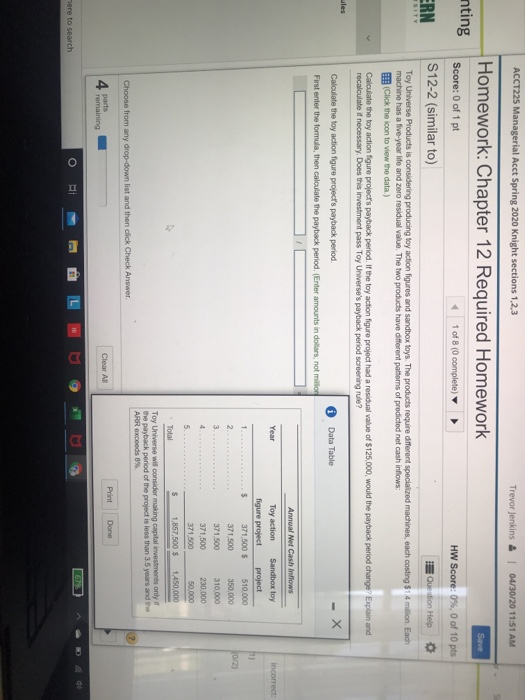

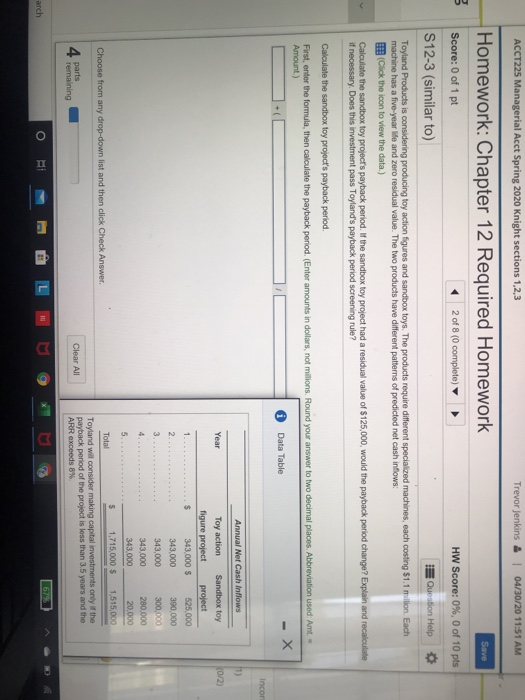

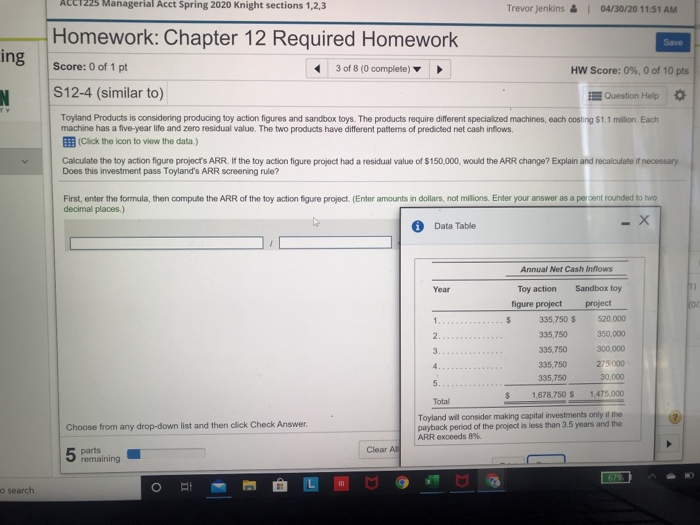

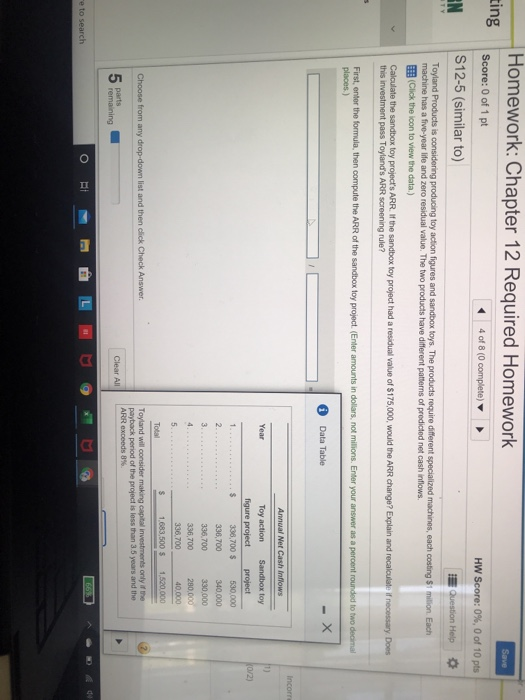

ACCT225 Managerial Acct Spring 2020 Knight sections 1,2,3 Trevor Jenkins & 04/30/20 11:51 AM nting Homework: Chapter 12 Required Homework Save Score: 0 of 1 pt 1 of 8 (0 complete) HW Score: 0%, 0 of 10 pts S12-2 (similar to) I Question Help Toy Universe Products is considering producing toy action figures and sandbox toys. The products require different specialized machines, each costing $14 milion. Each machine has a five-your life and zoro residual value. The two products have different patterns of predicted net cash inflows 33 Cho the icon to view the data) ERN Calculate the toy action figure projects payback period. If the toy action figure project had a residual value of $125,000, would the payback period change? Explain and recalculated necessary. Does this investment pass Toy Universos payback period screeningu Calculate the toy action figure project's payback period. First enter the formula, then calculate the payback period. (Enter amounts in dollars, not million Data Table Annal Net Cash Inflows incorrect Toy action Sandbox toy figure project project 371,500 $ 510,000 371,500 350,000 371.500 310.000 371,500 230,000 371.500 50.000 1.857 500 $ 450,000 Toy Universe will consider making capitalismes only the payback period of the project is less than 35 years and the Choose from any drop-down list and then click Check Answer Print Done Clear AB 4 parts ere to search ACCT225 Managerial Acct Spring 2020 Knight sections 1,2,3 Trevor Jenkins & I 04/30/20 11:51 AM Save nn Homework: Chapter 12 Required Homework Score: 0 of 1 pt 2 of 8 (0 complete) S12-3 (similar to) HW Score: 0%, 0 of 10 pts Question Help Toyland Products is considering producing toy action figures and sandbox toys. The products require different specialized machines, each costing $1.1 million. Each machine has a five-year life and zoro residual value. The two products have different patterns of predicted net cash inflows: (Click the icon to view the data.) Calculate the sandbox toy project's payback period. If the sandbox toy project had a residual value of $125,000, would the payback period change? Explain and recalculate if necessary. Does this investment pass Toyland's payback period screening rule? Calculate the sandbox toy project's payback period, First, enter the formula, then calculate the payback period. (Enter amounts in dollars, not milions. Round your answer to two decimal places, Abbreviation used: Amt. Amount.) * Data Table Incon Annual Net Cash Inflows (0/2) Year Toy action Sandbox toy figure project project 343,000 $ 525,000 343,000 390,000 343,000 300,000 343,000 280,000 343.000 20.000 $ Total 1,715,000 $ 1,515,000 Tayland will consider making capital investments only if the payback