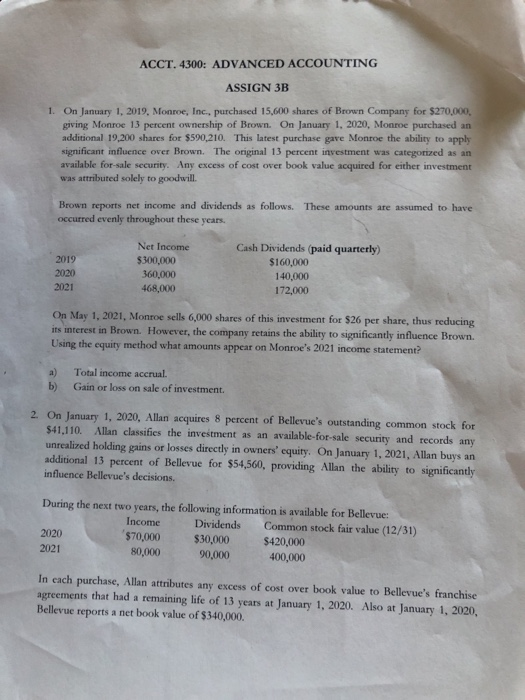

ACCT. 4300: ADVANCED ACCOUNTING ASSIGN 3B 1. On January 1, 2019, Monroe, Inc., purchased 15,600 shares of Brown Company for $270,000 giving Monroe 13 percent ownership of Brown. On January 1, 2020, Monroe purchased an additional 19,200 shares for $590,210. This latest purchase gave Monroe the ability to apply significant influence over Brown. The original 13 percent investment was categorized as an available for sale security. Any excess of cost over book value acquired for either investment was attributed solely to goodwill. Brown reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout these years. 2019 2020 2021 Net Income $300,000 360,000 468,000 Cash Dividends (paid quarterly) $160,000 140,000 172,000 On May 1, 2021, Monroe sells 6,000 shares of this investment for $26 per share, thus reducing its interest in Brown. However, the company retains the ability to significantly influence Brown Using the equity method what amounts appear on Monroe's 2021 income statement? a) b) Total income accrual. Gain or loss on sale of investment. 2. On January 1, 2020, Allan acquires 8 percent of Bellevue's outstanding common stock for 541.110. Allan classifies the investment as an available for sale security and records any unrealized holding gains or losses directly in owners' equity. On January 1, 2021, Allan buys an additional 13 percent of Bellevue for $54,560, providing Allan the ability to significantly influence Bellevue's decisions. During the next two years, the following information is available for Bellevue! Income Dividends Common stock fair value (12/31) 2020 $70,000 $30,000 $420,000 2021 80,000 90,000 400,000 In cach purchase, Allan attributes any excess of cost over book value to Bellevue's franchise agreements that had a remaining life of 13 years at January 1, 2020. Also at January 1, 2020, Bellevue reports a net book value of $340,000. ACCT. 4300: ADVANCED ACCOUNTING ASSIGN 3B 1. On January 1, 2019, Monroe, Inc., purchased 15,600 shares of Brown Company for $270,000 giving Monroe 13 percent ownership of Brown. On January 1, 2020, Monroe purchased an additional 19,200 shares for $590,210. This latest purchase gave Monroe the ability to apply significant influence over Brown. The original 13 percent investment was categorized as an available for sale security. Any excess of cost over book value acquired for either investment was attributed solely to goodwill. Brown reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout these years. 2019 2020 2021 Net Income $300,000 360,000 468,000 Cash Dividends (paid quarterly) $160,000 140,000 172,000 On May 1, 2021, Monroe sells 6,000 shares of this investment for $26 per share, thus reducing its interest in Brown. However, the company retains the ability to significantly influence Brown Using the equity method what amounts appear on Monroe's 2021 income statement? a) b) Total income accrual. Gain or loss on sale of investment. 2. On January 1, 2020, Allan acquires 8 percent of Bellevue's outstanding common stock for 541.110. Allan classifies the investment as an available for sale security and records any unrealized holding gains or losses directly in owners' equity. On January 1, 2021, Allan buys an additional 13 percent of Bellevue for $54,560, providing Allan the ability to significantly influence Bellevue's decisions. During the next two years, the following information is available for Bellevue! Income Dividends Common stock fair value (12/31) 2020 $70,000 $30,000 $420,000 2021 80,000 90,000 400,000 In cach purchase, Allan attributes any excess of cost over book value to Bellevue's franchise agreements that had a remaining life of 13 years at January 1, 2020. Also at January 1, 2020, Bellevue reports a net book value of $340,000