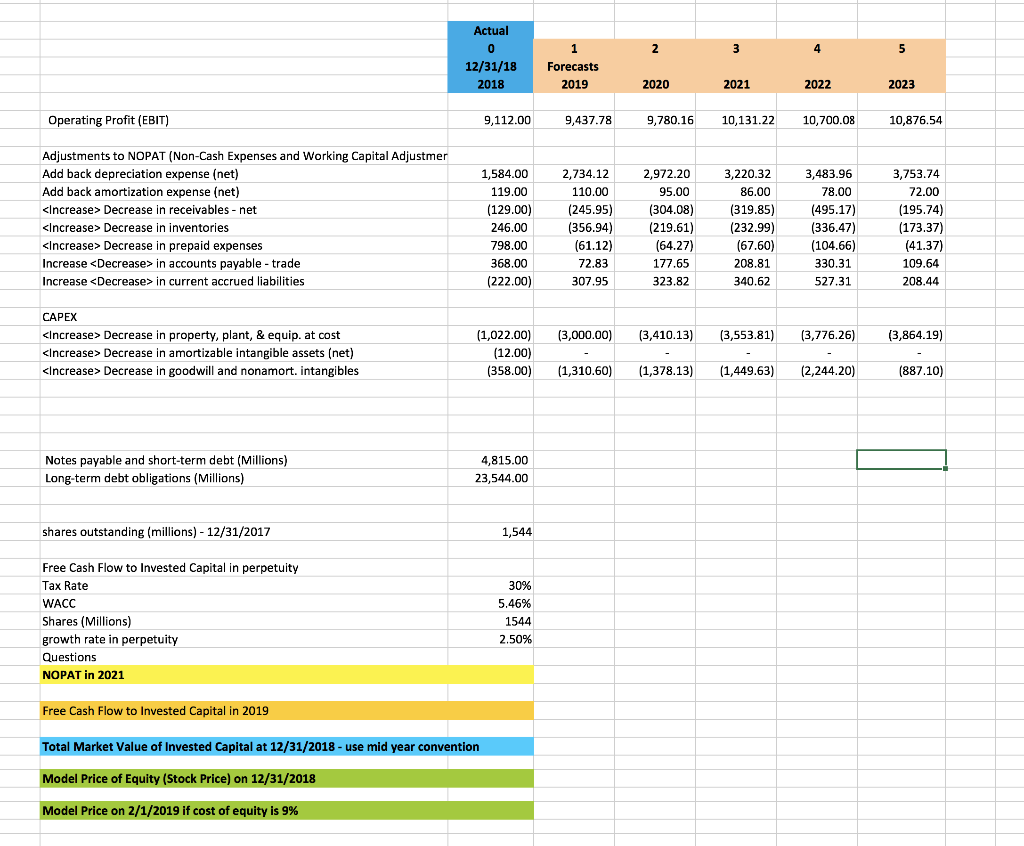

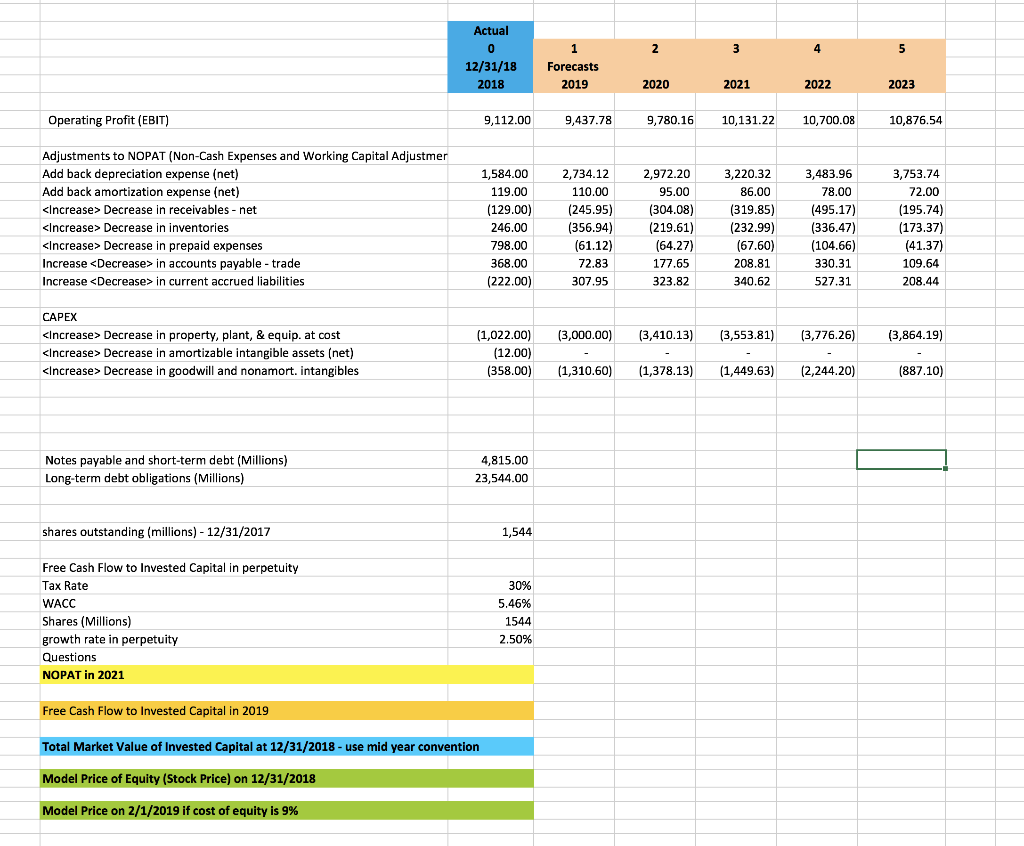

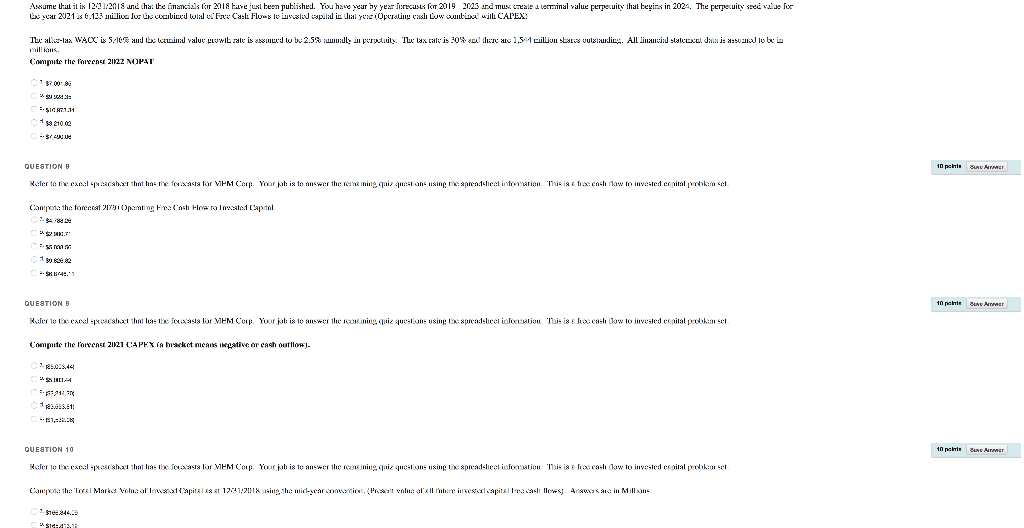

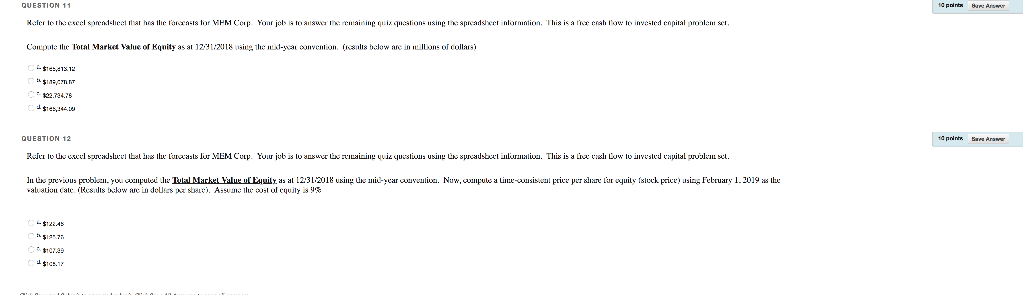

Actual 4 12/31/18 Forecasts 2018 2019 2020 2021 2022 2023 Operating Profit (EBIT) 9,112.00 9,437.78 9,780.1610,131.2210,700.08 10,876.54 Adjustments to NOPAT (Non-Cash Expenses and Working Capital Adjustmer Add back depreciation expense (net) Add back amortization expense (net)

