Answered step by step

Verified Expert Solution

Question

1 Approved Answer

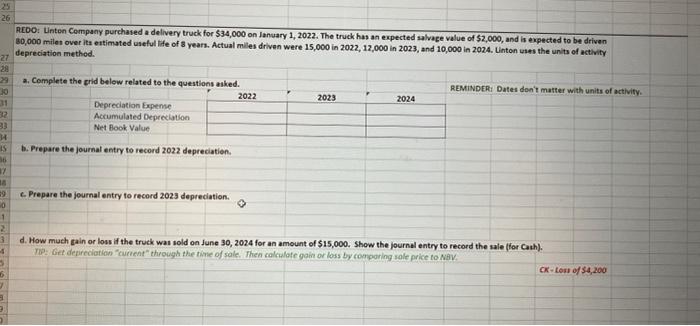

. ACDO: Unton Company purchased a delivery truck for $34,000 on January 1, 2022. The truck has an expected alvage value of $2,000, and is

.

ACDO: Unton Company purchased a delivery truck for $34,000 on January 1, 2022. The truck has an expected alvage value of $2,000, and is expected to be driven 80,000 miles over its entimated useful life of 3 years. Actual milles driven were 15,000 in 2022,12,000 in 2023, and 10,000 in 2024 . Uinton uses the units of activity depreciation method. a. Complete the crid below related to the questions aked. \begin{tabular}{l|l|l|l|} \hline \multicolumn{1}{|c|}{2022} & 2023 & & 2024 \\ \hline Depreciation Expense & & & \\ \hline Acrumulated Depreciation & & & \\ \hline Net Book Value & & & \\ \hline \end{tabular} REMENDERi Dates don't matter with units of activity. b. Prepare the journal entry to record 2022 depreciatien. c. Prepare the journal entry to record 2023 depredition. d. How much gain or loss if the truck wal sold on June 30, 2024 for an amount of $15,000. Show the journal entry to record the sale (for Cach). 79: Get depreciation "curient" through the time of sale. Then calculate gait or loss by comporing sole price to NAV. (x+conof$4,200 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started