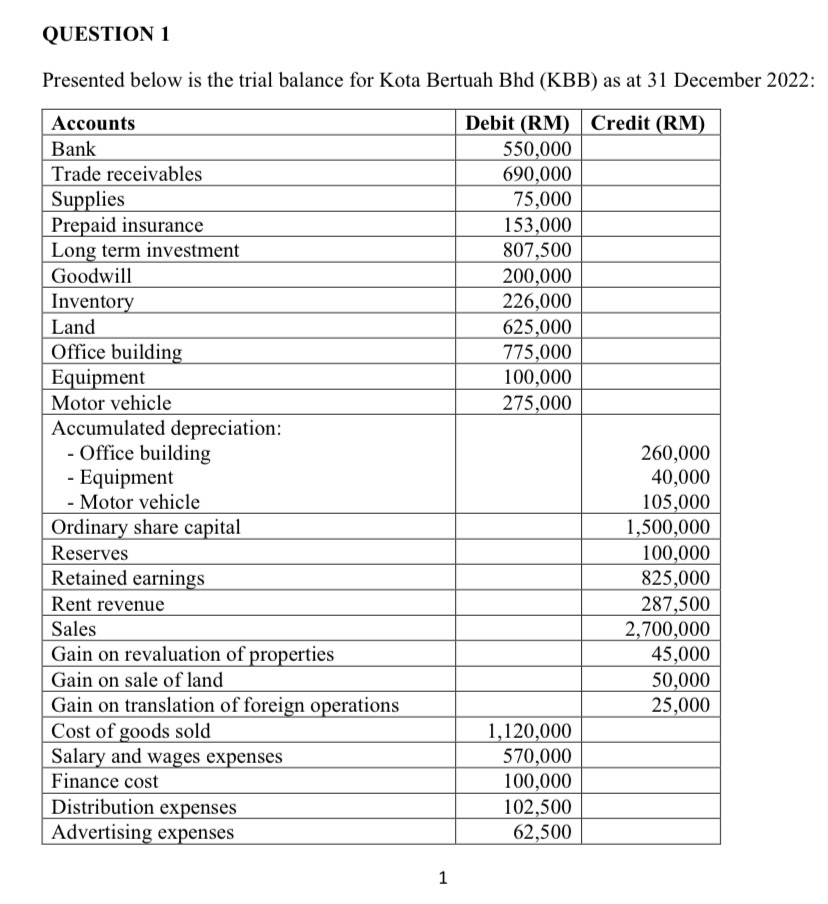

QUESTION 1 Presented below is the trial balance for Kota Bertuah Bhd (KBB) as at 31 December 2022: Accounts Bank Debit (RM) Credit (RM)

