Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= ACT204 Spring 2020 Test 3 FI cs.google.com cons Help All changes saved in Drive Calibri 11 BIVA OD E 1 -5. EX .. .

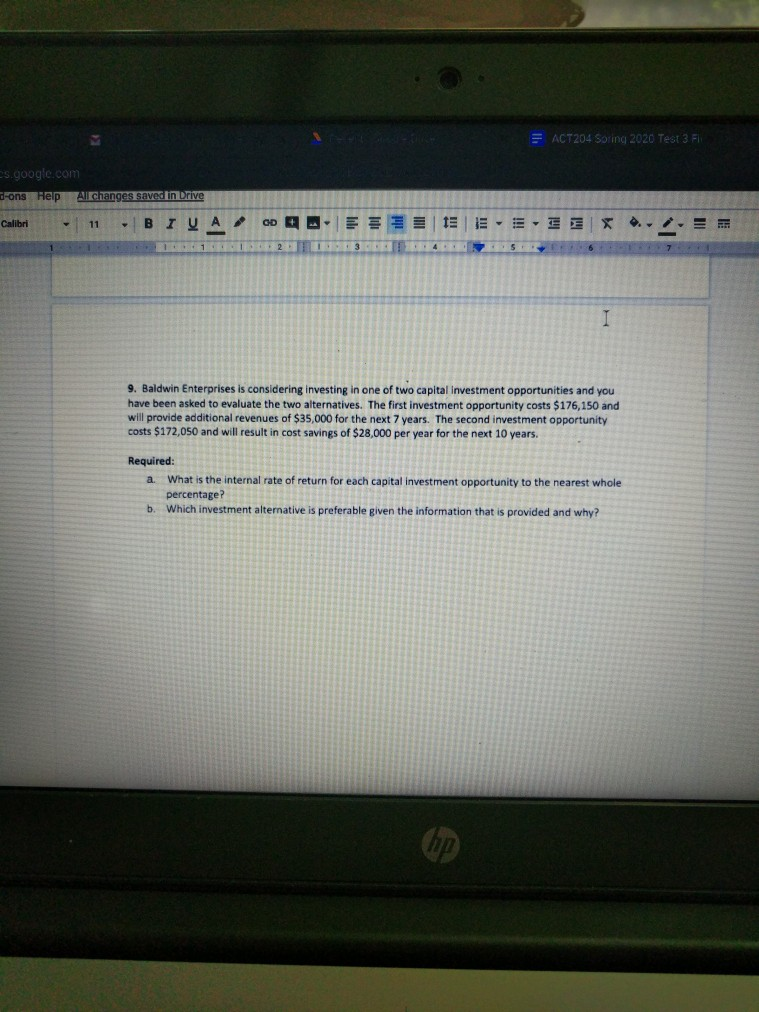

= ACT204 Spring 2020 Test 3 FI cs.google.com cons Help All changes saved in Drive Calibri 11 BIVA OD E 1 -5. EX .. . 2 9. Baldwin Enterprises is considering investing in one of two capital investment opportunities and you have been asked to evaluate the two alternatives. The first investment opportunity costs $176,150 and will provide additional revenues of $35,000 for the next 7 years. The second investment opportunity costs $172,050 and will result in cost savings of $28,000 per year for the next 10 years. Required: a. What is the internal rate of return for each capital investment opportunity to the nearest whole percentage? b. Which investment alternative is preferable given the information that is provided and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started