Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting with sales journal and purchases journal GST version Toby's Traders Ltd uses sales and purchases journals in its accounting system. The following transactions occurred

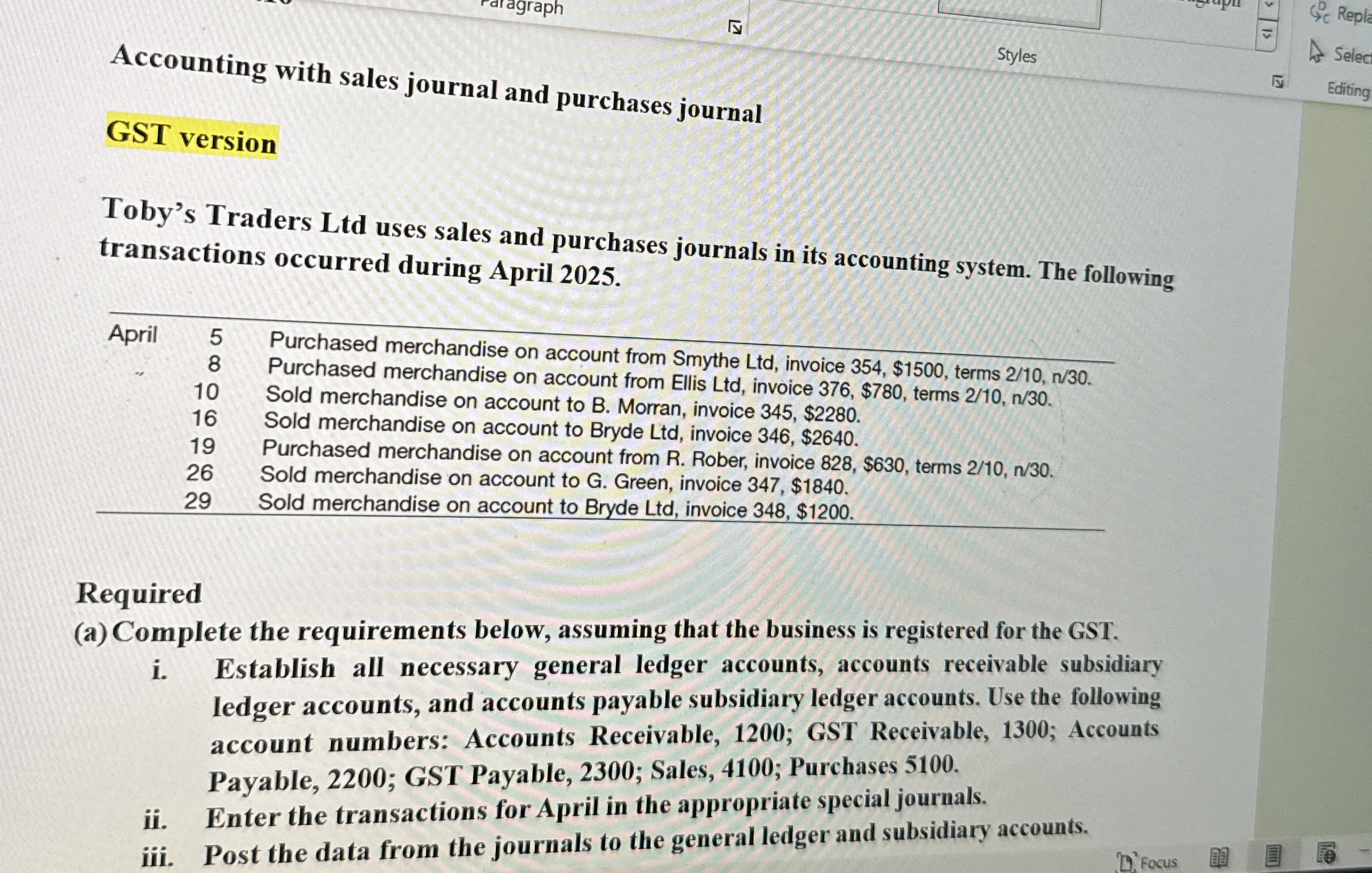

Accounting with sales journal and purchases journal

GST version

Toby's Traders Ltd uses sales and purchases journals in its accounting system. The following transactions occurred during April

tableAprilPurchased merchandise on account from Smythe Ltd invoice $ terms Purchased merchandise on account from Ellis Ltd invoice $ terms Sold merchandise on account to B Morran, invoice $Sold merchandise on account to Bryde Ltd invoice $Purchased merchandise on account from R Rober, invoice $ terms Sold merchandise on account to G Green, invoice $Sold merchandise on account to Bryde Ltd invoice $

Required

a Complete the requirements below, assuming that the business is registered for the GST

i Establish all necessary general ledger accounts, accounts receivable subsidiary Iedger accounts, and accounts payable subsidiary ledger accounts. Use the following account numbers: Accounts Receivable, ; GST Receivable, ; Accounts Payable, ; GST Payable, ; Sales, ; Purchases

ii Enter the transactions for April in the appropriate special journals.

iii. Post the data from the journals to the general ledger and subsidiary accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started