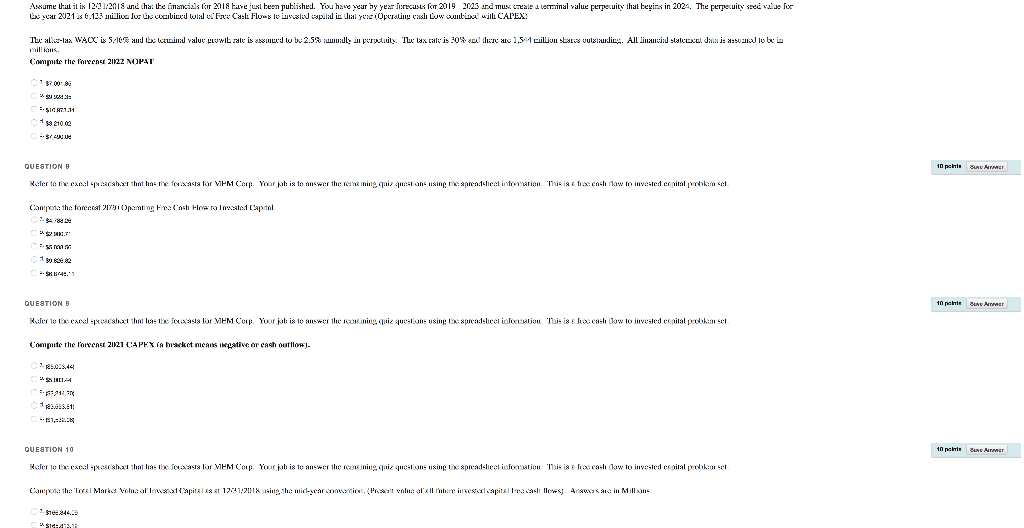

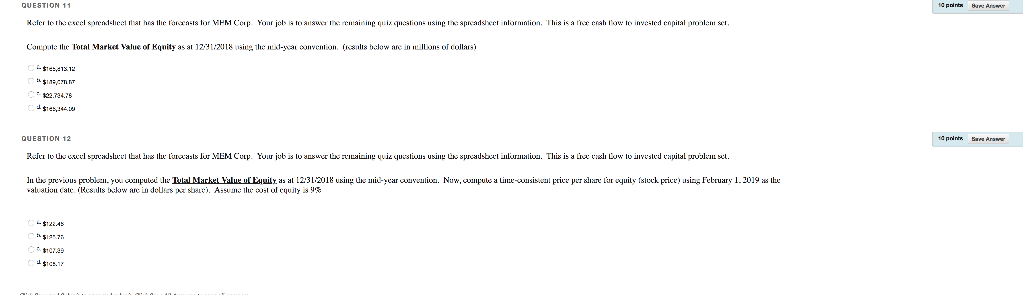

Decrease in receivables net Decrease in inventories Decrease in prepaid expenses Increase in accounts payable trade Increase in current accrued liabilities 1,584.00 119.00 (129.00) 246.00 798.00 368.00 (222.00) 2,734.12 110.00 (245.95) (356.94) (61.12) 72.83 307.95 2,972.20 95.00 (304.08) (219.61) (64.27) 177.65 323.82 3,220.32 86.00 (319.85) (232.99) (67.60) 208.81 340.62 3,483.96 78.00 (495.17) (336.47) (104.66) 330.31 527.31 3,753.74 72.00 (195.74) (173.37) (41.37) 109.64 208.44 CAPEX Decrease in property, plant, & equip. at cost Decrease in amortizable intangible assets (net) Decrease in goodwill and nonamort. intangibles (1,022.00) 3,000.00) 3,410.13)3,553.81) (3,776.26(3,864.19) (12.00) (358.00 (1,310.60) (1,378.13 (1,449.63)(2,244.20) (887.10) Notes payable and short-term debt (Millions) Long-term debt obligations (Millions) 4,815.00 23,544.00 shares outstanding (millions) 12/31/2017 1,544 Free Cash Flow to Invested Capital in perpetuity Tax Rate WACC Shares (Millions) growth rate in perpetuit Questions NOPAT in 2021 30% 5.46% 1544 2.50% Free Cash Flow to Invested Capital in 2019 Total Market Value of Invested Capital at 12/31/2018 - use mid year convention Model Price of Equity (Stock Price) on 12/31/2018 Model Price on 2/1/2019 if cost of equity is 9% As me ha i i 12 1 2018 uniha: henanna s c r 2018 have lusi een putashed You have year y year re us i 2019 20 23.rdmus s eai:1 te mal value per e uit ihat beyin in 202- The perpe uit sec a ue ir $700 8 QUESTION QUESTION 10 dpalnb 224.7 QUESTION 12 MEMCuu' 1.2019 s 910729 Actual 4 12/31/18 Forecasts 2018 2019 2020 2021 2022 2023 Operating Profit (EBIT) 9,112.00 9,437.78 