Answered step by step

Verified Expert Solution

Question

1 Approved Answer

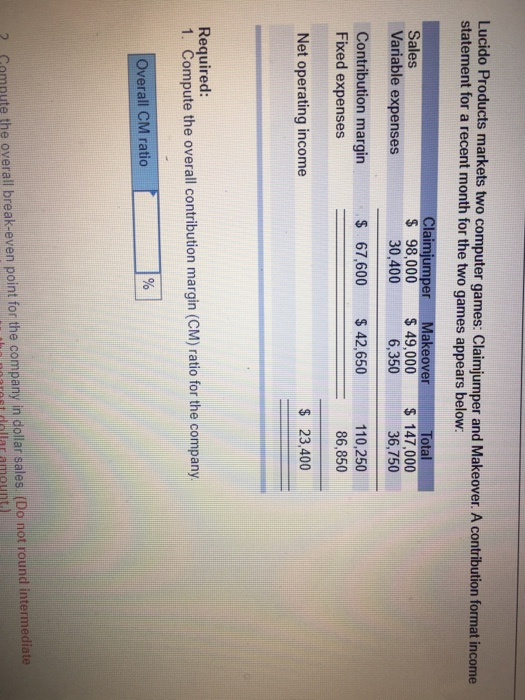

Act do Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below:

Act

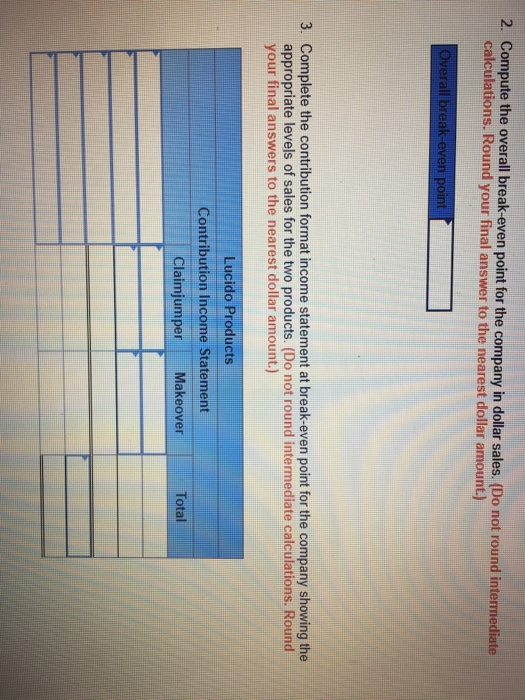

do Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Luci Total Sales Variable expenses $ 98,000 49,000 147,000 36,750 67,600 42,650 110,250 86,850 $ 23,400 30,400 6,350 Contribution margin Fixed expenses Net operating income Required: 1. Compute the overall contribution margin (CM) ratio for the company Overall CM ratio ? Gampute the overall break-even point for the company in dollar sales. (Do not round intermediate 2. Compute the overall break-even point for the company in dollar sales. (Do not round intermediate calculations. Round your final answer to the nearest dollar amount.) verall break-even point 3. Complete the contribution format income statement at break-even point for the company showing the appropriate levels of sales for the two products. (Do not round intermediate calculations. Round your final answers to the nearest dollar amount.) Lucido Products Contribution Income Statement Claimjumper Makeover Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started