Question

ACT 4494 Fixed Asset Project As you know, in July of 2020, Destiny Freebird opened her own interior design business. To get started her first

ACT 4494

Fixed Asset Project

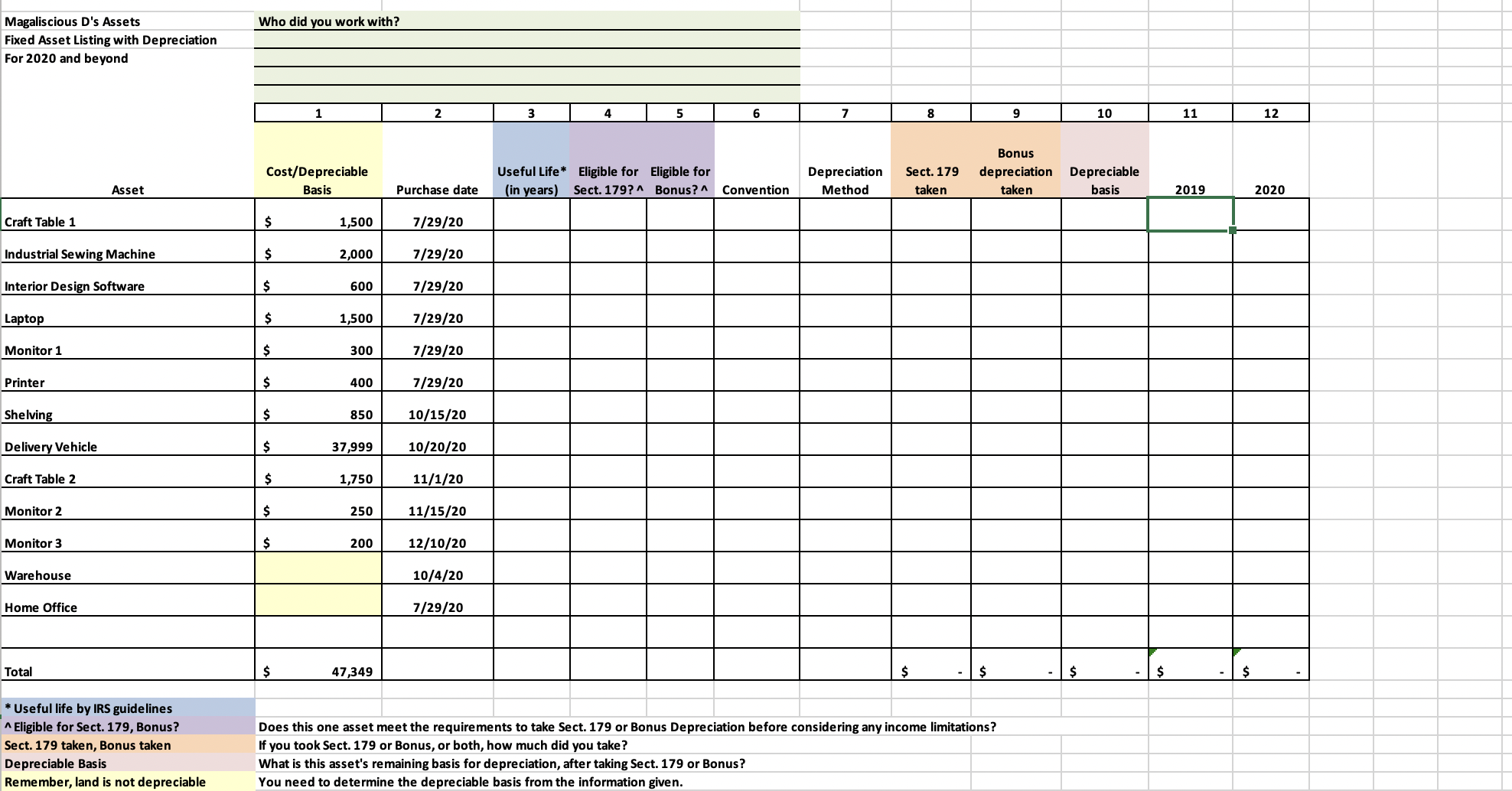

As you know, in July of 2020, Destiny Freebird opened her own interior design business. To get started her first year, she needed some equipment. She purchased the following assets: an industrial sewing machine, a delivery vehicle, two large craft tables, a large shelving system, a laptop computer, three computer monitors, a printer and professional interior design software. These items, with their costs and purchase dates are listed on the depreciation schedule included. You will also need to recalculate the depreciation for the warehouse she purchased, and the home office, both mentioned in Tax Return 5.

You will need some additional information to complete the depreciation schedule.

Destiny purchased the warehouse for $200,000. Destiny paid $20,000 as a down payment and financed the remaining $180,000. The tax appraisal showed the tax assessment for the property to be $125,000. The building was assessed at $93,750 and the land was assessed at $31,250. Legal fees incurred to purchase the property were $3,200.

Chance purchased the home for $200,000, and it had a fair market value in 2020 of $200,000. The tax appraisal for the entire property was $150,000. The building was assessed at $112,500 and the land was assessed at $37,500. The home office is 500 square feet while the house is 2000 sq. ft total.

For both of these properties, you should allocate the purchase price or fair market value by the tax assessment ratio to find the amount of the purchase price/fair market value that corresponds to the building and the land. Remember that land is not depreciable. Normally, it would be included in the depreciation schedule and not depreciated. You should not include the land in this schedule.

The delivery vehicle is a 2020 Ford Transit Connect, white with pink and purple racing stripes. (These came standard, at no additional cost.) The cost of the vehicle was $37,999.

Destiny would also like to know the effect depreciation will have on her business income in the future. While she would love to reduce her taxable income for 2020 down to zero, she knows that may not be a good idea. She currently feels as though her 2020 asset purchases will work for her for several years and she is not currently planning any major asset purchases for the next two years at least. In other words, do not immediately expense everything which would leave her with very little depreciation in future years to offset what Destiny hopes will be increased revenues.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started