9,780.1610,131.2210,700.08 10,876.54 Adjustments to NOPAT (Non-Cash Expenses and Working Capital Adjustmer Add back depreciation expense (net) Add back amortization expense (net) Decrease in receivables net Decrease in inventories Decrease in prepaid expenses Increase in accounts payable trade Increase in current accrued liabilities 1,584.00 119.00 (129.00) 246.00 798.00 368.00 (222.00) 2,734.12 110.00 (245.95) (356.94) (61.12) 72.83 307.95 2,972.20 95.00 (304.08) (219.61) (64.27) 177.65 323.82 3,220.32 86.00 (319.85) (232.99) (67.60) 208.81 340.62 3,483.96 78.00 (495.17) (336.47) (104.66) 330.31 527.31 3,753.74 72.00 (195.74) (173.37) (41.37) 109.64 208.44 CAPEX Decrease in property, plant, & equip. at cost Decrease in amortizable intangible assets (net) Decrease in goodwill and nonamort. intangibles (1,022.00) 3,000.00) 3,410.13)3,553.81) (3,776.26(3,864.19) (12.00) (358.00 (1,310.60) (1,378.13 (1,449.63)(2,244.20) (887.10) Notes payable and short-term debt (Millions) Long-term debt obligations (Millions) 4,815.00 23,544.00 shares outstanding (millions) 12/31/2017 1,544 Free Cash Flow to Invested Capital in perpetuity Tax Rate WACC Shares (Millions) growth rate in perpetuit Questions NOPAT in 2021 30% 5.46% 1544 2.50% Free Cash Flow to Invested Capital in 2019 Total Market Value of Invested Capital at 12/31/2018 - use mid year convention Model Price of Equity (Stock Price) on 12/31/2018 Model Price on 2/1/2019 if cost of equity is 9% As me ha i i 12 1 2018 uniha: henanna s c r 2018 have lusi een putashed You have year y year re us i 2019 20 23.rdmus s eai:1 te mal value per e uit ihat beyin in 202- The perpe uit sec a ue ir $700 8 QUESTION QUESTION 10 dpalnb 224.7 QUESTION 12 MEMCuu' 1.2019 s 910729