Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adam Mazella opened Fitness Equipment Doctor, Inc., on March 1, 2018, On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling

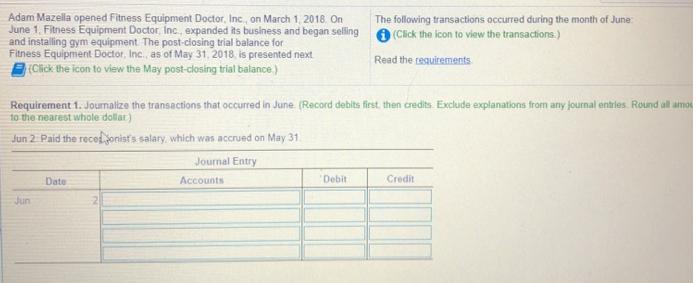

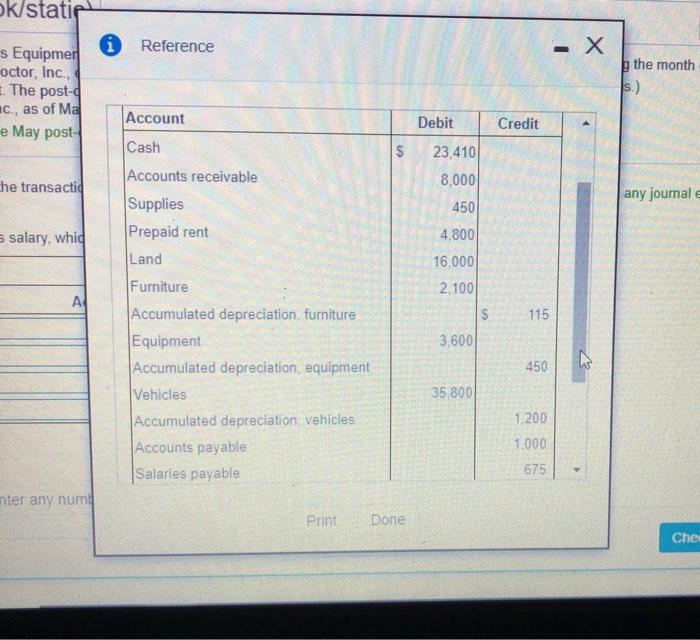

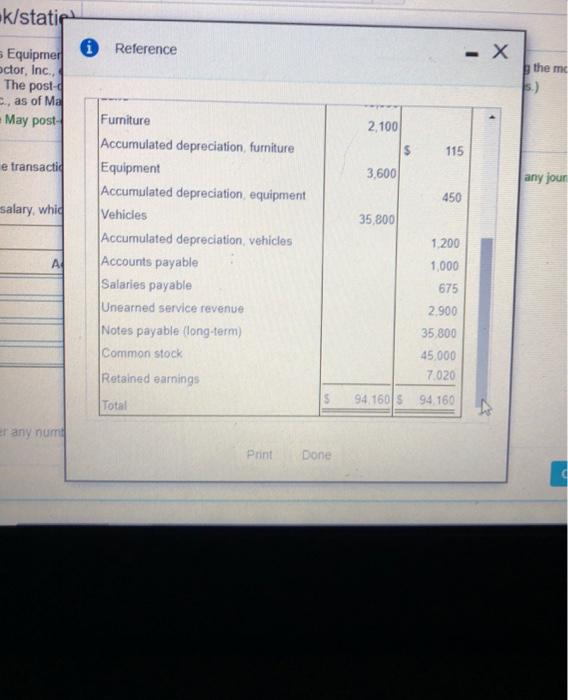

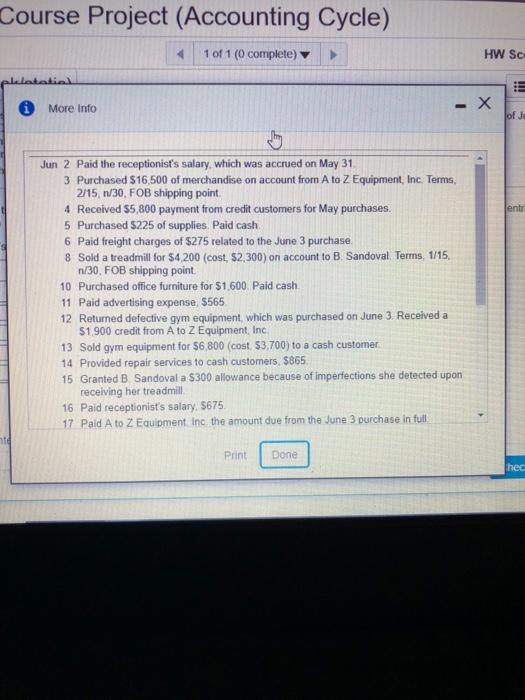

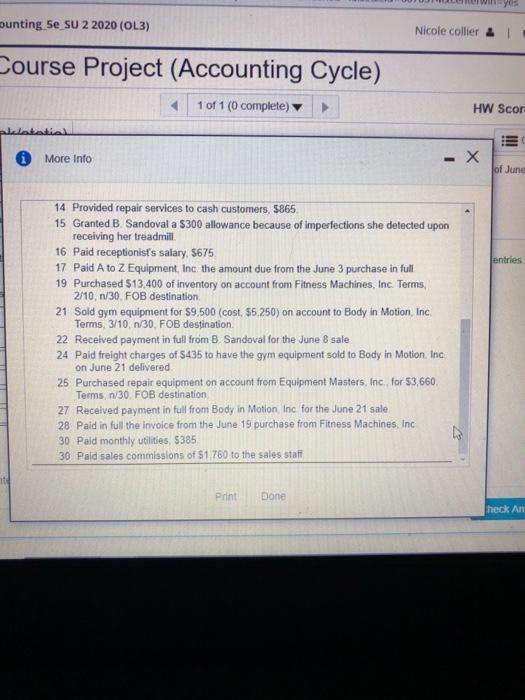

Adam Mazella opened Fitness Equipment Doctor, Inc., on March 1, 2018, On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling A (Cick the icon to view the transactions.) and installing gym equipment The post-closing trial balance for Fitness Equipment Doctor, Inc., as of May 31, 2018. is presented next (Click the icon to view the May post-closing trial balance.) The following transactions occurred during the month of June: Read the resuitements Requirement 1. Joumalize the transactions that occurred in June (Record debits first, then credits. Exclude explanations from any journal entries. Round all amo to the nearest whole dollar) Jun 2 Paid the receonist's salary, which was accrued on May 31. Journal Entry Date Accounts Debit Credit Jun ok/statie iReference s Equipmen octor, Inc., 1 The post- C., as of Ma e May post- h the month s.) Account Debit Credit Cash 23,410 Accounts receivable 8,000 he transactid any journal e Supplies 450 s salary, whid Prepaid rent 4.800 Land 16,000 Furniture 2,100 A Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 115 3.600 450 Vehicles 35,800 Accumulated depreciation, vehicles 1.200 Accounts payable 1.000 Salaries payable 675 nter any num Print Done Che %24 %24 k/statie i Reference - X s Equipmer octor, Inc., The post- E, as of Ma May post g the mc Furniture Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 2,100 115 e transacti 3,600 any jour 450 salary, whid Vehicles 35,800 Accumulated depreciation, vehicles Accounts payable Salaries payable Unearned service revenue Notes payable (long-term) 1,200 A 1,000 675 2,900 35,800 Common stock 45.000 Retained earnings 7.020 Total 94.160 S 94, 160 er any num Print Done %24 Course Project (Accounting Cycle) 1 of 1 (0 complete) v HW Sc datatial - X of Ja More Info Jun 2 Paid the receptionist's salary, which was accrued on May 31. 3 Purchased $16,500 of merchandise on account from A to Z Equipment, Inc. Terms, 2/15, n/30, FOB shipping point. 4 Received $5,800 payment from credit customers for May purchases. 5 Purchased $225 of supplies. Paid cash 6 Paid freight charges of $275 related to the June 3 purchase. 8 Sold a treadmill for $4,200 (cost, $2,300) on account to B. Sandoval. Terms, 1/15, n/30, FOB shipping point 10 Purchased office furniture for $1.600. Paid cash 11 Paid advertising expense. $565 12 Returned defective gym equipment, which was purchased on June 3. Received a $1.900 credit from A to Z Equipment, Inc. 13 Sold gym equipment for $6,800 (cost. $3,700) to a cash customer 14 Provided repair services to cash customers, $865. 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675. 17 Paid A to Z Equipment Inc the amount due from the June 3 purchase in full entr Print Done hec punting 5e suU 2 2020 (OL3) Nicole collier Course Project (Accounting Cycle) 1 of 1 (0 complete) HW Scor leletetiel i More Info of June 14 Provided repair services to cash customers, $865 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675 17 Paid A to Z Equipment, Inc. the amount due from the June 3 purchase in full 19 Purchased $13,400 of inventory on account from Fitness Machines, Inc. Terms, 2/10, n/30. FOB destination. 