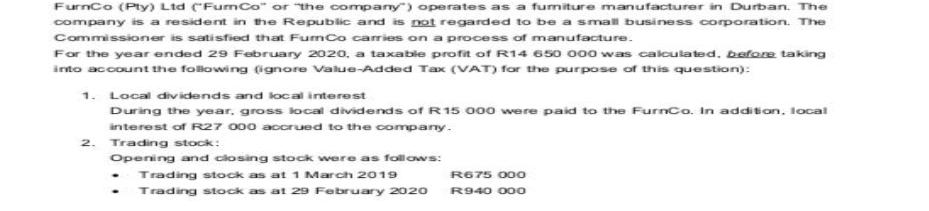

FurnCo (Pty) Ltd (FumCo or the company) operates as a furniture manufacturer in Durban. The company is a resident in the Republic and is

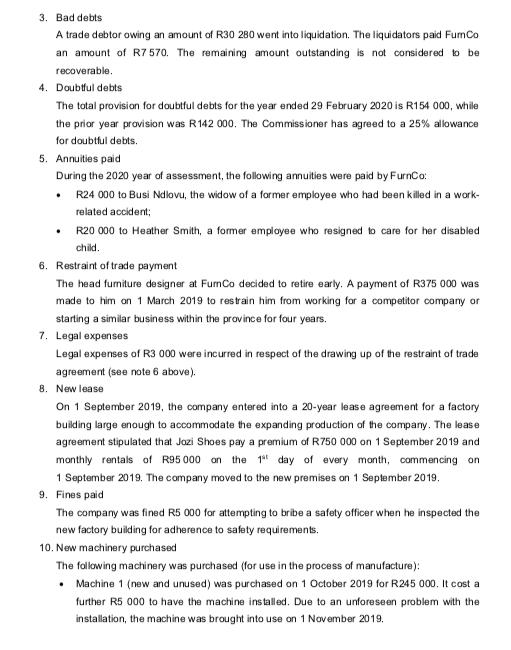

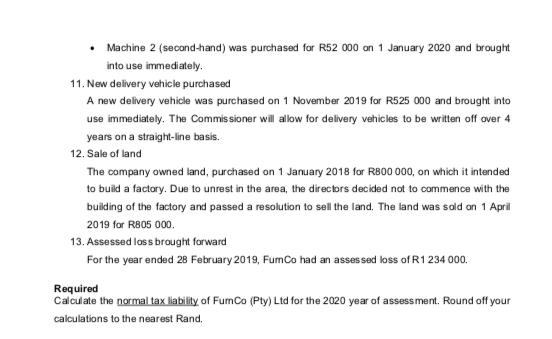

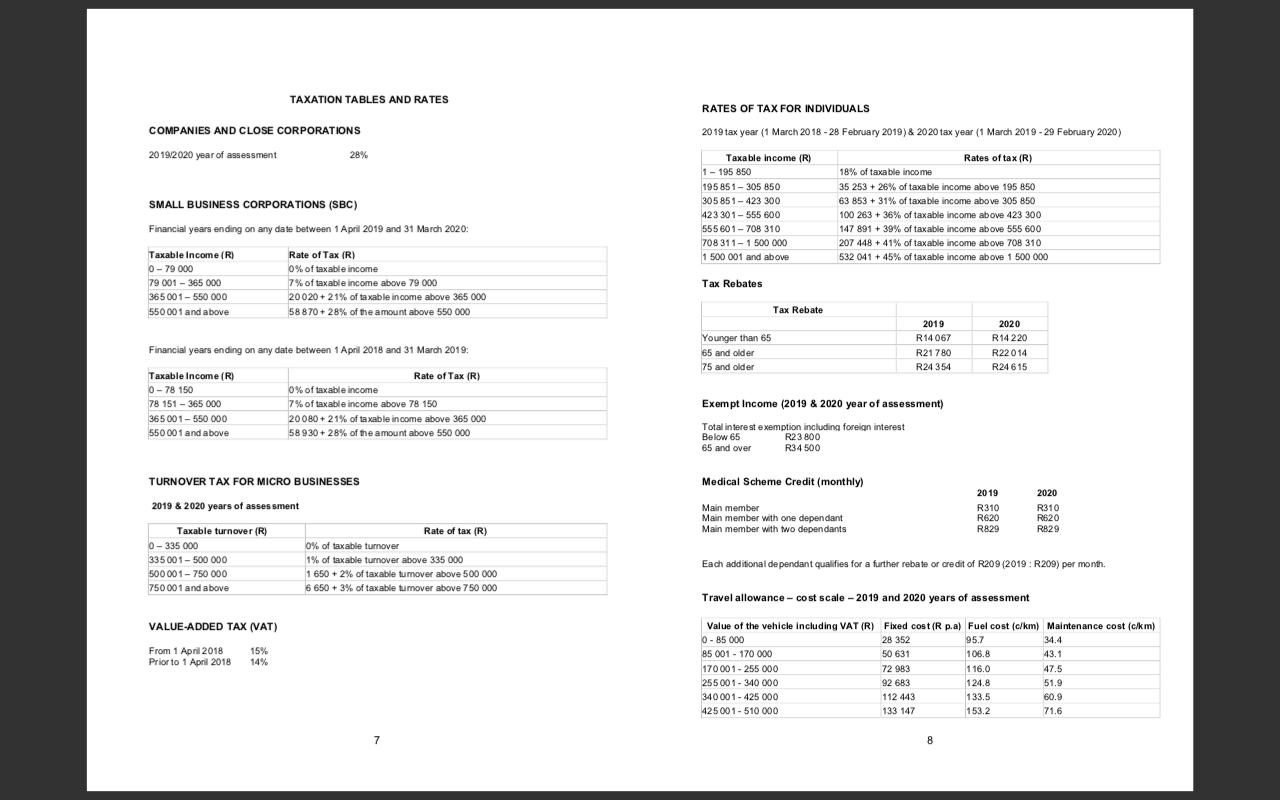

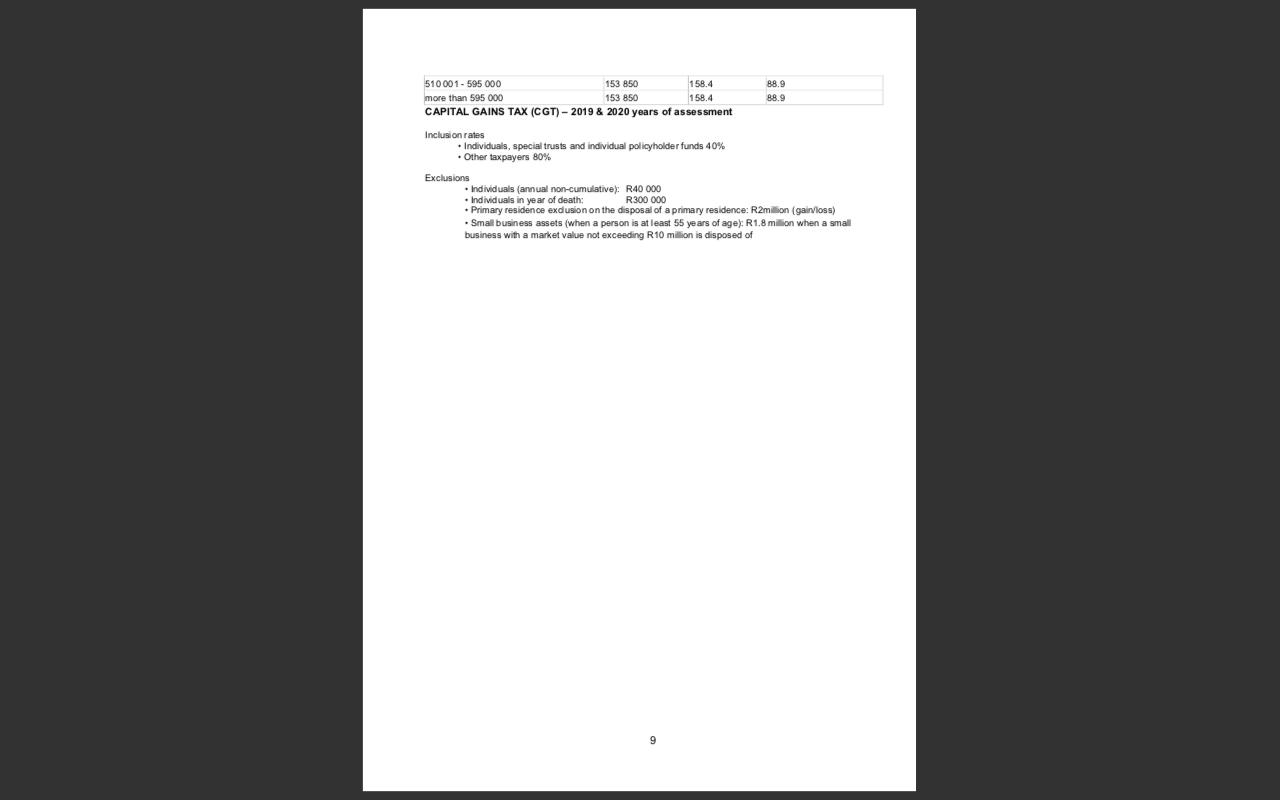

FurnCo (Pty) Ltd ("FumCo" or "the company") operates as a furniture manufacturer in Durban. The company is a resident in the Republic and is not regarded to be a small business corporation. The Commissioner is satisfied that FumCo carries on a process of manufacture. For the year ended 29 February 2020, a taxable profit of R14 650 000 was calculated, before taking into account the following (ignore Value-Added Tax (VAT) for the purpose of this question): 1. 2. Local dividends and local interest During the year, gross local dividends of R15 000 were paid to the FurnCo. In addition, local interest of R27 000 accrued to the company. Trading stock: Opening and closing stock were as follows: Trading stock as at 1 March 2019 Trading stock as at 29 February 2020 R675 000 R940 000 3. Bad debts A trade debtor owing an amount of R30 280 went into liquidation. The liquidators paid FumCo an amount of R7 570. The remaining amount outstanding is not considered to be recoverable. 4. Doubtful debts The total provision for doubtful debts for the year ended 29 February 2020 is R154 000, while the prior year provision was R142 000. The Commissioner has agreed to a 25% allowance for doubtful debts. 5. Annuities paid During the 2020 year of assessment, the following annuities were paid by FurnCo: R24 000 to Busi Ndlovu, the widow of a former employee who had been killed in a work- related accident; . R20 000 to Heather Smith, a former employee who resigned to care for her disabled child. 