Question

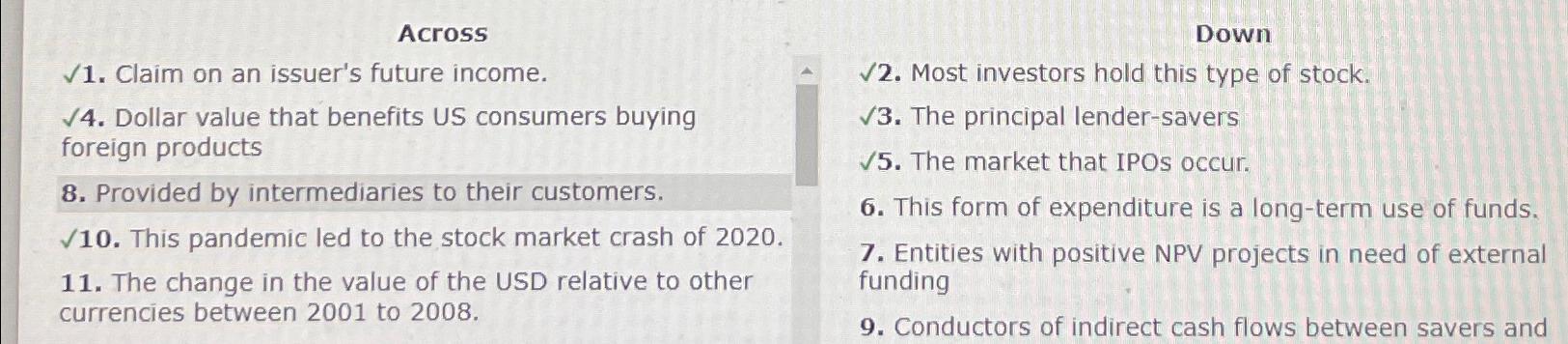

Across sqrt()1 . Claim on an issuer's future income. sqrt()4 . Dollar value that benefits US consumers buying foreign products 8. Provided by intermediaries to

Across\

\\\\sqrt()1. Claim on an issuer's future income.\

\\\\sqrt()4. Dollar value that benefits US consumers buying foreign products\ 8. Provided by intermediaries to their customers.\

\\\\sqrt(10). This pandemic led to the stock market crash of 2020.\ 11. The change in the value of the USD relative to other currencies between 2001 to 2008 .\ Down\

\\\\sqrt()2. Most investors hold this type of stock.\

\\\\sqrt()3. The principal lender-savers\

\\\\sqrt(5). The market that IPOs occur.\ 6. This form of expenditure is a long-term use of funds.\ 7. Entities with positive NPV projects in need of external funding\ 9. Conductors of indirect cash flows between savers and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started