21 Sold gym equipment for $9.500 (cost, $5.250) on account to Body in Motion, Inc. entries Terms, 3/10, n/30, FOB destination. 22 Received payment in full from B Sandoval for the June 8 sale 24 Paid freight charges of $435 to have the gym equipment sold to Body in Motion, Inc. on June 21 delivered. 25 Purchased repair equipment on account from Equipment Masters, Inc., for $3,660. Terms, n/30. FOB destination 27 Received payment in full from Body in Motion, Inc for the June 21 sale 28 Paid in full the invoice from the June 19 purchase from Fitness Machines, Inc 30 Paid monthly utilities, $385 30 Pald sales commissions of S1.760 to the sales staff Print Done heck An II Adam Mazella opened Fitness Equipment Doctor, Inc., on March 1, 2018, On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling A (Cick the icon to view the transactions.) and installing gym equipment The post-closing trial balance for Fitness Equipment Doctor, Inc., as of May 31, 2018. is presented next (Click the icon to view the May post-closing trial balance.) The following transactions occurred during the month of June: Read the resuitements Requirement 1. Joumalize the transactions that occurred in June (Record debits first, then credits. Exclude explanations from any journal entries. Round all amo to the nearest whole dollar) Jun 2 Paid the receonist's salary, which was accrued on May 31. Journal Entry Date Accounts Debit Credit Jun ok/statie iReference s Equipmen octor, Inc., 1 The post- C., as of Ma e May post- h the month s.) Account Debit Credit Cash 23,410 Accounts receivable 8,000 he transactid any journal e Supplies 450 s salary, whid Prepaid rent 4.800 Land 16,000 Furniture 2,100 A Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 115 3.600 450 Vehicles 35,800 Accumulated depreciation, vehicles 1.200 Accounts payable 1.000 Salaries payable 675 nter any num Print Done Che %24 %24 k/statie i Reference - X s Equipmer octor, Inc., The post- E, as of Ma May post g the mc Furniture Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 2,100 115 e transacti 3,600 any jour 450 salary, whid Vehicles 35,800 Accumulated depreciation, vehicles Accounts payable Salaries payable Unearned service revenue Notes payable (long-term) 1,200 A 1,000 675 2,900 35,800 Common stock 45.000 Retained earnings 7.020 Total 94.160 S 94, 160 er any num Print Done %24 Course Project (Accounting Cycle) 1 of 1 (0 complete) v HW Sc datatial - X of Ja More Info Jun 2 Paid the receptionist's salary, which was accrued on May 31. 3 Purchased $16,500 of merchandise on account from A to Z Equipment, Inc. Terms, 2/15, n/30, FOB shipping point. 4 Received $5,800 payment from credit customers for May purchases. 5 Purchased $225 of supplies. Paid cash 6 Paid freight charges of $275 related to the June 3 purchase. 8 Sold a treadmill for $4,200 (cost, $2,300) on account to B. Sandoval. Terms, 1/15, n/30, FOB shipping point 10 Purchased office furniture for $1.600. Paid cash 11 Paid advertising expense. $565 12 Returned defective gym equipment, which was purchased on June 3. Received a $1.900 credit from A to Z Equipment, Inc. 13 Sold gym equipment for $6,800 (cost. $3,700) to a cash customer 14 Provided repair services to cash customers, $865. 