Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The table below shows hypothetical outputs for 3 countries and 2 states of nature related to world climate conditions which may happen with

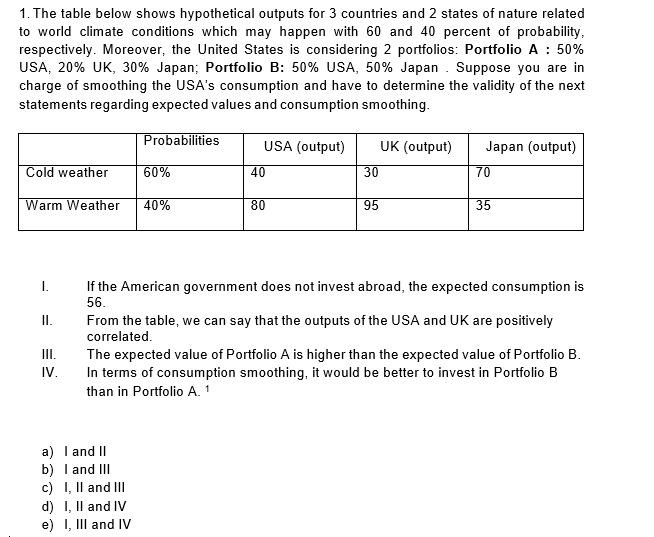

1. The table below shows hypothetical outputs for 3 countries and 2 states of nature related to world climate conditions which may happen with 60 and 40 percent of probability. respectively. Moreover, the United States is considering 2 portfolios: Portfolio A: 50% USA, 20% UK, 30% Japan; Portfolio B: 50% USA, 50% Japan. Suppose you are in charge of smoothing the USA's consumption and have to determine the validity of the next statements regarding expected values and consumption smoothing. Probabilities Cold weather 60% Warm Weather 40% II. III. IV. USA (output) 40 80 30 95 a) I and II b) I and III c) I, II and III d) I, II and IV e) I, III and IV UK (output) Japan (output) 70 35 If the American government does not invest abroad, the expected consumption is 56. From the table, we can say that the outputs of the USA and UK are positively correlated. The expected value of Portfolio A is higher than the expected value of Portfolio B. In terms of consumption smoothing, it would be better to invest in Portfolio B than in Portfolio A. 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Explanation 1 Expected production for Us if it does not invest abroad 40 if there i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started