Answered step by step

Verified Expert Solution

Question

1 Approved Answer

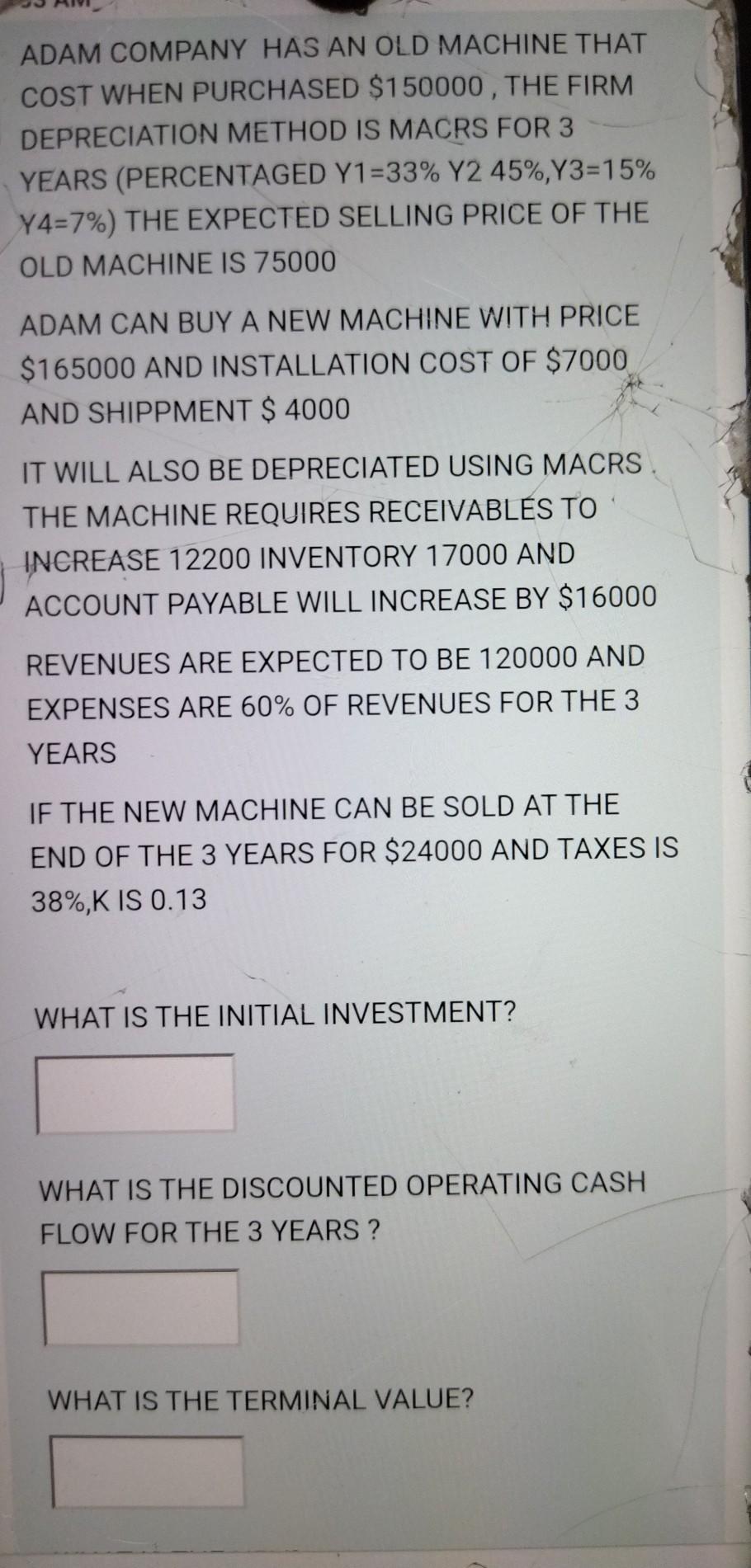

ADAM COMPANY HAS AN OLD MACHINE THAT COST WHEN PURCHASED $150000, THE FIRM DEPRECIATION METHOD IS MACRS FOR 3 YEARS (PERCENTAGED Y1 =33% Y2 45%,Y3=15%

ADAM COMPANY HAS AN OLD MACHINE THAT COST WHEN PURCHASED $150000, THE FIRM DEPRECIATION METHOD IS MACRS FOR 3 YEARS (PERCENTAGED Y1 =33% Y2 45%,Y3=15% Y4=7%) THE EXPECTED SELLING PRICE OF THE OLD MACHINE IS 75000 ADAM CAN BUY A NEW MACHINE WITH PRICE $165000 AND INSTALLATION COST OF $7000 AND SHIPPMENT $ 4000 IT WILL ALSO BE DEPRECIATED USING MACRS. THE MACHINE REQUIRES RECEIVABLES TO INCREASE 12200 INVENTORY 17000 AND ACCOUNT PAYABLE WILL INCREASE BY $16000 REVENUES ARE EXPECTED TO BE 120000 AND EXPENSES ARE 60% OF REVENUES FOR THE 3 YEARS IF THE NEW MACHINE CAN BE SOLD AT THE END OF THE 3 YEARS FOR $24000 AND TAXES IS 38%,K IS 0.13 WHAT IS THE INITIAL INVESTMENT? WHAT IS THE DISCOUNTED OPERATING CASH FLOW FOR THE 3 YEARS ? WHAT IS THE TERMINAL VALUE? WHAT IS THE TERMINAL VALUE? WHAT IS THE NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started