Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6. In 2019, Jean Yus acquired 1,000 shares of Fubar Ltd. (a Canadian public corporation) at a cost of $23,000 plus a brokerage

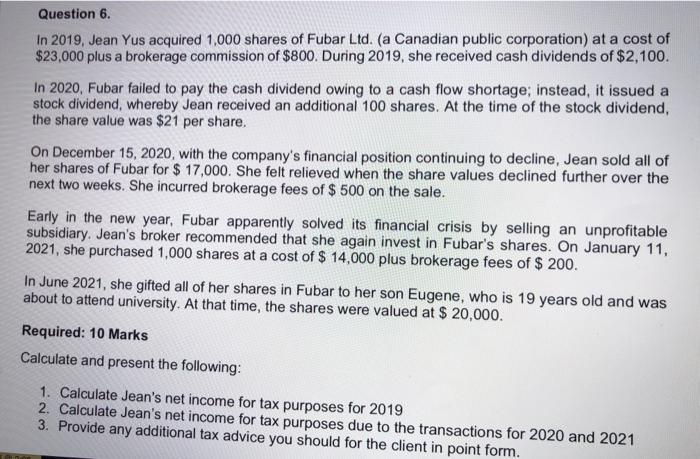

Question 6. In 2019, Jean Yus acquired 1,000 shares of Fubar Ltd. (a Canadian public corporation) at a cost of $23,000 plus a brokerage commission of $800. During 2019, she received cash dividends of $2,100. In 2020, Fubar failed to pay the cash dividend owing to a cash flow shortage; instead, it issued a stock dividend, whereby Jean received an additional 100 shares. At the time of the stock dividend, the share value was $21 per share. On December 15, 2020, with the company's financial position continuing to decline, Jean sold all of her shares of Fubar for $ 17,000. She felt relieved when the share values declined further over the next two weeks. She incurred brokerage fees of $ 500 on the sale. Early in the new year, Fubar apparently solved its financial crisis by selling an unprofitable subsidiary. Jean's broker recommended that she again invest in Fubar's shares. On January 11, 2021, she purchased 1,000 shares at a cost of $ 14,000 plus brokerage fees of $ 200. In June 2021, she gifted all of her shares in Fubar to her son Eugene, who is 19 years old and was about to attend university. At that time, the shares were valued at $ 20,000. Required: 10 Marks Calculate and present the following: 1. Calculate Jean's net income for tax purposes for 2019 2. Calculate Jean's net income for tax purposes due to the transactions for 2020 and 2021 3. Provide any additional tax advice you should for the client in point form.

Step by Step Solution

★★★★★

3.59 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 Net income for tax purposes for 2019 D ivid ends received C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started