Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACE Company opened for business on January 1, 202X and experienced the following events during the year ended December 31, 202X. Record the 15 economic

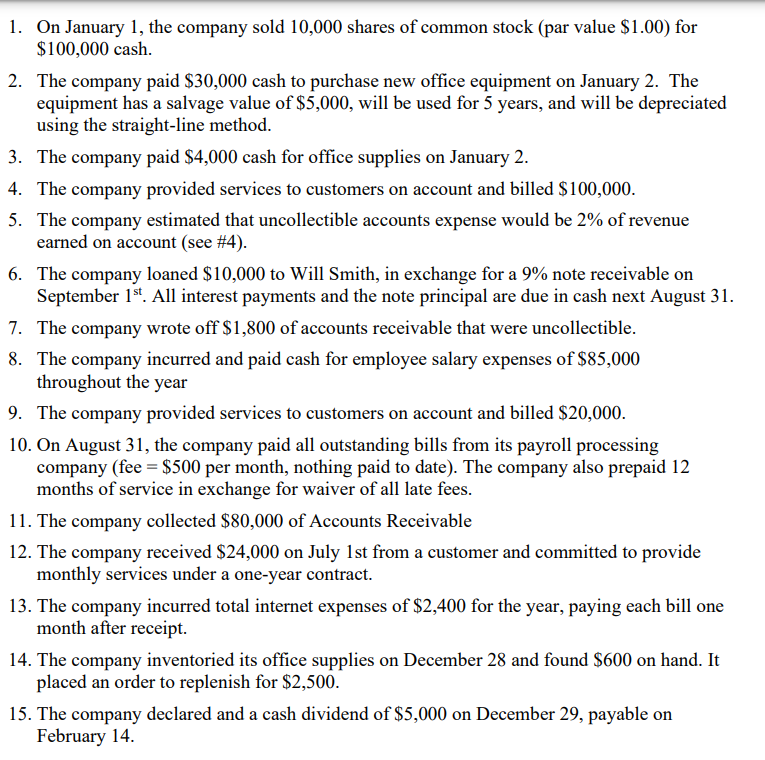

ACE Company opened for business on January 1, 202X and experienced the following events during the year ended December 31, 202X.

Record the 15 economic transactions and all necessary adjusting entries

1. On January 1 , the company sold 10,000 shares of common stock (par value $1.00 ) for $100,000 cash. 2. The company paid $30,000 cash to purchase new office equipment on January 2 . The equipment has a salvage value of $5,000, will be used for 5 years, and will be depreciated using the straight-line method. 3. The company paid $4,000 cash for office supplies on January 2. 4. The company provided services to customers on account and billed $100,000. 5. The company estimated that uncollectible accounts expense would be 2% of revenue earned on account (see #4). 6. The company loaned $10,000 to Will Smith, in exchange for a 9% note receivable on September 1st. All interest payments and the note principal are due in cash next August 31 . 7. The company wrote off $1,800 of accounts receivable that were uncollectible. 8. The company incurred and paid cash for employee salary expenses of $85,000 throughout the year 9. The company provided services to customers on account and billed $20,000. 10. On August 31, the company paid all outstanding bills from its payroll processing company (fee =$500 per month, nothing paid to date). The company also prepaid 12 months of service in exchange for waiver of all late fees. 11. The company collected $80,000 of Accounts Receivable 12. The company received $24,000 on July 1 st from a customer and committed to provide monthly services under a one-year contract. 13. The company incurred total internet expenses of $2,400 for the year, paying each bill one month after receipt. 14. The company inventoried its office supplies on December 28 and found $600 on hand. It placed an order to replenish for $2,500. 15. The company declared and a cash dividend of $5,000 on December 29 , payable on February 14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started