6. Restraint of trade payment The head furniture designer at FurnCo decided to retire early. A payment of R375 000 was made to him on 1 March 2019 to restrain him from working for a competitor company or starting a similar business within the province for four years. 7. Legal expenses Legal expenses of R3 000 were incurred in respect of the drawing up of the restraint of trade agreement (see note 6 above). 8. New lease On 1 September 2019, the company entered into a 20-year lease agreement for a factory building large enough to accommodate the expanding production of the company. The lease agreement stipulated that Jozi Shoes pay a premium of R750 000 on 1 September 2019 and monthly rentals of R95 000 on the 1st day of every month, commencing on 1 September 2019. The company moved to the new premises on 1 September 2019. 9. Fines paid The company was fined R5 000 for attempting to bribe a safety officer when he inspected the new factory building for adherence to safety requirements. 10. New machinery purchased The following machinery was purchased (for use in the process of manufacture): Machine 1 (new and unused) was purchased on 1 October 2019 for R245 000. It cost a further R5 000 to have the machine installed. Due to an unforeseen problem with the installation, the machine was brought into use on 1 November 2019. Machine 2 (second-hand) was purchased for R52 000 on 1 January 2020 and brought into use immediately. 11. New delivery vehicle purchased A new delivery vehicle was purchased on 1 November 2019 for R525 000 and brought into use immediately. The Commissioner will allow for delivery vehicles to be written off over 4 years on a straight-line basis. 12. Sale of land The company owned land, purchased on 1 January 2018 for R800 000, on which it intended to build a factory. Due to unrest in the area, the directors decided not to commence with the building of the factory and passed a resolution to sell the land. The land was sold on 1 April 2019 for R805 000. 