Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Antique Furnishings Ltd. is a Yuen Long based manufacturer making three unique wood products: bed-frames, coffee tables, footstools. These products are completely carved by

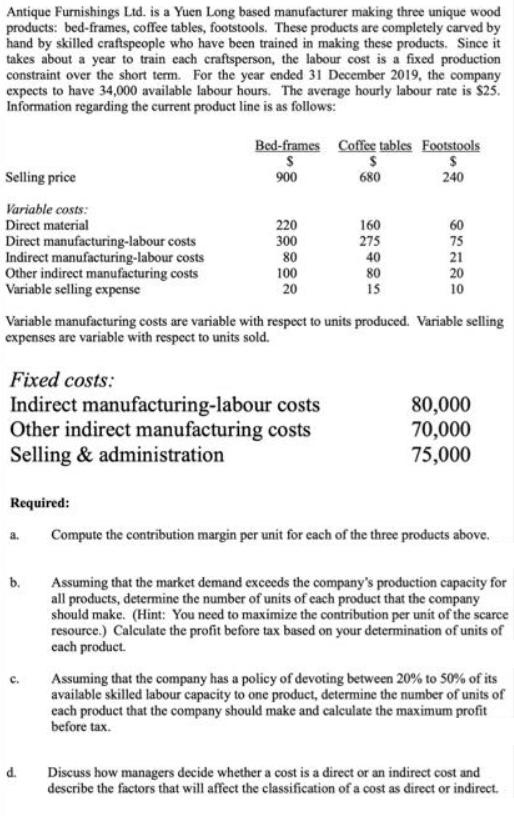

Antique Furnishings Ltd. is a Yuen Long based manufacturer making three unique wood products: bed-frames, coffee tables, footstools. These products are completely carved by hand by skilled craftspeople who have been trained in making these products. Since it takes about a year to train each craftsperson, the labour cost is a fixed production constraint over the short term. For the year ended 31 December 2019, the company expects to have 34,000 available labour hours. The average hourly labour rate is $25. Information regarding the current product line is as follows: Bed-frames Coffee tables Footstools Selling price 900 680 240 Variable costs: Direct material 220 300 160 275 60 Direct manufacturing-labour costs Indirect manufacturing-labour costs Other indirect manufacturing costs Variable selling expense 75 80 40 21 20 100 80 20 15 10 Variable manufacturing costs are variable with respect to units produced. Variable selling expenses are variable with respect to units sold. Fixed costs: Indirect manufacturing-labour costs Other indirect manufacturing costs Selling & administration 80,000 70,000 75,000 Required: a. Compute the contribution margin per unit for cach of the three products above. b. Assuming that the market demand exceeds the company's production capacity for all products, determine the number of units of cach product that the company should make. (Hint: You need to maximize the contribution per unit of the scarce resource.) Calculate the profit before tax based on your determination of units of cach product. Assuming that the company has a policy of devoting between 20% to 50% of its available skilled labour capacity to one product, determine the number of units of cach product that the company should make and calculate the maximum profit before tax. d. Discuss how managers decide whether a cost is a direct or an indirect cost and describe the factors that will affect the classification of a cost as direct or indirect.

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A PARTICULATS BAD FRAMES COFFE TABLES FOOTSTOOLS SALES 900 680 240 LESS VARIABLE COST DIRECT MATERIAL 220 160 60 DIRECT LABOUR 300 275 75 INDIRECT LABOUR 80 40 21 OTHER INDIRECT MFG COST 100 80 20 VAR...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started