Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCT4200 Advanced Accounting I Group Test 1 Part I. (Asset Acquisition) On January 1, 2014, Mark Corporation issued $3,800,000 face amount of 20-year to yield

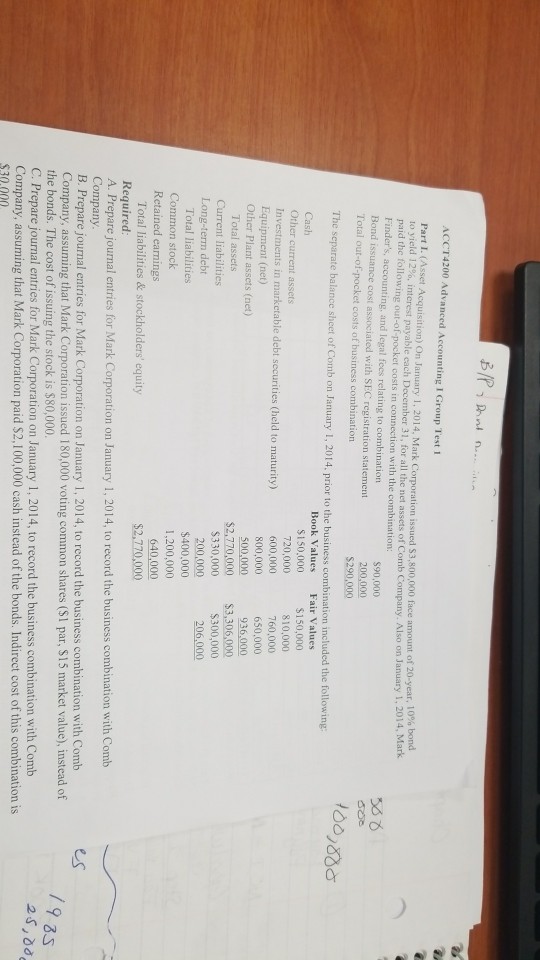

ACCT4200 Advanced Accounting I Group Test 1 Part I. (Asset Acquisition) On January 1, 2014, Mark Corporation issued $3,800,000 face amount of 20-year to yield 12%, interest payable cach December 31, for all the net assets of Comb Company. Also on January 1 paid thef Finder's, accounting, and legal fees relating to combination Bond issuance cost associated with SEC registration statement out-of-pocket costs in c with the 56 6 $90,000 200,000 Total out-of-pocket costs of business combination rComb on January 1, 2014. prior to the business combination included the following Book Values $150,000 720,000 600,000 Fair Values $150,000 810,000 760,000 650,000 Other current assets Investments in marketable debt securities (held to maturity) Equipment (net) Other Plant assets (net) 936 $2,770,000 3,306,000 Total assets Current liabilities $300,000 200,000 $400,000 1,200,000 640,000 Long-term debt 206,000 Total liabilities Common stock Retained earnings Total liabilities& stockholders' equity Required A. Prepare journal entries for Mark Corporation on January 1, 2014, to record the business combination with Comb Company B. Prepare journal entries for Mark Corporation on January 1, 2014, to record the business combination with Comb Company, assuming that Mark Corporation issued 180,000 voting common shares (S1 par, $15 market value), instead of the bonds. The cost of issuing the stock is $80,000 es C. Prepare journal entries for Mark Corporation on January 1, 2014, to record the business combination with Comb Company, assuming that Mark Corporation paid $2,100,000 cash instead of the bonds. Indirect cost of this combination is $30.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started