13. Assessed loss brought forward For the year ended 28 February 2019, FumCo had an assessed loss of R1 234 000. Required Calculate the normal tax liability of FumCo (Pty) Ltd for the 2020 year of assessment. Round off your calculations to the nearest Rand. COMPANIES AND CLOSE CORPORATIONS 2019/2020 year of assessment Taxable Income (R) 0-79 000 79 001-365 000 365001-550 000 550 001 and above SMALL BUSINESS CORPORATIONS (SBC) Financial years ending on any date between 1 April 2019 and 31 March 2020: TAXATION TABLES AND RATES 0-335 000 335001-500 000 500 001-750 000 750 001 and above 28% Financial years ending on any date between 1 April 2018 and 31 March 2019: Rate of Tax (R) Taxable Income (R) 0-78 150 78 151-365 000 365 001-550 000 550 001 and above VALUE-ADDED TAX (VAT) From 1 April 2018 Prior to 1 April 2018 Rate of Tax (R) 0% of taxable income 7% of taxable income above 79 000 15% 14% 20020+21% of taxable income above 365 000 58870+ 28% of the amount above 550 TURNOVER TAX FOR MICRO BUSINESSES 2019 & 2020 years of assessment Taxable turnover (R) 0% of taxable income 7% of taxable income above 78 150 20080 +21% of taxable income above 365 000 58930 + 28% of the amount above 550 000 Rate of tax (R) 0% of taxable turnover 1% of taxable turnover above 335 000 1 650 + 2% of taxable turnover above 500 000 6 650 + 3% of taxable turnover above 750 000 7 RATES OF TAX FOR INDIVIDUALS 2019 tax year (1 March 2018-28 February 2019) & 2020 tax year (1 March 2019-29 February 2020) Rates of tax (R) Taxable income (R) 1-195 850 195 851-305 850 305851-423 300 423 301-555 600 555601-708 310 708 311-1 500 000 1 500 001 and above Tax Rebates Younger than 65 65 and older 75 and older Tax Rebate 18% of taxable income 35 