period of the project is less than 3.5 years and the ARR excoeds 6% Choose from any drop-down list and then click Check Answer 4 parts Clear All remaining 67% - arch ACC1225 Managerial Acct Spring 2020 Knight sections 1,2,3 Trevor Jenkins & 04/30/20 11:51 AM Save ing Homework: Chapter 12 Required Homework Score: 0 of 1 pt 3 of 8 (0 complete) S12-4 (similar to) HW Score: 0%, 0 of 10 pts Question Help Toyland Products is considering producing toy action figures and sandbox toys. The products require different specialized machines, each costing $1.1 million. Each machine has a five-year life and zero residual value. The two products have different patterns of predicted net cash inflows. ES: (Click the icon to view the data) Calculate the toy action figure project's ARR. If the toy action figure project had a residual value of $150,000, would the ARR change? Explain and recalculate if necessary Does this investment pass Toyland's ARR screening rule? First, enter the formula, then compute the ARR of the toy action figure project. (Enter amounts in dollars, not milions. Enter your answer as a percent rounded to two decimal places.) Data Table Annual Ner Cash Inflows Year wN Toy action Sandbox toy figure project project 335,750 $ 520,000 335 750 350,000 335.750 300,000 335,750 275.000 335.750 30.000 1.678.750 $ 1.475.000 Total Choose from any drop-down list and then click Check Answer. Toyland will consider making capital investments only if the payback period of the project is less than 3.5 years and the ARR exceeds 8%. 5 parts Clear AL remaining o search Save zing Homework: Chapter 12 Required Homework Score: 0 of 1 pt 4 of 8 (0 complete) S12-5 (similar to) HW Score: 0%, 0 of 10 pts IE Question Help Toyland Products is considering producing toy action figures and sandbox toys. The products require different specialized machines, each costing $1 milion Each machine has a five-year life and zero residual value. The two products have different patterns of predicted net cash inflows. E: (Click the icon to view the data) Calculate the sandbox toy project's ARR. If the sandbox toy project had a residual value of $175,000, would the ARR change? Explain and recalculate if necessary. Does this investment pass Toyland's ARR screening rule? First, enter the formula, then compute the ARR of the sandbox toy project. (Enter amounts in dollars, not millions. Enter your answer as a percent rounded to two decimal places) * Data Table - X Income Annual Net Cash inflows Toy action Sandbox toy figure project project 336,700 $ 530,000 336,700 340,000 336.700 330,000 336,700 280,000 336.700 40.000 1.683,500 $ 1.520.000 Choose from any drop-down list and then click Check Answer. Toyland will consider making capital investments only if the payback period of the project is less than 35 years and the ARR exceeds 8%. 5 remaining 5 parts Clear All e to search