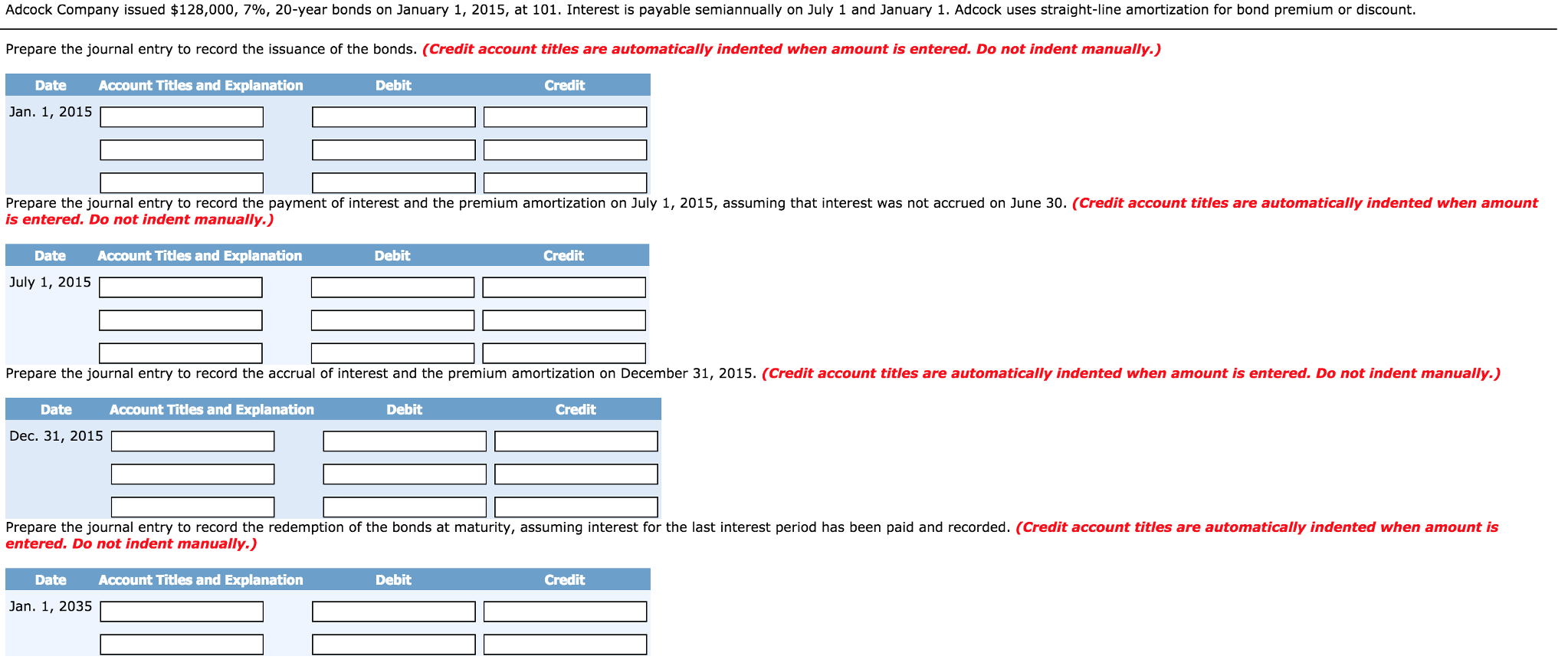

Question

Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Bonds Payable Cash Common Stock Cost of Goods Sold Depreciation Expense Discount on Bonds Payable Dividends Equipment Federal Income

Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Bonds Payable Cash Common Stock Cost of Goods Sold Depreciation Expense Discount on Bonds Payable Dividends Equipment Federal Income Taxes Payable Federal Uemployment Taxes Payable FICA Taxes Payable Gain on Bond Redemption Income Tax Expense Income Taxes Payable Insurance Expense Interest Expense Interest Payable Inventory Lease Liability Loss on Bond Redemption Mortgage Payable Notes Payable Other Operating Expenses Paid-in Capital in Excess of Par-Common Stock Payroll Tax Expense Preferred Stock Premium on Bonds Payable Prepaid Insurance Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Sales Taxes Payable Service Revenue State Income Taxes Payable State Unemployment Taxes Payable Subscription Revenue Ticket Revenue Unearned Service Revenue Unearned Subscription Revenue Unearned Ticket Revenue

Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Bonds Payable Cash Common Stock Cost of Goods Sold Depreciation Expense Discount on Bonds Payable Dividends Equipment Federal Income Taxes Payable Federal Uemployment Taxes Payable FICA Taxes Payable Gain on Bond Redemption Income Tax Expense Income Taxes Payable Insurance Expense Interest Expense Interest Payable Inventory Lease Liability Loss on Bond Redemption Mortgage Payable Notes Payable Other Operating Expenses Paid-in Capital in Excess of Par-Common Stock Payroll Tax Expense Preferred Stock Premium on Bonds Payable Prepaid Insurance Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Sales Taxes Payable Service Revenue State Income Taxes Payable State Unemployment Taxes Payable Subscription Revenue Ticket Revenue Unearned Service Revenue Unearned Subscription Revenue Unearned Ticket Revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started