Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The 10-year Treasury is 0.64%, 5 year is 0.28% and money market instruments are running around 0.09%. The rates, adjusting for inflation, are all

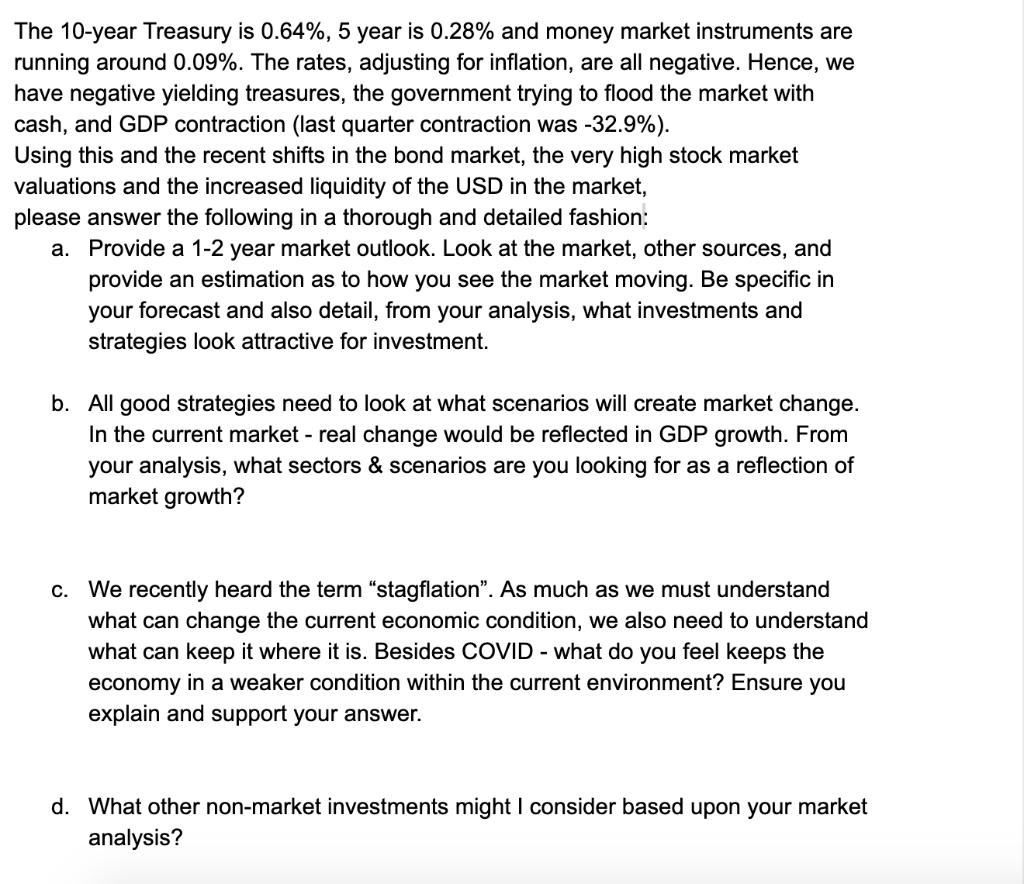

The 10-year Treasury is 0.64%, 5 year is 0.28% and money market instruments are running around 0.09%. The rates, adjusting for inflation, are all negative. Hence, we have negative yielding treasures, the government trying to flood the market with cash, and GDP contraction (last quarter contraction was -32.9%). Using this and the recent shifts in the bond market, the very high stock market valuations and the increased liquidity of the USD in the market, please answer the following in a thorough and detailed fashion: a. Provide a 1-2 year market outlook. Look at the market, other sources, and provide an estimation as to how you see the market moving. Be specific in your forecast and also detail, from your analysis, what investments and strategies look attractive for investment. b. All good strategies need to look at what scenarios will create market change. In the current market - real change would be reflected in GDP growth. From your analysis, what sectors & scenarios are you looking for as a reflection of market growth? c. We recently heard the term "stagflation". As much as we must understand what can change the current economic condition, we also need to understand what can keep it where it is. Besides COVID - what do you feel keeps the economy in a weaker condition within the current environment? Ensure you explain and support your answer. d. What other non-market investments might I consider based upon your market analysis?

Step by Step Solution

★★★★★

3.38 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 Present universally securities exchange going great it remedied over 35 we expect further going gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started