Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting || questions(please answer all) Which item does not belong to direct materials? Selected Answer: The cost of electronic components for a television B. Answers:

Accounting || questions(please answer all)

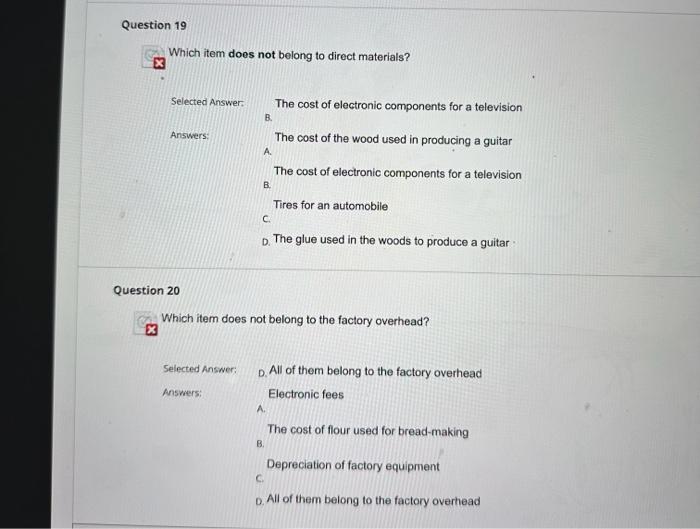

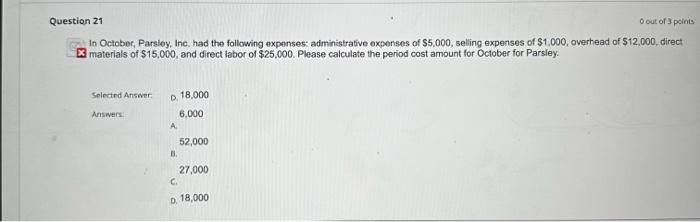

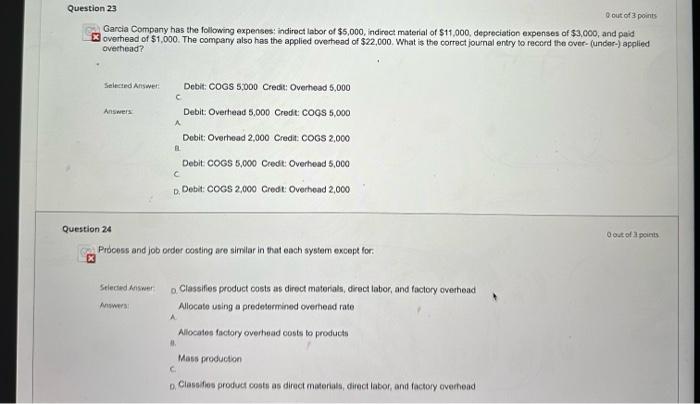

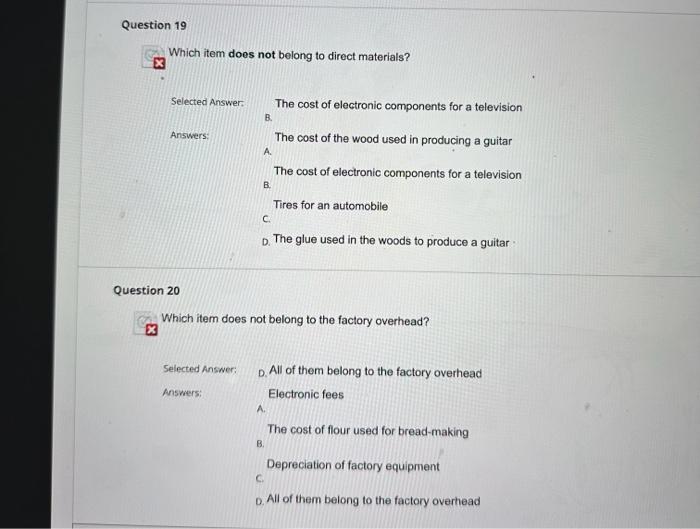

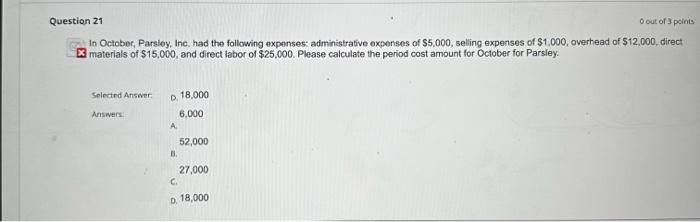

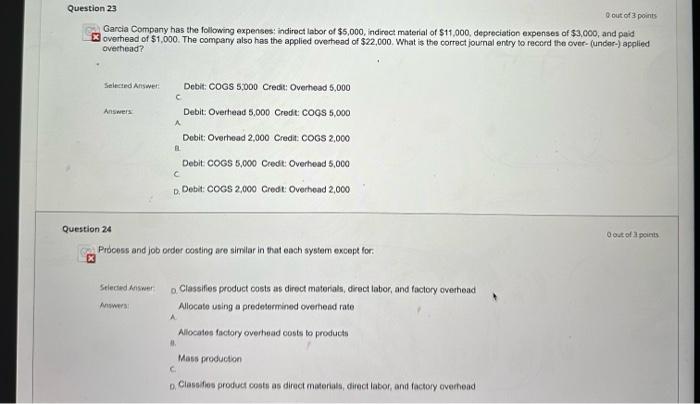

Which item does not belong to direct materials? Selected Answer: The cost of electronic components for a television B. Answers: The cost of the wood used in producing a guitar A. The cost of electronic components for a television B. Tires for an automobile C. D. The glue used in the woods to produce a guitar : estion 20 Which item does not belong to the factory overhead? x Selected Answer: D. All of them belong to the factory overhead Answers: Electronic fees A. The cost of flour used for bread-making B. Depreciation of factory equipment C. D. All of them belong to the factory overhead Garcia Company has the following expenses; indirect labor of $5,000, indirect material of $11,000, depreciation expenses of $3,000, and paid 8 overhead of $1,000. The company also has the applied overthead of $22,000. What is the correct journal entry to record the over- (under-) applied ovechead? Seleteded Answet: C. Answers: Debit: COGS 5,000 Crest; Overhoad 5,000 Debit: Overhead 5,000 Credt: COCS 5,000 A Dobit: Overhead 2,000 Credit: COGS 2,000 A. Debit COGS 5,000 Credt: Overhead 5,000 c. D. Debit: COGS 2,000 Gredt: Overhoad 2,000 Iuestion 24 oost of 3 points X Process and job order costing are similar in that each system except for: Selected hoswet Anomers 0. Classifies product costs as direct materials, direct labor, and factory ovenhead Alocate using a predetermined overhead rate A. Allocates factory overhead costs to products a. Mass production C. 0, Classifes product costs as direct materials, direct labor, and factory ovechead In October, Parsloy, Inc, had the following expenses: administrative expenses of $5,000, selling expenses of $1,000, overhead of $12,000, direct I materials of $15,000, and direct labor of $25,000. Please calculate the period cost amount for October for Parsley

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started