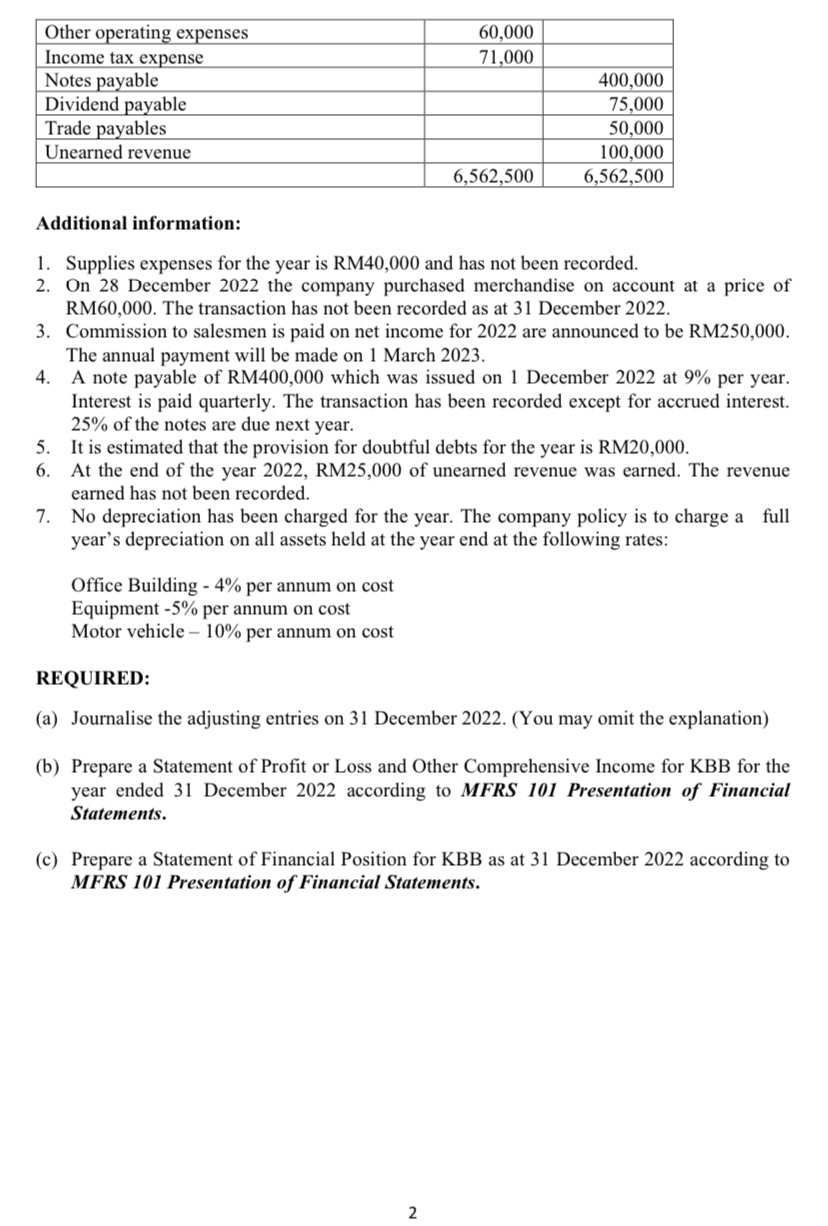

QUESTION 1 Presented below is the trial balance for Kota Bertuah Bhd (KBB) as at 31 December 2022: Accounts Bank Debit (RM) Credit (RM) 550,000 Trade receivables 690,000 Supplies 75,000 Prepaid insurance 153,000 Long term investment 807,500 Goodwill 200,000 Inventory 226,000 Land 625,000 Office building 775,000 Equipment 100,000 275,000 260,000 Motor vehicle Accumulated depreciation: - Office building - Equipment - Motor vehicle Ordinary share capital Reserves Retained earnings Rent revenue Sales Gain on revaluation of properties Gain on sale of land Gain on translation of foreign operations Cost of goods sold Salary and wages expenses Finance cost Distribution expenses Advertising expenses 40,000 105,000 1,500,000 100,000 825,000 287,500 2,700,000 45,000 50,000 25,000 1,120,000 570,000 100,000 102,500 62,500 1 Other operating expenses 60,000 Income tax expense 71,000 Notes payable Dividend payable Trade payables 400,000 75,000 50,000 Unearned revenue Additional information: 100,000 6,562,500 6,562,500 1. Supplies expenses for the year is RM40,000 and has not been recorded. 2. On 28 December 2022 the company purchased merchandise on account at a price of RM60,000. The transaction has not been recorded as at 31 December 2022. 3. Commission to salesmen is paid on net income for 2022 are announced to be RM250,000. The annual payment will be made on 1 March 2023. 4. A note payable of RM400,000 which was issued on 1 December 2022 at 9% per year. Interest is paid quarterly. The transaction has been recorded except for accrued interest. 25% of the notes are due next year. 5. It is estimated that the provision for doubtful debts for the year is RM20,000. 6. At the end of the year 2022, RM25,000 of unearned revenue was earned. The revenue earned has not been recorded. 7. No depreciation has been charged for the year. The company policy is to charge a full year's depreciation on all assets held at the year end at the following rates: Office Building - 4% per annum on cost Equipment -5% per annum on cost Motor vehicle REQUIRED: 10% per annum on cost (a) Journalise the adjusting entries on 31 December 2022. (You may omit the explanation) (b) Prepare a Statement of Profit or Loss and Other Comprehensive Income for KBB for the year ended 31 December 2022 according to MFRS 101 Presentation of Financial Statements. (c) Prepare a Statement of Financial Position for KBB as at 31 December 2022 according to MFRS 101 Presentation of Financial Statements. 2

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Adjusting Entries on 31 December 2022 No Account Debit RM Credit RM 1 Supplies Expenses 400...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started