Question

Acme has a wholly owned manufacturing subsidiary. Acme China, located in China's Guangdong Province, from which it buys all of its product (various toys) for

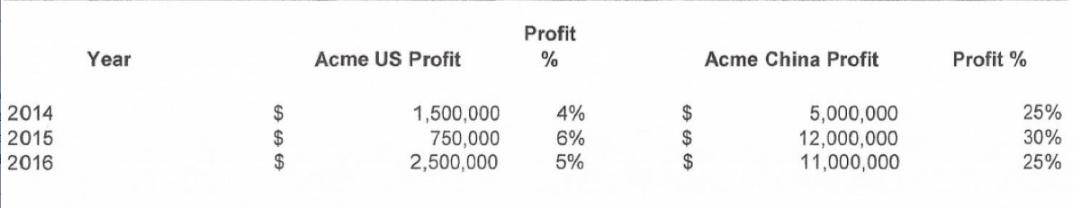

Acme has a wholly owned manufacturing subsidiary. Acme China, located in China's Guangdong Province, from which it buys all of its product (various toys) for resale in the US markets through its US distribution company. Acme China has typically set the prices its charges to Acme US based on what it believed to be a reasonable profit for a manufacturer in China. Given the significant demand for product many manufacturers in China have experienced significant profits over the last 5 years. Acme China believes its profit levels are comparable to other manufacturers in the Province in which it is located. While Acme US has had limited profits in the US in recent years, Acme China has had significant profit levels. A summary of profits in US dollars for both Acme US and Acme China for the last three years is as follows:

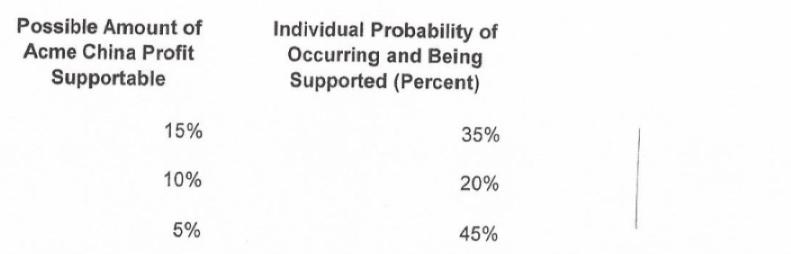

For the 2014 and 2015 years, Acme had a transfer pricing study performed for the transactions between Acme China and Acme US. That study was performed to meet the provisions of Section 6662 of the Internal Revenue Code and was performed by a leading and reputable international accounting and consulting firm. Section 5662 governs circumstances when penalties apply for the underpayment of taxes applicable to transfer pricing. That study indicated that Acme China had a reasonable basis for its pricing it set and charged to Acme US and that Acme China was the tested party. During 2016, Acme had a transfer pricing study performed by a different reputable international accounting and consulting firm. The study was performed to meet the requirements of Section 482 of the Internal Revenue Code. Section 482 governs the provisions surrounding appropriate profit levels of entities that are affiliated and pricing that is charged between the entities. Le. transfer pricing. That study concluded that Acme had an economically viable basis for its position which upon challenge by the IRS could be supported and that Acme China was the tested party. In reviewing both studies. Acme's newly appointed Tax Director noticed that each study indicated that the Acme China was involved in the development of unique manufacturing processes, development of proprietary designs and also owned the intellectual property associated with Acme's products. Acme's Tax Director, however. is concerned because Acme US is the holder of the intellectual property and also the developer of the manufacturing processes and designs. Acme's Tax Director believes Acme China is more of a contract manufacturer in nature given these facts. This seems inconsistent with the information contained in the transfer pricing studies. In discussing with the firm who performed the 2015 study it appears the firm was attempting to reach a more likely than not basis for the transfer pricing position. However, the firm believes that the inconsistency in facts identified by Acme's Tax Director calls into question that level of opinion on the study. The firm still believes that Acme China should be the tested party, meaning the apprOpriate level of profit in the US for Acme US is dependent on how much profit is supportable for Acme China. Any difference in the profit level that can be supported for Acme China is assumed to belong to Acme US as they are affiliated entities. In working with the outside firm. Acme's Tax Director has obtained comparable company information. This information suggests that contract manufacturers with similar manufacturing processes and inventory risk would generally have annual operating profit level of between approximately 5% and 15% during the 2013 - 2015 timeframe. The outside firm believes that there are essentially three levels of annual profit that are supportable at a more likely than not level based on the nature of Acme's operations and the comparable company information available. Further. the outside firm has had recent experience working with the lRS on similar transfer pricing issues in a number of situations and has provided information to Acme's Tax Director as to the probability of success defending with the IRS each level of profit in the circumstances. Using that information, Acme's Tax Director developed the following table as result for purposes of supporting the position:

