Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question (10 marks) Beth Murphy owns a bookshop, The Book Inn, as a sole trader. She sells books for cash and on credit. The

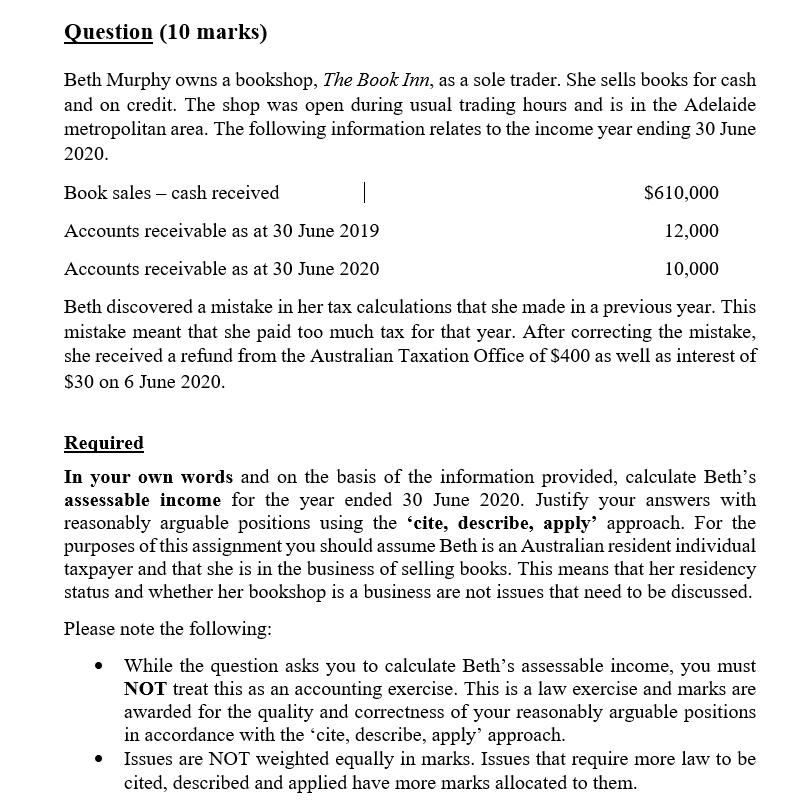

Question (10 marks) Beth Murphy owns a bookshop, The Book Inn, as a sole trader. She sells books for cash and on credit. The shop was open during usual trading hours and is in the Adelaide metropolitan area. The following information relates to the income year ending 30 June 2020. Book sales - cash received $610,000 Accounts receivable as at 30 June 2019 12,000 Accounts receivable as at 30 June 2020 10,000 Beth discovered a mistake in her tax calculations that she made in a previous year. This mistake meant that she paid too much tax for that year. After correcting the mistake, she received a refund from the Australian Taxation Office of $400 as well as interest of $30 on 6 June 2020. Required In your own words and on the basis of the information provided, calculate Beth's assessable income for the year ended 30 June 2020. Justify your answers with reasonably arguable positions using the cite, describe, apply' approach. For the purposes of this assignment you should assume Beth is an Australian resident individual taxpayer and that she is in the business of selling books. This means that her residency status and whether her bookshop is a business are not issues that need to be discussed. Please note the following: While the question asks you to calculate Beth's assessable income, you must NOT treat this as an accounting exercise. This is a law exercise and marks are awarded for the quality and correctness of your reasonably arguable positions in accordance with the 'cite, describe, apply' approach. Issues are NOT weighted equally in marks. Issues that require more law to be cited, described and applied have more marks allocated to them.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER B eth s assess able income for the year ended 30 June 2020 is 600 03...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started