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675. 17 Paid A to Z Equipment Inc the amount due from the June 3 purchase in full entr Print Done hec punting 5e suU 2 2020 (OL3) Nicole collier Course Project (Accounting Cycle) 1 of 1 (0 complete) HW Scor leletetiel i More Info of June 14 Provided repair services to cash customers, $865 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675 17 Paid A to Z Equipment, Inc. the amount due from the June 3 purchase in full 19 Purchased $13,400 of inventory on account from Fitness Machines, Inc. Terms, 2/10, n/30. FOB destination. 21 Sold gym equipment for $9.500 (cost, $5.250) on account to Body in Motion, Inc. entries Terms, 3/10, n/30, FOB destination. 22 Received payment in full from B Sandoval for the June 8 sale 24 Paid freight charges of $435 to have the gym equipment sold to Body in Motion, Inc. on June 21 delivered. 25 Purchased repair equipment on account from Equipment Masters, Inc., for $3,660. Terms, n/30. FOB destination 27 Received payment in full from Body in Motion, Inc for the June 21 sale 28 Paid in full the invoice from the June 19 purchase from Fitness Machines, Inc 30 Paid monthly utilities, $385 30 Pald sales commissions of S1.760 to the sales staff Print Done heck An II Adam Mazella opened Fitness Equipment Doctor, Inc., on March 1, 2018, On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling A (Cick the icon to view the transactions.) and installing gym equipment The post-closing trial balance for Fitness Equipment Doctor, Inc., as of May 31, 2018. is presented next (Click the icon to view the May post-closing trial balance.) The following transactions occurred during the month of June: Read the resuitements Requirement 1. Joumalize the transactions that occurred in June (Record debits first, then credits. Exclude explanations from any journal entries. Round all amo to the nearest whole dollar) Jun 2 Paid the receonist's salary, which was accrued on May 31. Journal Entry Date Accounts Debit Credit Jun ok/statie iReference s Equipmen octor, Inc., 1 The post- C., as of Ma e May post- h the month s.) Account Debit Credit Cash 23,410 Accounts receivable 8,000 he transactid any journal e Supplies 450 s salary, whid Prepaid rent 4.800 Land 16,000 Furniture 2,100 A Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 115 3.600 450 Vehicles 35,800 Accumulated depreciation, vehicles 1.200 Accounts payable 1.000 Salaries payable 675 nter any num Print Done Che %24 %24 k/statie i Reference - X s Equipmer octor, Inc., The post- E, as of Ma May post g the mc Furniture Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 2,100 115 e transacti 3,600 any jour 450 salary, whid Vehicles 35,800 Accumulated depreciation, vehicles Accounts payable Salaries payable Unearned service revenue Notes payable (long-term) 1,200 A 1,000 675 2,900 35,800 Common stock 45.000 Retained earnings 7.020 Total 94.160 S 94, 160 er any num Print Done %24 Course Project (Accounting Cycle) 1 of 1 (0 complete) v HW Sc datatial - X of Ja More Info Jun 2 Paid the receptionist's salary, which was accrued on May 31. 