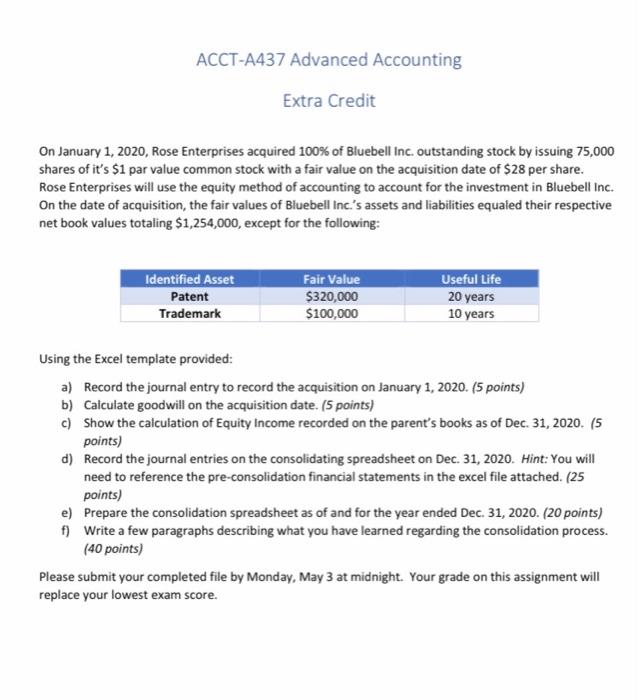

ACCT-A437 Advanced Accounting Extra Credit On January 1, 2020, Rose Enterprises acquired 100% of Bluebell Inc. outstanding stock by issuing 75,000 shares of it's $1 par value common stock with a fair value on the acquisition date of $28 per share. Rose Enterprises will use the equity method of accounting to account for the investment in Bluebell Inc. On the date of acquisition, the fair values of Bluebell Inc.'s assets and liabilities equaled their respective net book values totaling $1,254,000, except for the following: Identified Asset Patent Trademark Fair Value $320,000 $100,000 Useful Life 20 years 10 years Using the Excel template provided a) Record the journal entry to record the acquisition on January 1, 2020. (5 points) b) Calculate goodwill on the acquisition date. (5 points) c) Show the calculation of Equity Income recorded on the parent's books as of Dec. 31, 2020. (5 points) d) Record the journal entries on the consolidating spreadsheet on Dec. 31, 2020. Hint: You will need to reference the pre-consolidation financial statements in the excel file attached. (25 points) e) Prepare the consolidation spreadsheet as of and for the year ended Dec. 31, 2020. (20 points) f) Write a few paragraphs describing what you have learned regarding the consolidation process. (40 points) Please submit your completed file by Monday, May 3 at midnight. Your grade on this assignment will replace your lowest exam score. ACCT-A437 Advanced Accounting Extra Credit On January 1, 2020, Rose Enterprises acquired 100% of Bluebell Inc. outstanding stock by issuing 75,000 shares of it's $1 par value common stock with a fair value on the acquisition date of $28 per share. Rose Enterprises will use the equity method of accounting to account for the investment in Bluebell Inc. On the date of acquisition, the fair values of Bluebell Inc.'s assets and liabilities equaled their respective net book values totaling $1,254,000, except for the following: Identified Asset Patent Trademark Fair Value $320,000 $100,000 Useful Life 20 years 10 years Using the Excel template provided a) Record the journal entry to record the acquisition on January 1, 2020. (5 points) b) Calculate goodwill on the acquisition date. (5 points) c) Show the calculation of Equity Income recorded on the parent's books as of Dec. 31, 2020. (5 points) d) Record the journal entries on the consolidating spreadsheet on Dec. 31, 2020. Hint: You will need to reference the pre-consolidation financial statements in the excel file attached. (25 points) e) Prepare the consolidation spreadsheet as of and for the year ended Dec. 31, 2020. (20 points) f) Write a few paragraphs describing what you have learned regarding the consolidation process. (40 points) Please submit your completed file by Monday, May 3 at midnight. Your grade on this assignment will replace your lowest exam score