Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounts Cash Receivables Inventory of maintenance supplies Equipment Accumulated depreciation Prepaid insurance Other assets Accounts payable Salaries payable Deferred transportation revenue Income tax payable Contributed

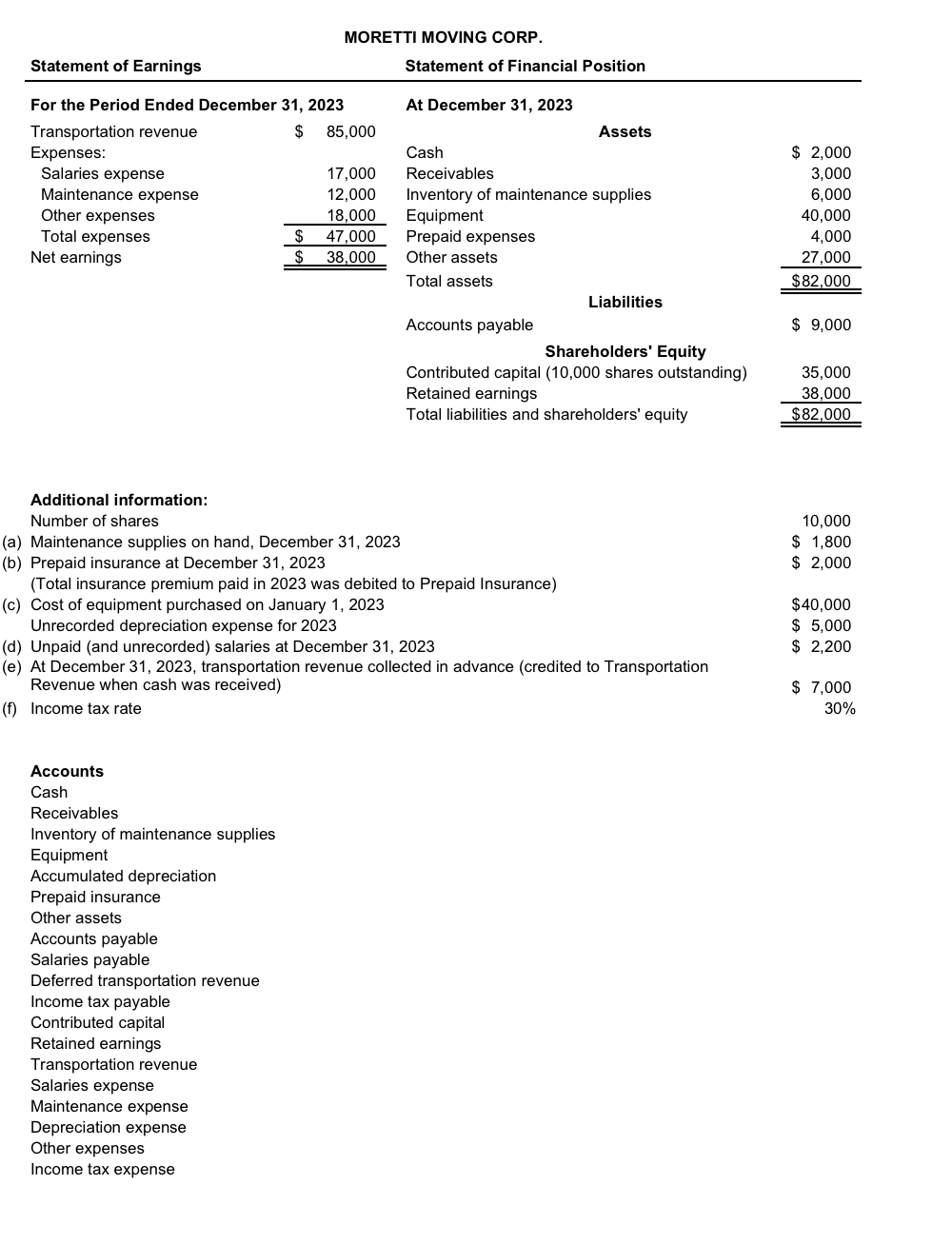

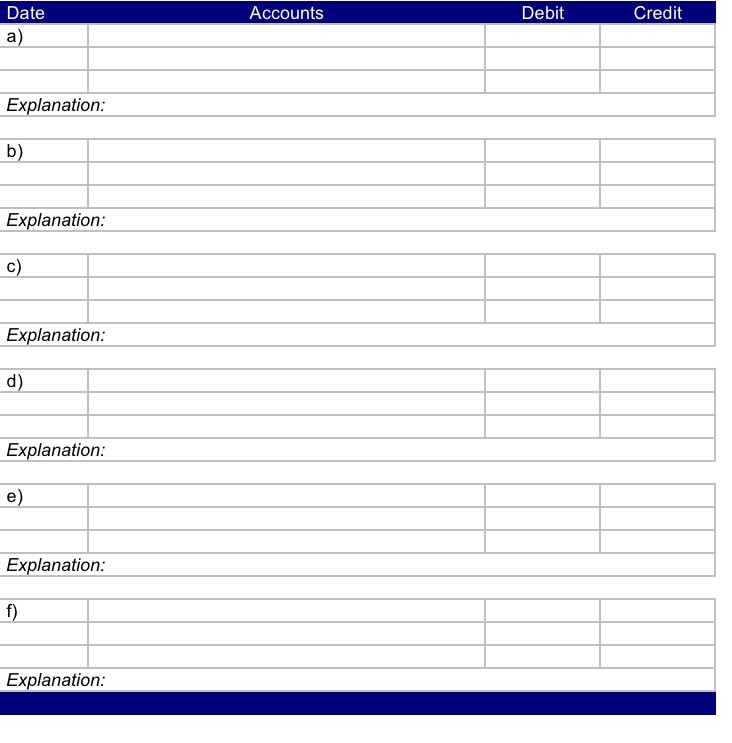

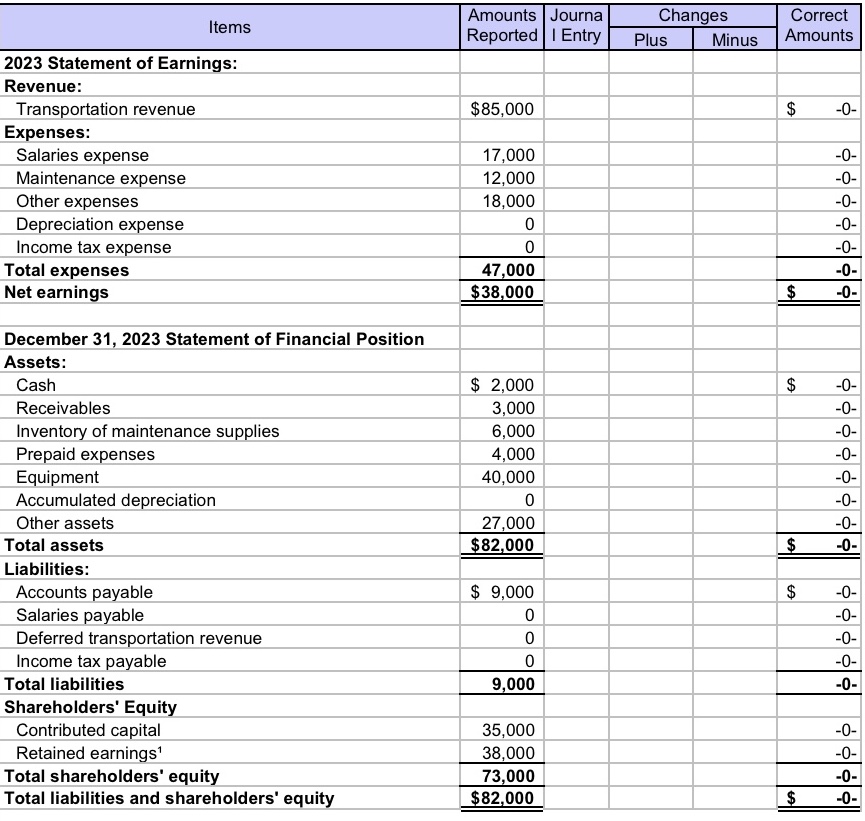

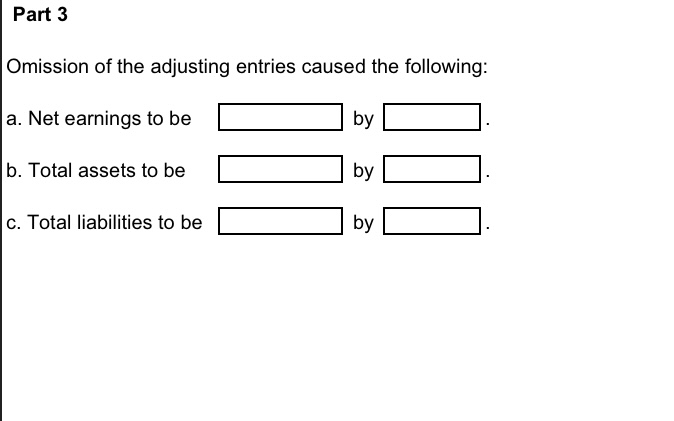

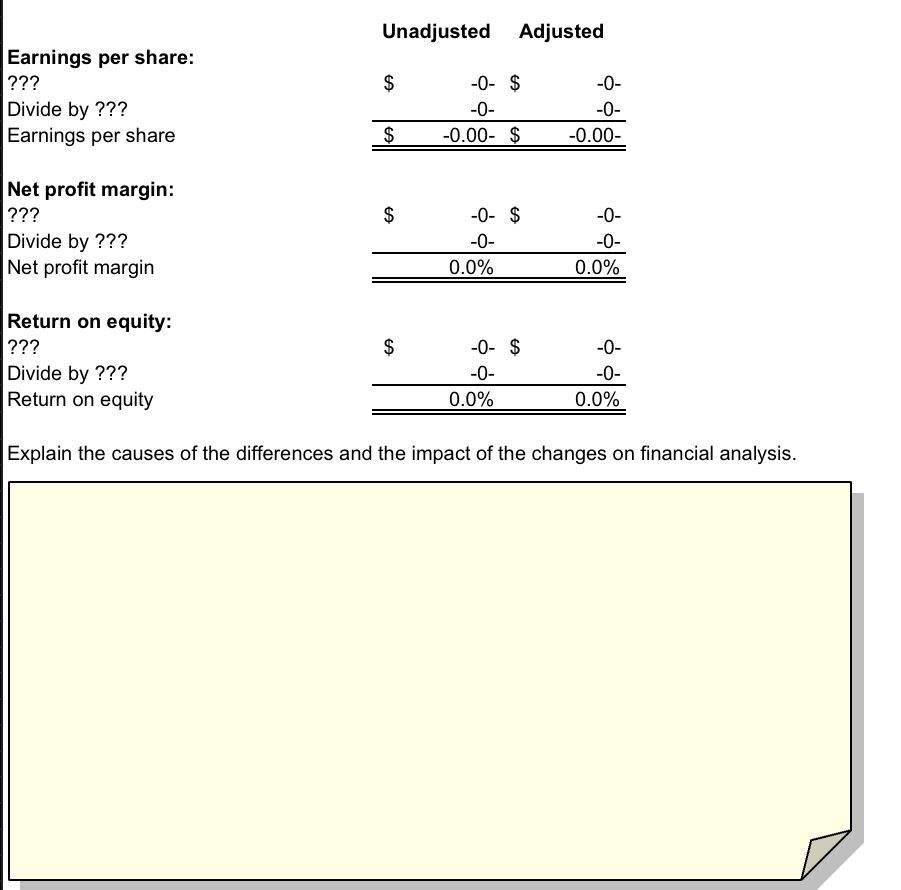

Accounts Cash Receivables Inventory of maintenance supplies Equipment Accumulated depreciation Prepaid insurance Other assets Accounts payable Salaries payable Deferred transportation revenue Income tax payable Contributed capital Retained earnings Transportation revenue Salaries expense Maintenance expense Depreciation expense Other expenses Income tax expense Omission of the adjusting entries caused the following: a. Net earnings to be by b. Total assets to be by c. Total liabilities to be by Write a letter to the company explaining the results of the adjustments, your analysis, and your decision regarding the loan. Explain the causes of the differences and the impact of the changes on financial analysis. Date Accounts Credit a) Explanation: b) Explanation: c) Explanation: d) Explanation: e) Explanation: f) Explanation: \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{Items2023StatementofFarninas:} & \multirow{2}{*}{\begin{tabular}{|l|} Amounts \\ Reported \end{tabular}} & \multirow{2}{*}{\begin{tabular}{|l|} Journa \\ I Entry \\ \end{tabular}} & \multicolumn{2}{|c|}{ Changes } & \multirow{2}{*}{\multicolumn{2}{|c|}{CorrectAmounts}} \\ \hline & & & Plus & Minus & & \\ \hline \multicolumn{7}{|l|}{2023 Statement of Earnings: } \\ \hline \multicolumn{7}{|l|}{ Revenue: } \\ \hline Transportation revenue & $85,000 & & & & $ & 0 \\ \hline \multicolumn{7}{|l|}{ Expenses: } \\ \hline Salaries expense & 17,000 & & & & & 0 \\ \hline Maintenance expense & 12,000 & & & & & 0 \\ \hline Other expenses & 18,000 & & & & & 0 \\ \hline Depreciation expense & 0 & & & & & 0 \\ \hline Income tax expense & 0 & & & & & 0 \\ \hline Total expenses & 47,000 & & & & & -0 - \\ \hline Net earnings & $38,000 & & & & $ & 0 \\ \hline \multicolumn{7}{|c|}{ December 31, 2023 Statement of Financial Position } \\ \hline \multicolumn{7}{|l|}{ Assets: } \\ \hline Cash & $2,000 & & & & $ & 0 \\ \hline Receivables & 3,000 & & & & & 0 \\ \hline Inventory of maintenance supplies & 6,000 & & & & & 0 \\ \hline Prepaid expenses & 4,000 & & & & & 0 \\ \hline Equipment & 40,000 & & & & & 0 \\ \hline Accumulated depreciation & 0 & & & & & 0 \\ \hline Other assets & 27,000 & & & & & 0 \\ \hline Total assets & $82,000 & & & & $ & 0 \\ \hline \multicolumn{7}{|l|}{ Liabilities: } \\ \hline Accounts payable & $9,000 & & & & $ & 0 \\ \hline Salaries payable & 0 & & & & & 0 \\ \hline Deferred transportation revenue & 0 & & & & & 0 \\ \hline Income tax payable & 0 & & & & & 0 \\ \hline Total liabilities & 9,000 & & & & & 0 \\ \hline \multicolumn{7}{|l|}{ Shareholders' Equity } \\ \hline Contributed