3 Purchased $16,500 of merchandise on account from A to Z Equipment, Inc. Terms, 2/15, n/30, FOB shipping point. 4 Received $5,800 payment from credit customers for May purchases. 5 Purchased $225 of supplies. Paid cash 6 Paid freight charges of $275 related to the June 3 purchase. 8 Sold a treadmill for $4,200 (cost, $2,300) on account to B. Sandoval. Terms, 1/15, n/30, FOB shipping point 10 Purchased office furniture for $1.600. Paid cash 11 Paid advertising expense. $565 12 Returned defective gym equipment, which was purchased on June 3. Received a $1.900 credit from A to Z Equipment, Inc. 13 Sold gym equipment for $6,800 (cost. $3,700) to a cash customer 14 Provided repair services to cash customers, $865. 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675. 17 Paid A to Z Equipment Inc the amount due from the June 3 purchase in full entr Print Done hec punting 5e suU 2 2020 (OL3) Nicole collier Course Project (Accounting Cycle) 1 of 1 (0 complete) HW Scor leletetiel i More Info of June 14 Provided repair services to cash customers, $865 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675 17 Paid A to Z Equipment, Inc. the amount due from the June 3 purchase in full 19 Purchased $13,400 of inventory on account from Fitness Machines, Inc. Terms, 2/10, n/30. FOB destination. 21 Sold gym equipment for $9.500 (cost, $5.250) on account to Body in Motion, Inc. entries Terms, 3/10, n/30, FOB destination. 22 Received payment in full from B Sandoval for the June 8 sale 24 Paid freight charges of $435 to have the gym equipment sold to Body in Motion, Inc. on June 21 delivered. 25 Purchased repair equipment on account from Equipment Masters, Inc., for $3,660. Terms, n/30. FOB destination 27 Received payment in full from Body in Motion, Inc for the June 21 sale 28 Paid in full the invoice from the June 19 purchase from Fitness Machines, Inc 30 Paid monthly utilities, $385 30 Pald sales commissions of S1.760 to the sales staff Print Done heck An II Adam Mazella opened Fitness Equipment Doctor, Inc., on March 1, 2018, On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling A (Cick the icon to view the transactions.) and installing gym equipment The post-closing trial balance for Fitness Equipment Doctor, Inc., as of May 31, 2018. is presented next (Click the icon to view the May post-closing trial balance.) The following transactions occurred during the month of June: Read the resuitements Requirement 1. Joumalize the transactions that occurred in June (Record debits first, then credits. Exclude explanations from any journal entries. Round all amo to the nearest whole dollar) Jun 2 Paid the receonist's salary, which was accrued on May 31. Journal Entry Date Accounts Debit Credit Jun ok/statie iReference s Equipmen octor, Inc., 1 The post- C., as of Ma e May post- h the month s.) Account Debit Credit Cash 23,410 Accounts receivable 8,000 he transactid any journal e Supplies 450 s salary, whid Prepaid rent 4.800 Land 16,000 Furniture 2,100 A Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 115 3.600 450 Vehicles 35,800 Accumulated depreciation, vehicles 1.200 Accounts payable 1.000 Salaries payable 675 nter any num Print Done Che %24 %24 k/statie i Reference - X s Equipmer octor, Inc., The post- E, as of Ma May post g the mc