Question

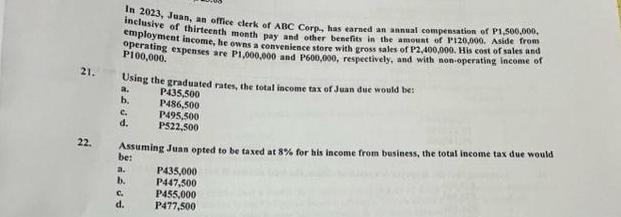

21. 22. In 2023, Juan, an office clerk of ABC Corp, has earned an annual compensation of P1,500,000, inclusive of thirteenth month pay and

21. 22. In 2023, Juan, an office clerk of ABC Corp, has earned an annual compensation of P1,500,000, inclusive of thirteenth month pay and other benefits in the amount of P120,000. Aside from employment income, he owns a convenience store with gross sales of P2,400,000. His cost of sales and perating expenses are P1,000,000 and P600,000, respectively, and with non-operating income of P100,000. Using the graduated rates, the total income tax of Juan due would be: a. P435,500 b. P486,500 P495,500 PS22,500 c. d. Assuming Juan opted to be taxed at 8% for his income from business, the total income tax due would be: a. b. C. d. P435,000 P447,500 P455,000 P477,500

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Using the graduated rates the computati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Spreadsheet Modeling And Decision Analysis A Practical Introduction To Business Analytics

Authors: Cliff Ragsdale

7th Edition

1285418689, 978-1285969701, 1285969707, 978-1285418681

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App