Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The financial statements of Isaacson Corporation follow: Calculate these profitability measures for 2018. Show each computation. a. Rate of return on sales. (Click the

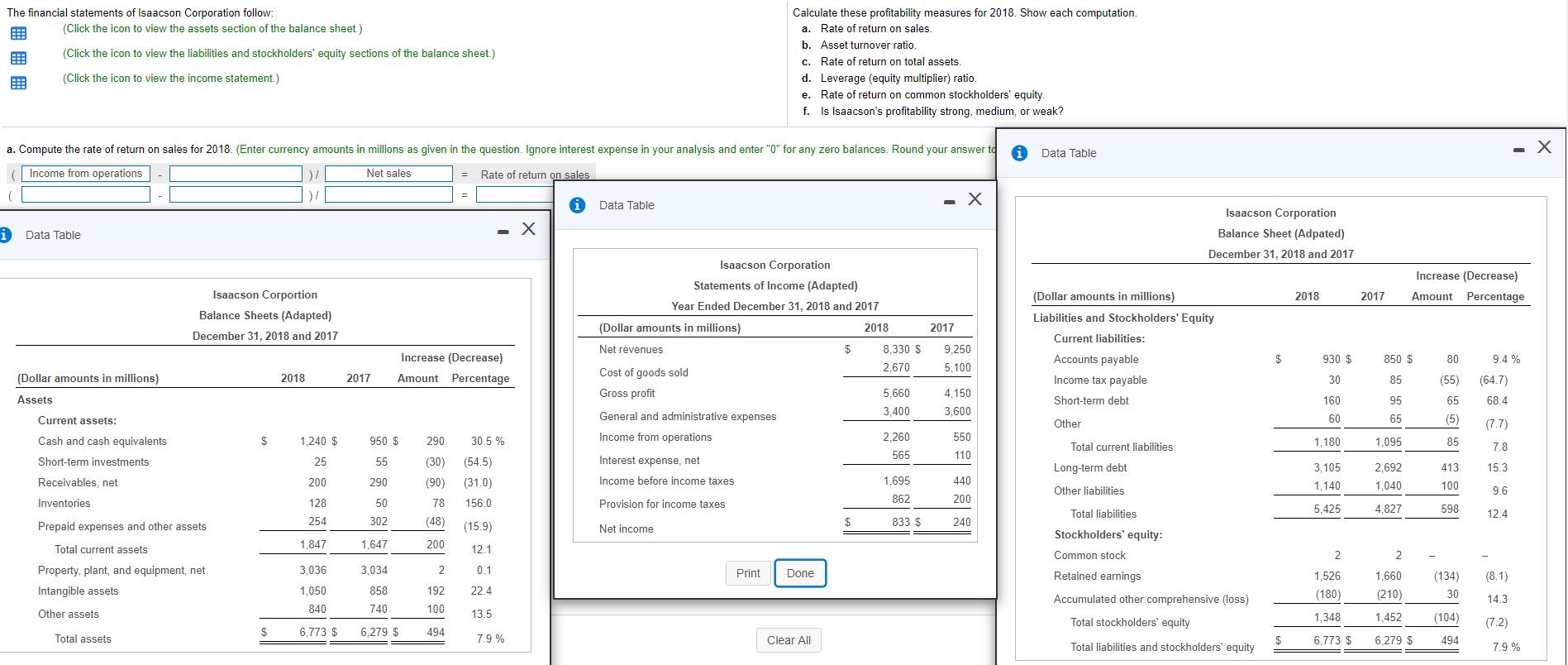

The financial statements of Isaacson Corporation follow: Calculate these profitability measures for 2018. Show each computation. a. Rate of return on sales. (Click the icon to view the assets section of the balance sheet.) b. Asset turnover ratio. (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) c. Rate of return on total assets. d. Leverage (equity multiplier) ratio. e. Rate of return on common stockholders' equity. (Click the icon to view the income statement.) f. Is Isaacson's profitability strong, medium, or weak? a. Compute the rate of return on sales for 2018. (Enter currency amounts in millions as given in the question. Ignore interest expense in your analysis and enter "0" for any zero balances. Round your answer to - X Data Table Income from operations Net sales Rate of return on sales %3D ( Data Table Isaacson Corporation - X Balance Sheet (Adpated) Data Table December 31, 2018 and 2017 Isaacson Corporation Increase (Decrease) Statements of Income (Adapted) Isaacson Corportion (Dollar amounts in millions) 2018 2017 Amount Percentage Year Ended December 31, 2018 and 2017 Balance Sheets (Adapted) Liabilities and Stockholders' Equity (Dollar amounts in millions) 2018 2017 December 31, 2018 and 2017 Current liabilities: Net revenues $ 8,330 $ 9,250 Increase (Decrease) Accounts payable $ 930 $ 850 $ 80 9.4 % Cost of goods sold 2,670 5,100 (Dollar amounts in millions) 2018 2017 Amount Percentage Income tax payable 30 85 (55) (64.7) Gross profit 5,660 4,150 Assets Short-term debt 160 95 65 68.4 General and administrative expenses 3,400 3,600 (5) Current assets: 60 65 Other (7.7) Cash and cash equivalents $ 1,240 $ 950 $ 290 30.5 % Income from operations 2,260 550 1,180 1,095 85 Total current liabilities 7.8 565 110 Short-term investments 25 55 (30) (54.5) Interest expense, net Long-term debt 3,105 2.692 413 15.3 Receivables, net 200 290 (90) (31.0) Income before income taxes 1,695 440 1,140 1,040 100 Other liabilities 9.6 862 200 Inventories 128 50 78 156.0 Provision for income taxes 5.425 4,827 598 Total liabilities 12.4 Prepaid expenses and other assets 254 302 (48) (15.9) Net income 833 $ 240 Stockholders' equity: 1,847 1,647 200 Total current assets 12.1 Common stock 2 Property, plant, and equipment, net 3,036 3,034 0.1 Print Done Retained earnings 1,526 1,660 (134) (8.1) Intangible assets 1,050 858 192 22.4 (180) (210) 30 Accumulated other comprehensive (loss) 14.3 840 740 100 Other assets 13.5 1,348 1,452 (104) Total stockholders' equity (7.2) $ 6,773 $ 6,279 $ 494 Total assets 7.9 % Clear All $ Total liabilities and stockholders' equity 6,773 $ 6.279 $ 494 7.9 % Income from operations Average common SE Average inventory Average net receivables Average total assets Cash Current assets Current liabilities Income from operations Interest expense Inventory Net income Net sales Preferred dividends Short-term investments Total assets Total liabilities

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Rate of Return on SalesNet Income Net Revenues 1000 833833...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started