Question

Acquirer firm announces to launch a takeover of Target firm. The deal is expected to increase the free cash flow of the merged firm by

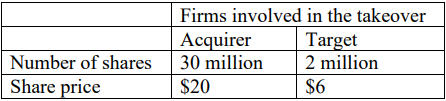

Acquirer firm announces to launch a takeover of Target firm. The deal is expected to increase the free cash flow of the merged firm by $2.4 million per year forever. The appropriate discount rate for this merger is 12% p.a. Acquirer intends to make a stock swap offer with an exchange ratio of 0.5. The table below shows the information of the two firms immediately before the announcement.

(Ignore transaction costs and fees and assume a semi-strong form efficient market. The acquisition is planned to occur immediately, so ignore the time value of money.)

(i) Calculate the total value of synergy. (3 marks)

(ii) Calculate the share price of acquirer immediately after the announcement is made. (6 marks) (hint: it is equal to the expected share price of the merged firm)

(iii) Calculate the value of the synergy that Target will receive. (3 marks)

Number of shares Share price Firms involved in the takeover Acquirer Target 30 million 2 million $20 $6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started