capital & 35,000 & & & & & 0 \\ \hline & 38,000 & & & & & 0 \\ \hline Total shareholders' equity & 73,000 & & & & & 0 \\ \hline Total liabilities and shareholders' equity & $82,000 & & & & $ & -0 - \\ \hline \end{tabular} Accounts Cash Receivables Inventory of maintenance supplies Equipment Accumulated depreciation Prepaid insurance Other assets Accounts payable Salaries payable Deferred transportation revenue Income tax payable Contributed capital Retained earnings Transportation revenue Salaries expense Maintenance expense Depreciation expense Other expenses Income tax expense Omission of the adjusting entries caused the following: a. Net earnings to be by b. Total assets to be by c. Total liabilities to be by Write a letter to the company explaining the results of the adjustments, your analysis, and your decision regarding the loan. Explain the causes of the differences and the impact of the changes on financial analysis. Date Accounts Credit a) Explanation: b) Explanation: c) Explanation: d) Explanation: e) Explanation: f) Explanation: \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{Items2023StatementofFarninas:} & \multirow{2}{*}{\begin{tabular}{|l|} Amounts \\ Reported \end{tabular}} & \multirow{2}{*}{\begin{tabular}{|l|} Journa \\ I Entry \\ \end{tabular}} & \multicolumn{2}{|c|}{ Changes } & \multirow{2}{*}{\multicolumn{2}{|c|}{CorrectAmounts}} \\ \hline & & & Plus & Minus & & \\ \hline \multicolumn{7}{|l|}{2023 Statement of Earnings: } \\ \hline \multicolumn{7}{|l|}{ Revenue: } \\ \hline Transportation