Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCT . . . . Search results - 0 0 6 2 3 8 Market Trends - Google... Electric Guitar Market 2 0 . My

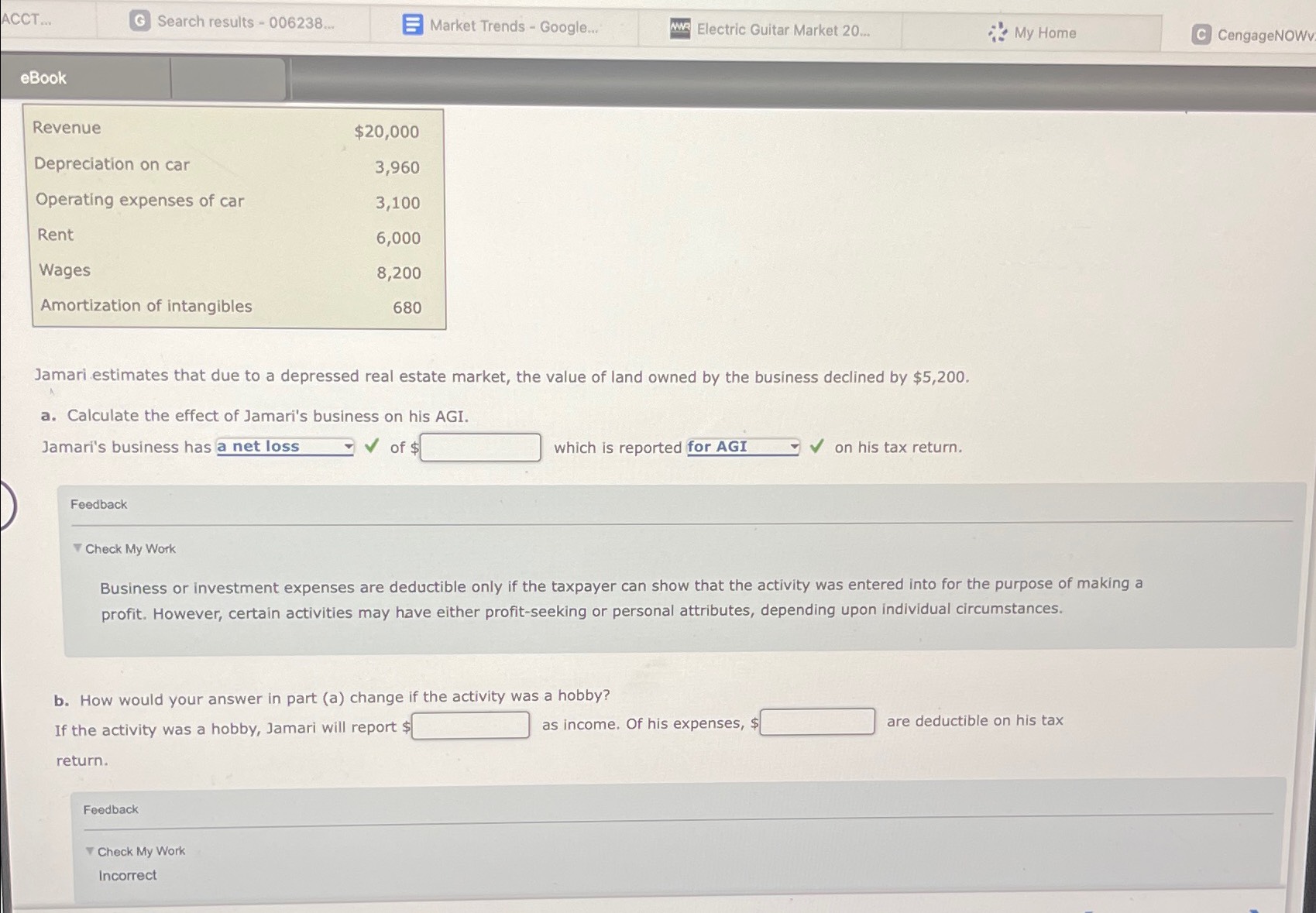

ACCT Search results Market Trends Google... Electric Guitar Market My Home CengageNOWV eBook Revenue $ Depreciation on car Operating expenses of car Rent Wages Amortization of intangibles Jamari estimates that due to a depressed real estate market, the value of land owned by the business declined by $ a Calculate the effect of Jamari's business on his AGI. Jamari's business has of which is reported on his tax return. Feedback Check My Work Business or investment expenses are deductible only if the taxpayer can show that the activity was entered into for the purpose of making a profit. However, certain activities may have either profitseeking or personal attributes, depending upon individual circumstances. b How would your answer in part a change if the activity was a hobby? If the activity was a hobby, Jamari will report $ as income. Of his expenses, $ are deductible on his tax return. Feodback Check My Work Incorrect

ACCT

Search results

Market Trends Google...

Electric Guitar Market

My Home

CengageNOWV

eBook

Revenue

$

Depreciation on car

Operating expenses of car

Rent

Wages

Amortization of intangibles

Jamari estimates that due to a depressed real estate market, the value of land owned by the business declined by $

a Calculate the effect of Jamari's business on his AGI.

Jamari's business has

of

which is reported

on his tax return.

Feedback

Check My Work

Business or investment expenses are deductible only if the taxpayer can show that the activity was entered into for the purpose of making a profit. However, certain activities may have either profitseeking or personal attributes, depending upon individual circumstances.

b How would your answer in part a change if the activity was a hobby?

If the activity was a hobby, Jamari will report $ as income. Of his expenses, $ are deductible on his tax return.

Feodback

Check My Work

Incorrect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started