Furniture Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 2,100 115 e transacti 3,600 any jour 450 salary, whid Vehicles 35,800 Accumulated depreciation, vehicles Accounts payable Salaries payable Unearned service revenue Notes payable (long-term) 1,200 A 1,000 675 2,900 35,800 Common stock 45.000 Retained earnings 7.020 Total 94.160 S 94, 160 er any num Print Done %24 Course Project (Accounting Cycle) 1 of 1 (0 complete) v HW Sc datatial - X of Ja More Info Jun 2 Paid the receptionist's salary, which was accrued on May 31. 3 Purchased $16,500 of merchandise on account from A to Z Equipment, Inc. Terms, 2/15, n/30, FOB shipping point. 4 Received $5,800 payment from credit customers for May purchases. 5 Purchased $225 of supplies. Paid cash 6 Paid freight charges of $275 related to the June 3 purchase. 8 Sold a treadmill for $4,200 (cost, $2,300) on account to B. Sandoval. Terms, 1/15, n/30, FOB shipping point 10 Purchased office furniture for $1.600. Paid cash 11 Paid advertising expense. $565 12 Returned defective gym equipment, which was purchased on June 3. Received a $1.900 credit from A to Z Equipment, Inc. 13 Sold gym equipment for $6,800 (cost. $3,700) to a cash customer 14 Provided repair services to cash customers, $865. 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675. 17 Paid A to Z Equipment Inc the amount due from the June 3 purchase in full entr Print Done hec punting 5e suU 2 2020 (OL3) Nicole collier Course Project (Accounting Cycle) 1 of 1 (0 complete) HW Scor leletetiel i More Info of June 14 Provided repair services to cash customers, $865 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675 17 Paid A to Z Equipment, Inc. the amount due from the June 3 purchase in full 19 Purchased $13,400 of inventory on account from Fitness Machines, Inc. Terms, 2/10, n/30. FOB destination. 21 Sold gym equipment for $9.500 (cost, $5.250) on account to Body in Motion, Inc. entries Terms, 3/10, n/30, FOB destination. 22 Received payment in full from B Sandoval for the June 8 sale 24 Paid freight charges of $435 to have the gym equipment sold to Body in Motion, Inc. on June 21 delivered. 25 Purchased repair equipment on account from Equipment Masters, Inc., for $3,660. Terms, n/30. FOB destination 27 Received payment in full from Body in Motion, Inc for the June 21 sale 28 Paid in full the invoice from the June 19 purchase from Fitness Machines, Inc 30 Paid monthly utilities, $385 30 Pald sales commissions of S1.760 to the sales staff Print Done heck An II Adam Mazella opened Fitness Equipment Doctor, Inc., on March 1, 2018, On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling A (Cick the icon to view the transactions.) and installing gym equipment The post-closing trial balance for Fitness Equipment Doctor, Inc., as of May 31, 2018. is presented next (Click the icon to view the May post-closing trial balance.) The following transactions occurred during the month of June: Read the resuitements Requirement 1. Joumalize the transactions that occurred in June (Record debits first, then credits. Exclude explanations from any journal entries. Round all amo to the nearest whole dollar) Jun 2 Paid the receonist's salary, which was accrued on May 31. Journal Entry Date Accounts Debit Credit Jun ok/statie iReference s Equipmen