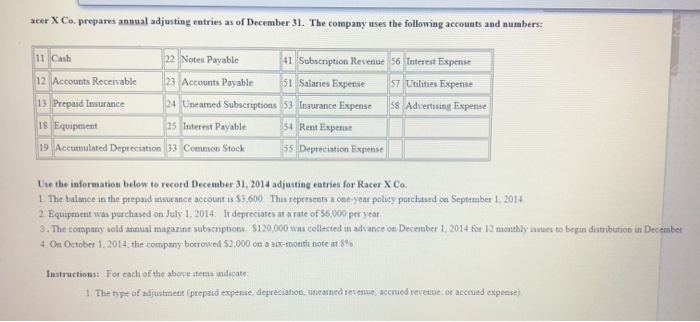

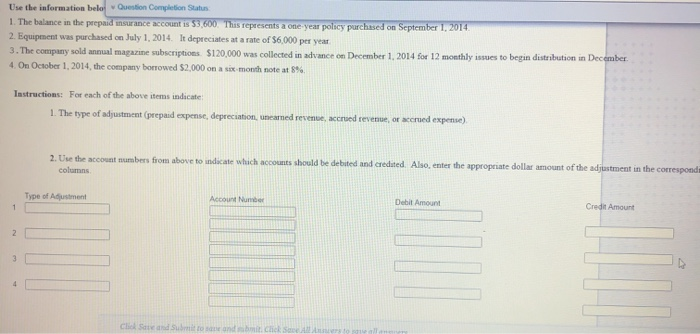

acer X Co prepares annual adjusting entries as of December 31. The company uses the following accounts and numbers: 11 Cash 22 Notes Payable 41 Subscription Revenue 56 Interest Expense 12 Accounts Receivable 23 Accounts Payable 51 Salaries Expense 57 Utilities Expense 13 Prepaid Insurance 24 Uneamed Subscriptions 53 Insurance Expense 58 Advertising Expense 18 Equipment 25 Interest Payable S4 Rent Expense 19 Accumulated Depreciation 33 Common Stock 55 Depreciation Expense Use the information below to record December 31, 2014 adjusting entries for Racer X Co. 1. The balance in the prepaid insurance account is $3,600. This represents a one-year policy purchased on September 1, 2014 2. Equipment was purchased on July 1, 2014. It depreciates at a rate of $6,000 per year 3. The company sold annual magazine subscriptions $120,000 was collected in advance on December 1, 2014 for 12 monthly issues to begin distribution in December 4. On October 1, 2014, the company borrowed $2,000 on a six-month note at 8%. Instructions: For each of the above items indicate 1. The type of adjustment (prepaid expense, depreciation, uneared revenue, accrued revenue, or accrued expense) Use the information belo Question Completion Status: 1. The balance in the prepaid insurance account is $3,600. This represents a one year policy purchased on September 1, 2014 2. Equipment was purchased on July 1, 2014. It depreciates at a rate of $6,000 per year 3. The company sold annual magazine subscriptions $120,000 was collected in advance on December 1, 2014 for 12 monthly issues to begin distribution in December 4.On October 1, 2014, the company borrowed $2,000 on a six month note at 8% Instructions: For each of the above items indicate 1. The type of adjustment (prepaid expense, depreciation, unearned revenue, accrued revenue, or accrued expense) 2. Use the account numbers from above to indicate which accounts should be debited and credited. Also enter the appropriate dollar amount of the adjustment in the corresponde columns Type of Adjustment Account Number Debit Amount 1 Credit Amount 2 3 4 Care and Subrosand