Accounting Warren 26e

Problems: Series B

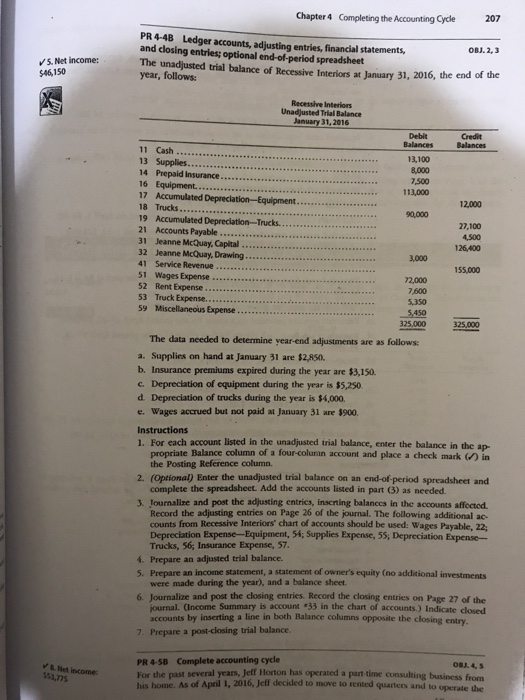

PR 4-4B

Chapter 4 Completing the Accounting Cyce 207 OBJ.2, 3 '5. Net income: The unadjusted trial balance of Recessive Interiors at January 31, 2016, the end of the PR 4-4B and closing entries; optional end-of-period spreadsheet $46,150 year, follows Recessive Interiors Unadjusted Trial Balance January 31, 2016 Debit Balances 11 Cash 13,100 8,000 .500 113,000 16 Equipment. 17 18 Trucks. 90000 12000 27,100 21 Accounts Payable 31 Jeanne McQuay, Capital 41 Service Revenue 3000 126400 52 Rent Expense 72000 155,000 7,600 Truck Expense.. 59 Miscellaneous Expens 5,450 1500 25.0 The data needed to determine year-end adjustments are as follows a. Supplies on hand at January 31 are $2,850 b. Insurance premiums expired during the year are $3,150 c. Depreciation of equipment during the year is $5,250 d. Depreciation of trucks during the year is $4,000. e. Wages accrued but not paid at January 31 are $900 1. For each account listed in the unadjusted trial balance, enter the balance in the a propriate Balance column of a four-coluin account and place a check mark in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. lournalize and post the adjusting entrics, inscrting balanccs in the accounts affected Record the adjusting entries on Page 26 of the journal. The following additional ac- counts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22 Depreciation Expense-Equipment, 54; Supplies Expense, 55, Depreciation Expense- Trucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance 5. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a balance sheet 6 lournalize and post the closing entries Record the closing entries on Page 27 of the iournal. (Income Summary is account "33 in the chart of accounts) Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry 7. Prepare a post-closing trial balance. PR 4-5B Complete accounting cycle For the past several years, Jeff Horton has operated a part time consulting business from his home. As of April 1, 2016, Jeff decided to move to rented quarters and to OBJ. 4, 5 V & Net income ss3.75 uperate the