Answered step by step

Verified Expert Solution

Question

1 Approved Answer

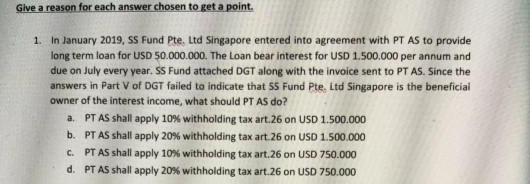

Give a reason for each answer chosen to get a point. 1. In January 2019, SS Fund Pte. Ltd Singapore entered into agreement with

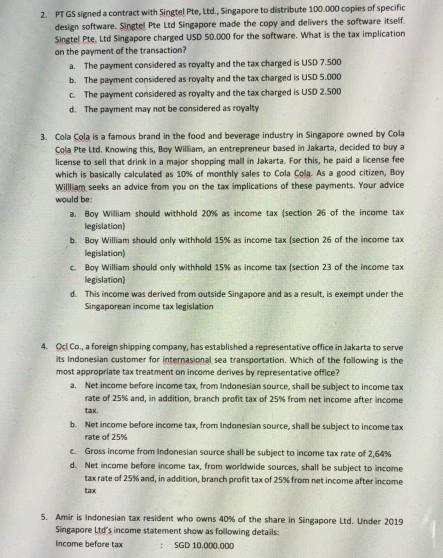

Give a reason for each answer chosen to get a point. 1. In January 2019, SS Fund Pte. Ltd Singapore entered into agreement with PT AS to provide long term loan for USD 50.000.000. The Loan bear interest for USD 1.500.000 per annum and due on July every year. SS Fund attached DGT along with the invoice sent to PT AS. Since the answers in Part V of DGT failed to indicate that 55 Fund Pte. Ltd Singapore is the beneficial owner of the interest income, what should PT AS do? a. b. PT AS shall apply 10 % withholding tax art.26 on USD 1.500.000 PT AS shall apply 20% withholding tax art.26 on USD 1.500.000 PT AS shall apply 10% withholding tax art.26 on USD 750.000 d. PT AS shall apply 20% withholding tax art.26 on USD 750.000 c. 2. PT GS signed a contract with Singtel Pte, Ltd., Singapore to distribute 100.000 copies of specific design software. Singtel Pte Ltd Singapore made the copy and delivers the software itself. Singtel Pte. Ltd Singapore charged USD 50.000 for the software. What is the tax implication. on the payment of the transaction? a. The payment considered as royalty and the tax charged is USD 7.500 b. The payment considered as royalty and the tax charged is USD 5.000 c. The payment considered as royalty and the tax charged is USD 2.500 d. The payment may not be considered as royalty 3. Cola Cola is a famous brand in the food and beverage industry in Singapore owned by Cola Cola Pte Ltd. Knowing this, Boy William, an entrepreneur based in Jakarta, decided to buy a license to sell that drink in a major shopping mall in Jakarta. For this, he paid a license feel which is basically calculated as 10% of monthly sales to Cola Cola. As a good citizen, Boy William seeks an advice from you on the tax implications of these payments. Your advice. would be: a. Boy William should withhold 20% as income tax (section 26 of the income tax legislation) b. Boy William should only withhold 15% as income tax (section 26 of the income tax legislation) c Boy William should only withhold 15% as income tax (section 23 of the income tax legislation) d. This income was derived from outside Singapore and as a result, is exempt under the Singaporean income tax legislation 4. Oci Co., a foreign shipping company, has established a representative office in Jakarta to serve its Indonesian customer for internasional sea transportation. Which of the following is the most appropriate tax treatment on income derives by representative office? a. Net income before income tax, from Indonesian source, shall be subject to income tax rate of 25% and, in addition, branch profit tax of 25% from net income after income tax b. Net income before income tax, from Indonesian source, shall be subject to income tax rate of 25% c Gross income from Indonesian source shall be subject to income tax rate of 2,64% d. Net income before income tax, from worldwide sources, shall be subject to income tax rate of 25% and, in addition, branch profit tax of 25% from net income after income tax 5. Amir is Indonesian tax resident who owns 40% of the share in Singapore Ltd. Under 2019 Singapore Ltd's income statement show as following details: Income before tax : SGD 10.000.000 SGD 1.700.000 Income Corporate Income tax after tax SGD 8.300.000 Nevertheless, after a quarter of 2020, Amir as a majority shareholder of Singapore Ltd. has no received any deviden payment. Based on the data above....... a. In the fourth month after the annual corporate income tax return filling deadline in Singapore, Amir has to declare his dividend income b. Amir is deemed to received dividend from Singapore Ltd on the amount of SGD 3.320.000 c. Both A and B are correct answers d. A,B,C are incorrect answers Case 1 (point 20%) dr. Veejay (K/3) is an Indian citizen who started living in Indonesia in June 2019. dr. Veejay is a cardiologist who practices at a Healthy Heart Hospital with the agreement that every doctor's service that suits the patient will be deducted 20% by the hospital as part of the hospital stage and the remaining 80% of the doctor's services will be carried out to dr. Veejay at the end of each month. dr. Veejay has been registered as a taxpayer at KPP Pratama Jakarta Tanah Abang Dua, House in the Petamburan area, dr. Veejay also open a cardiac specialist practice. In the first three months of 2014, the doctor's services were seen by patients at the Healthy Heart Hospital for the actions of dr. Veejay is as follows: Amount of Doctor Services paid by Patients (Rp) 50,000,000 40,000,000 Month January February March 70,000,000 Calculate the tax objects that are the obligation of the Healthy Heart Hospital and explain the tax implications! Case 2 (point 20%) PT ABC is a company engaged in all fields of business. Shareholders of PT ABC are Mr. Widodo (25% ownership), Mr. Wen Yung a Malaysian citizen and residing in Malaysia (25% ownership), PT SWJ (30% ownership) and PT TUM (20% ownership). In October 2019 PT ABC paid dividends to each shareholder according to their ownership with a total dividend of Idr 100,000,000. Calculate the tax in that case and explain it each tax object! Case 3 (point 10 %) Dutch NV is a limited company which domicile in Netherlands. This Company received royalty payment from PT. ABS (Indonesian Company) in June 2019 amount of USD 50.000. Due to Dutch NV is late to provide GDT-1 form. Explain the case based on the students know about international taxation!

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 c PT AS shall apply 10 withholding tax art26 on USD 750000 The reason PT AS should apply 10 withho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started