Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.What is the overhead allocation rate using the traditional direct-hour allocation base? 2. What is the net income for the Corporate client services segment using

1.What is the overhead allocation rate using the traditional direct-hour allocation base?

2. What is the net income for the Corporate client services segment using the traditional direct-hour allocation base?

3. What is the net income for the Corporate client services segment using the three cost drivers in the ABC model?

4.What is the total net income for the firm using the traditional direct-hour allocation base?

5.What is the total net income for the firm using the three cost drivers in the ABC model?

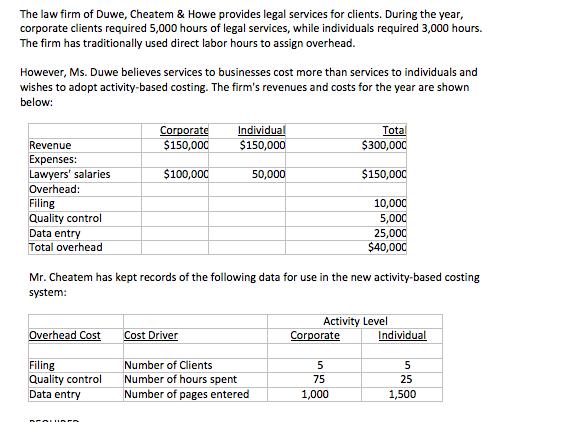

The law firm of Duwe, Cheatem & Howe provides legal services for clients. During the year, corporate clients required 5,000 hours of legal services, while individuals required 3,000 hours. The firm has traditionally used direct labor hours to assign overhead. However, Ms. Duwe believes services to businesses cost more than services to individuals and wishes to adopt activity-based costing. The firm's revenues and costs for the year are shown below: Corporate $150,000 Individual $150,000 Total $300,000 Revenue Expenses: Lawyers' salaries $100,000 50,000 $150,000 Overhead: Filing Quality control Data entry 10,000 5,000 25,000 Total overhead $40,000 Mr. Cheatem has kept records of the following data for use in the new activity-based costing system: Overhead Cost Activity Level Corporate Cost Driver Individual Filing Quality control Data entry Number of Clients Number of hours spent Number of pages entered 75 25 1,000 1,500

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Overhead allocation rate Total overheadTotal hours 400008000 5 2 The end result for the business u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started