Answered step by step

Verified Expert Solution

Question

1 Approved Answer

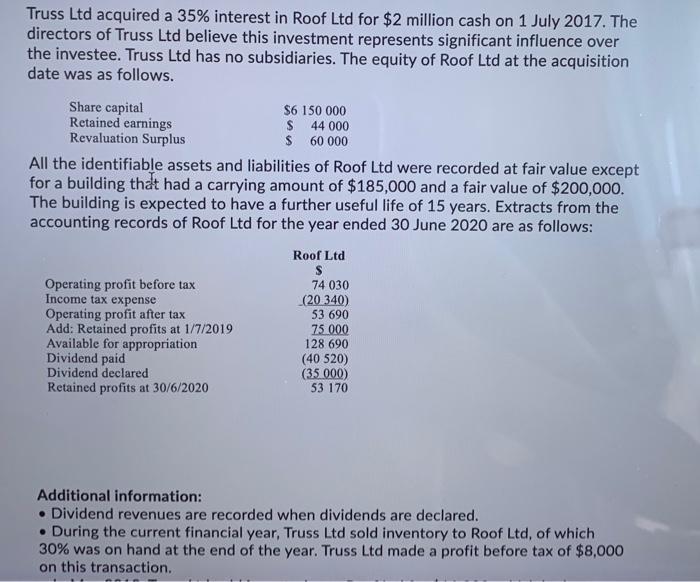

Truss Ltd acquired a 35% interest in Roof Ltd for $2 million cash on 1 July 2017. The directors of Truss Ltd believe this

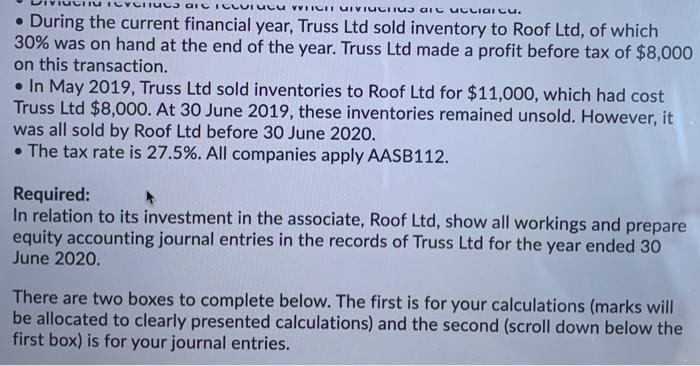

Truss Ltd acquired a 35% interest in Roof Ltd for $2 million cash on 1 July 2017. The directors of Truss Ltd believe this investment represents significant influence over the investee. Truss Ltd has no subsidiaries. The equity of Roof Ltd at the acquisition date was as follows. Share capital Retained earnings Revaluation Surplus $6 150 000 $ 44 000 $ 60 000 All the identifiable assets and liabilities of Roof Ltd were recorded at fair value except for a building that had a carrying amount of $185,000 and a fair value of $200,000. The building is expected to have a further useful life of 15 years. Extracts from the accounting records of Roof Ltd for the year ended 30 June 2020 are as follows: Operating profit before tax Income tax expense Operating profit after tax Add: Retained profits at 1/7/2019 Available for appropriation Dividend paid Dividend declared Retained profits at 30/6/2020 Roof Ltd. S 74 030 (20 340) 53 690 75.000 128 690 (40 520) (35.000) 53 170 Additional information: Dividend revenues are recorded when dividends are declared. During the current financial year, Truss Ltd sold inventory to Roof Ltd, of which 30% was on hand at the end of the year. Truss Ltd made a profit before tax of $8,000 on this transaction. TOYOTTU are ICLUTUCU WHICHT UIVIUCrius arcuccialCu. . During the current financial year, Truss Ltd sold inventory to Roof Ltd, of which 30% was on hand at the end of the year. Truss Ltd made a profit before tax of $8,000 on this transaction. In May 2019, Truss Ltd sold inventories to Roof Ltd for $11,000, which had cost Truss Ltd $8,000. At 30 June 2019, these inventories remained unsold. However, it was all sold by Roof Ltd before 30 June 2020. The tax rate is 27.5%. All companies apply AASB112. Required: In relation to its investment in the associate, Roof Ltd, show all workings and prepare equity accounting journal entries in the records of Truss Ltd for the year ended 30 June 2020. There are two boxes to complete below. The first is for your calculations (marks will be allocated to clearly presented calculations) and the second (scroll down below the first box) is for your journal entries.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Dr Associate Equity 3 690 Cr Investment in Asso...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started