revenue & $85,000 & & & & $ & 0 \\ \hline \multicolumn{7}{|l|}{ Expenses: } \\ \hline Salaries expense & 17,000 & & & & & 0 \\ \hline Maintenance expense & 12,000 & & & & & 0 \\ \hline Other expenses & 18,000 & & & & & 0 \\ \hline Depreciation expense & 0 & & & & & 0 \\ \hline Income tax expense & 0 & & & & & 0 \\ \hline Total expenses & 47,000 & & & & & -0 - \\ \hline Net earnings & $38,000 & & & & $ & 0 \\ \hline \multicolumn{7}{|c|}{ December 31, 2023 Statement of Financial Position } \\ \hline \multicolumn{7}{|l|}{ Assets: } \\ \hline Cash & $2,000 & & & & $ & 0 \\ \hline Receivables & 3,000 & & & & & 0 \\ \hline Inventory of maintenance supplies & 6,000 & & & & & 0 \\ \hline Prepaid expenses & 4,000 & & & & & 0 \\ \hline Equipment & 40,000 & & & & & 0 \\ \hline Accumulated depreciation & 0 & & & & & 0 \\ \hline Other assets & 27,000 & & & & & 0 \\ \hline Total assets & $82,000 & & & & $ & 0 \\ \hline \multicolumn{7}{|l|}{ Liabilities: } \\ \hline Accounts payable & $9,000 & & & & $ & 0 \\ \hline Salaries payable & 0 & & & & & 0 \\ \hline Deferred transportation revenue & 0 & & & & & 0 \\ \hline Income tax payable & 0 & & & & & 0 \\ \hline Total liabilities & 9,000 & & & & & 0 \\ \hline \multicolumn{7}{|l|}{ Shareholders' Equity } \\ \hline Contributed capital & 35,000 & & & & & 0 \\ \hline & 38,000 & & & & & 0 \\ \hline Total shareholders' equity & 73,000 & & & & & 0 \\ \hline Total liabilities and shareholders' equity & $82,000 & & & & $ & -0 - \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started