octor, Inc., 1 The post- C., as of Ma e May post- h the month s.) Account Debit Credit Cash 23,410 Accounts receivable 8,000 he transactid any journal e Supplies 450 s salary, whid Prepaid rent 4.800 Land 16,000 Furniture 2,100 A Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 115 3.600 450 Vehicles 35,800 Accumulated depreciation, vehicles 1.200 Accounts payable 1.000 Salaries payable 675 nter any num Print Done Che %24 %24 k/statie i Reference - X s Equipmer octor, Inc., The post- E, as of Ma May post g the mc Furniture Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment 2,100 115 e transacti 3,600 any jour 450 salary, whid Vehicles 35,800 Accumulated depreciation, vehicles Accounts payable Salaries payable Unearned service revenue Notes payable (long-term) 1,200 A 1,000 675 2,900 35,800 Common stock 45.000 Retained earnings 7.020 Total 94.160 S 94, 160 er any num Print Done %24 Course Project (Accounting Cycle) 1 of 1 (0 complete) v HW Sc datatial - X of Ja More Info Jun 2 Paid the receptionist's salary, which was accrued on May 31. 3 Purchased $16,500 of merchandise on account from A to Z Equipment, Inc. Terms, 2/15, n/30, FOB shipping point. 4 Received $5,800 payment from credit customers for May purchases. 5 Purchased $225 of supplies. Paid cash 6 Paid freight charges of $275 related to the June 3 purchase. 8 Sold a treadmill for $4,200 (cost, $2,300) on account to B. Sandoval. Terms, 1/15, n/30, FOB shipping point 10 Purchased office furniture for $1.600. Paid cash 11 Paid advertising expense. $565 12 Returned defective gym equipment, which was purchased on June 3. Received a $1.900 credit from A to Z Equipment, Inc. 13 Sold gym equipment for $6,800 (cost. $3,700) to a cash customer 14 Provided repair services to cash customers, $865. 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675. 17 Paid A to Z Equipment Inc the amount due from the June 3 purchase in full entr Print Done hec punting 5e suU 2 2020 (OL3) Nicole collier Course Project (Accounting Cycle) 1 of 1 (0 complete) HW Scor leletetiel i More Info of June 14 Provided repair services to cash customers, $865 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill. 16 Paid receptionist's salary, $675 17 Paid A to Z Equipment, Inc. the amount due from the June 3 purchase in full 19 Purchased $13,400 of inventory on account from Fitness Machines, Inc. Terms, 2/10, n/30. FOB destination. 21 Sold gym equipment for $9.500 (cost, $5.250) on account to Body in Motion, Inc. entries Terms, 3/10, n/30, FOB destination. 22 Received payment in full from B Sandoval for the June 8 sale 24 Paid freight charges of $435 to have the gym equipment sold to Body in Motion, Inc. on June 21 delivered. 25 Purchased repair equipment on account from Equipment Masters, Inc., for $3,660. Terms, n/30. FOB destination 27 Received payment in full from Body in Motion, Inc for the June 21 sale 28 Paid in full the invoice from the June 19 purchase from Fitness Machines, Inc 30 Paid monthly utilities, $385 30 Pald sales commissions of S1.760 to the sales staff Print Done heck An II

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Date Account Titles Debit Credit Jun02 Salaries Payable Cash Jun03 Inventory 16500 Accounts PayableA ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started