253 +26% of taxable income above 195 850 63 853 +31% of taxable income above 305 850 100 263 + 36 % of taxable income above 423 300 147 891 +39% of taxable income above 555 600 207 448 + 41% of taxable income above 708 310 532 041+45% of taxable income above 1 500 000 Exempt Income (2019 & 2020 year of assessment) Total interest exemption including foreign interest Below 65 R23 800 65 and over R34 500 Medical Scheme Credit (monthly) Main member Main member with one dependant Main member with two dependants 2019 R14 067 R21780 R24 354 85 001 - 170 000 170 001-255 000 255 001-340 000 340001-425 000 425 001-510 000 2020 R14 220 R22014 R24 615 2019 R310 R620 R829 Each additional de pendant qualifies for a further rebate or credit of R209 (2019: R209) per month. Travel allowance - cost scale-2019 and 2020 years of assessment Value of the vehicle including VAT (R) 0-85 000 8 2020 R310 R620 R829 Fixed cost (R p.a) Fuel cost (c/km) Maintenance cost (c/km) 28 352 95.7 50 631 106.8 72 983 116.0 92 683 124.8 112 443 133.5 133 147 153.2 34.4 43.1 47.5 51.9 60.9 71.6 158.4 153 850 153 850 158.4 CAPITAL GAINS TAX (CGT)-2019 & 2020 years of assessment. 510001-595 000 more than 595 000 Inclusion rates Individuals, special trusts and individual policyholder funds 40% . Other taxpayers 80% Exclusions 88.9 Individuals (annual non-cumulative): R40 000 Individuals in year of death: R300 000 Primary residence exclusion on the disposal of a primary residence: R2million (gain/loss) Small business assets (when a person is at least 55 years of age): R1.8 million when a small business with a market value not exceeding R10 million is disposed of

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Normal tax liability taxable profit x tax rate Taxable profit gross profit allowable deductio...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started