For the 2014 and 2015 years, Acme had a transfer pricing study performed for the transactions between Acme China and Acme US. That study was performed to meet the provisions of Section 6662 of the Internal Revenue Code and was performed by a leading and reputable international accounting and consulting firm. Section 5662 governs circumstances when penalties apply for the underpayment of taxes applicable to transfer pricing. That study indicated that Acme China had a reasonable basis for its pricing it set and charged to Acme US and that Acme China was the tested party. During 2016, Acme had a transfer pricing study performed by a different reputable international accounting and consulting firm. The study was performed to meet the requirements of Section 482 of the Internal Revenue Code. Section 482 governs the provisions surrounding appropriate profit levels of entities that are affiliated and pricing that is charged between the entities. Le. transfer pricing. That study concluded that Acme had an economically viable basis for its position which upon challenge by the IRS could be supported and that Acme China was the tested party. In reviewing both studies. Acme's newly appointed Tax Director noticed that each study indicated that the Acme China was involved in the development of unique manufacturing processes, development of proprietary designs and also owned the intellectual property associated with Acme's products. Acme's Tax Director, however. is concerned because Acme US is the holder of the intellectual property and also the developer of the manufacturing processes and designs. Acme's Tax Director believes Acme China is more of a contract manufacturer in nature given these facts. This seems inconsistent with the information contained in the transfer pricing studies. In discussing with the firm who performed the 2015 study it appears the firm was attempting to reach a more likely than not basis for the transfer pricing position. However, the firm believes that the inconsistency in facts identified by Acme's Tax Director calls into question that level of opinion on the study. The firm still believes that Acme China should be the tested party, meaning the apprOpriate level of profit in the US for Acme US is dependent on how much profit is supportable for Acme China. Any difference in the profit level that can be supported for Acme China is assumed to belong to Acme US as they are affiliated entities. In working with the outside firm. Acme's Tax Director has obtained comparable company information. This information suggests that contract manufacturers with similar manufacturing processes and inventory risk would generally have annual operating profit level of between approximately 5% and 15% during the 2013 - 2015 timeframe. The outside firm believes that there are essentially three levels of annual profit that are supportable at a more likely than not level based on the nature of Acme's operations and the comparable company information available. Further. the outside firm has had recent experience working with the lRS on similar transfer pricing issues in a number of situations and has provided information to Acme's Tax Director as to the probability of success defending with the IRS each level of profit in the circumstances. Using that information, Acme's Tax Director developed the following table as result for purposes of supporting the position:

Assume a tax rate of 40% applies in the US. Assume that no penalties and interest apply and assume that it is it not more likely than not that Acme China will be able to change its previous tax or financial statement positions.

Assume a tax rate of 40% applies in the US. Assume that no penalties and interest apply and assume that it is it not more likely than not that Acme China will be able to change its previous tax or financial statement positions.

Required:

Assess Acme's transfer pricing position under the requirements of FIN 48 based on the information provided above. identify below the amount of total unrecognized tax benefit that should be recorded for the transfer pricing position as applicable for its open years (2013, 2014, 2015). Provide the journal entry required and a computation showing how you arrived at the unrecognized tax benefit amount with a brief comment on your rationale.

2014 2015 2016 Year $ $ $ Acme US Profit 1,500,000 750,000 2,500,000 Profit % 4% 6% 5% $ $ $ Acme China Profit 5,000,000 12,000,000 11,000,000 Profit % 25% 30% 25%

Step by Step Solution

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Sure here is an assessment of Acmes transfer pricing position under the requirements of FIN 48 Assessment of Transfer Pricing Position Based on the information provided it appears that Acme China has ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started