Answered step by step

Verified Expert Solution

Question

1 Approved Answer

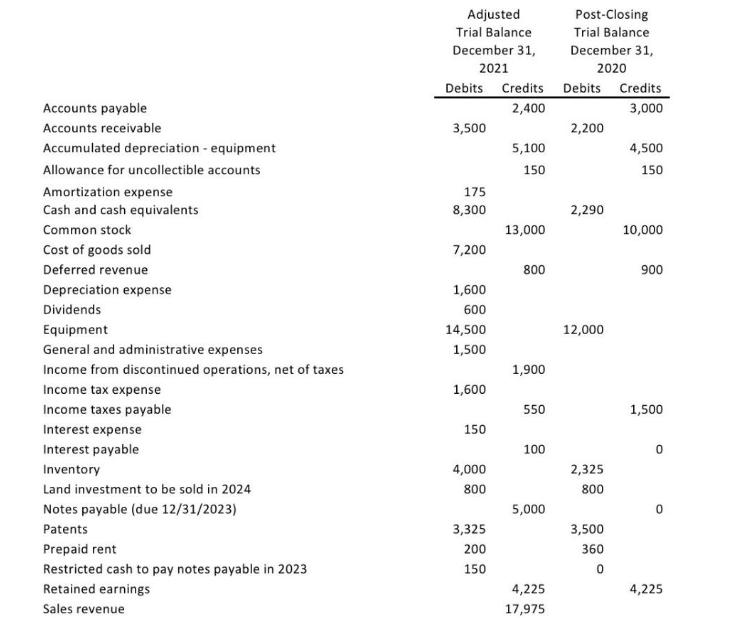

Accounts payable Accounts receivable Accumulated depreciation - equipment Allowance for uncollectible accounts Amortization expense Cash and cash equivalents Common stock Cost of goods sold

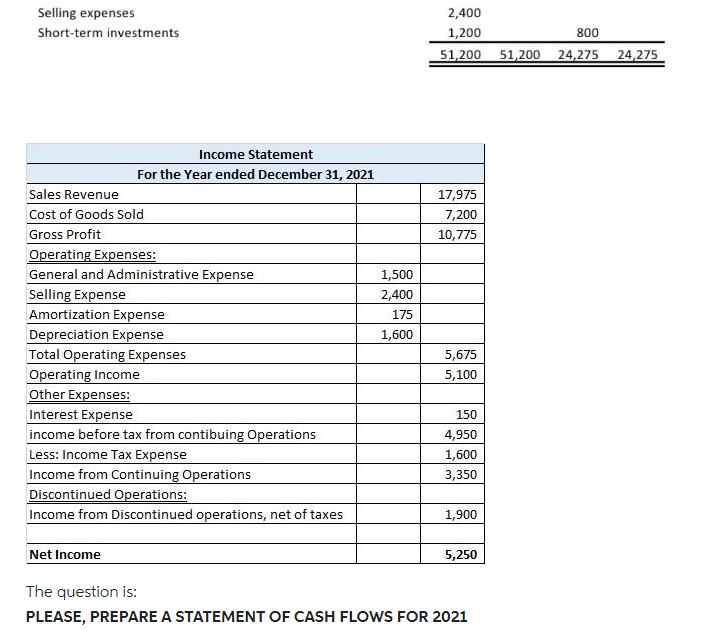

Accounts payable Accounts receivable Accumulated depreciation - equipment Allowance for uncollectible accounts Amortization expense Cash and cash equivalents Common stock Cost of goods sold Deferred revenue Depreciation expense Dividends Equipment General and administrative expenses Income from discontinued operations, net of taxes Income tax expense Income taxes payable Interest expense Interest payable Inventory Land investment to be sold in 2024 Notes payable (due 12/31/2023) Patents Prepaid rent Restricted cash to pay notes payable in 2023 Retained earnings Sales revenue Adjusted Trial Balance December 31, 2021 Debits Credits 2,400 3,500 175 8,300 7,200 1,600 600 14,500 1,500 1,600 150 4,000 800 3,325 200 150 5,100 150 13,000 800 1,900 550 100 5,000 4,225 17,975 Post-Closing Trial Balance December 31, 2020 Debits Credits 3,000 2,200 2,290 12,000 2,325 800 3,500 360 0 4,500 150 10,000 900 1,500 0 0 4,225 Selling expenses Short-term investments Income Statement For the Year ended December 31, 2021 Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: General and Administrative Expense Selling Expense Amortization Expense Depreciation Expense Total Operating Expenses Operating Income Other Expenses: Interest Expense income before tax from contibuing Operations Less: Income Tax Expense Income from Continuing Operations Discontinued Operations: Income from Discontinued operations, net of taxes Net Income 1,500 2,400 175 1,600 2,400 1,200 800 51,200 51,200 24,275 24,275 17,975 7,200 10,775 5,675 5,100 150 4,950 1,600 3,350 1,900 5,250 The question is: PLEASE, PREPARE A STATEMENT OF CASH FLOWS FOR 2021

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started