Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 0 5 Making Automobile and Housing Decisions Assignment This treatment on your federal and, in most states, state income taxes results in a taxable

Chapter Making Automobile and Housing Decisions Assignment

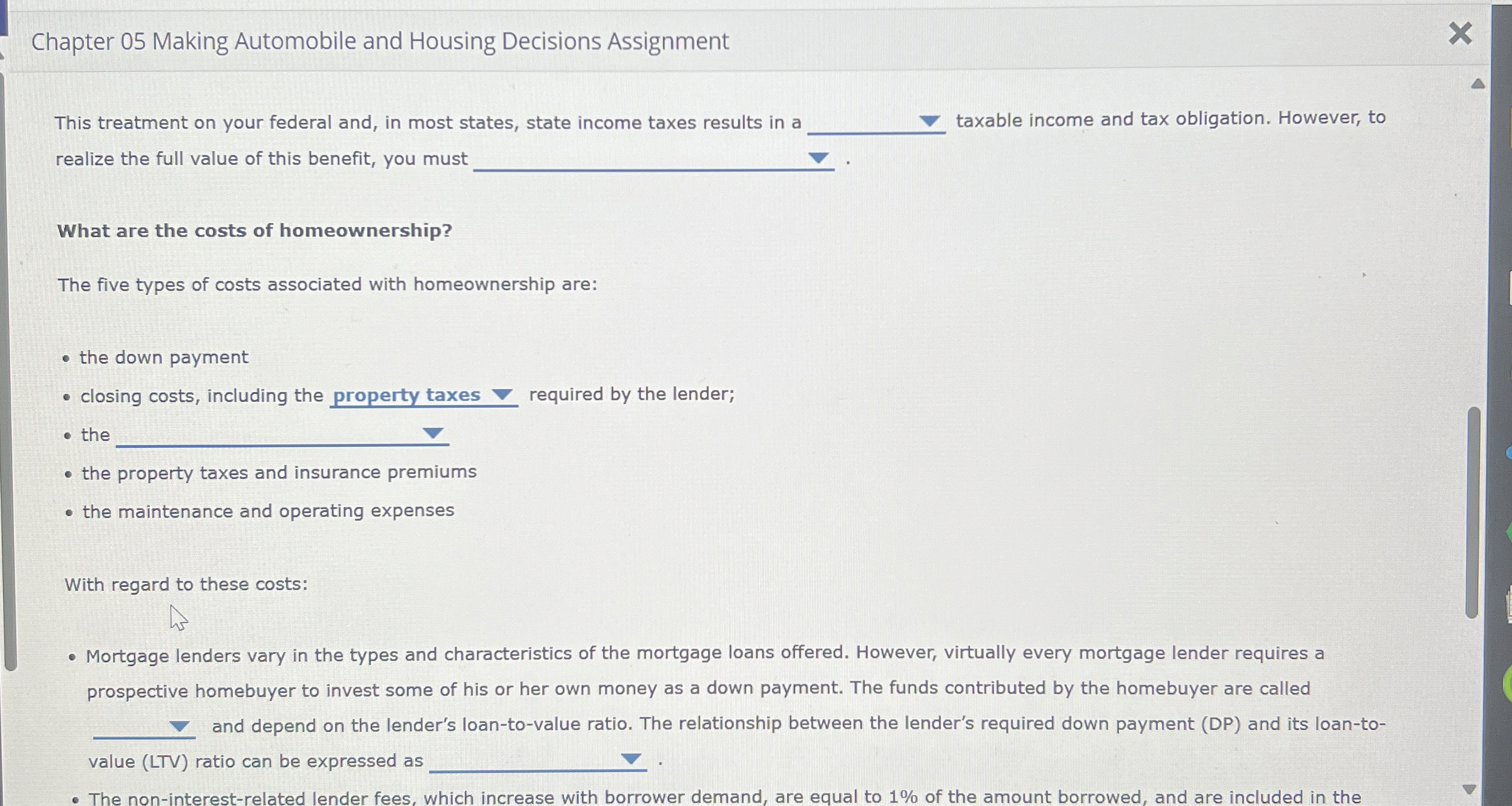

This treatment on your federal and, in most states, state income taxes results in a taxable income and tax obligation. However, to realize the full value of this benefit, you mus

What are the costs of homeownership?

The five types of costs associated with homeownership are:

the down payment

closing costs, including the required by the lender;

the

the property taxes and insurance premiums

the maintenance and operating expenses

With regard to these costs:

Mortgage lenders vary in the types and characteristics of the mortgage loans offered. However, virtually every mortgage lender requires a prospective homebuyer to invest some of his or her own money as a down payment. The funds contributed by the homebuyer are called and depend on the lender's loantovalue ratio. The relationship between the lender's required down payment DP and its loantovalue LTV ratio can be expressed as

The noninterestrelated lender fees, which increase with borrower demand, are equal to of the amount borrowed, and are included in the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started