Add scratch work, please! :) Thank you!!

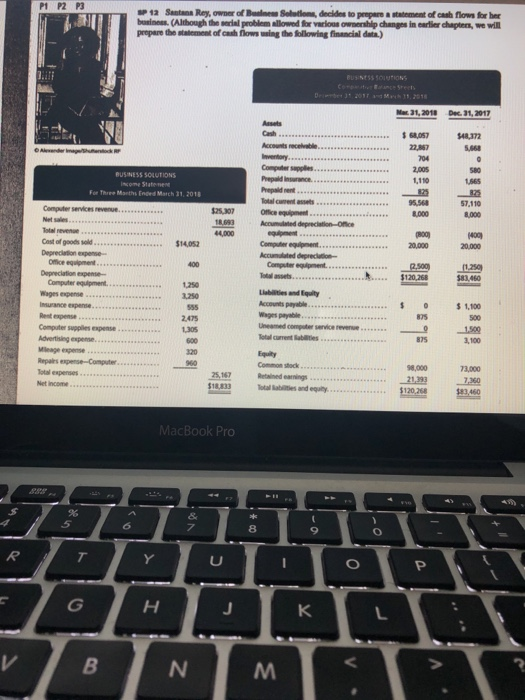

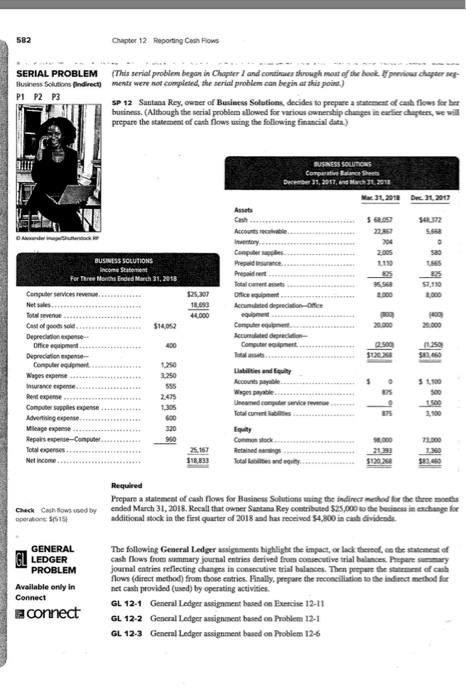

P1 P2 P3 a Santana Rey, owner of the bo (Althood the wall problem prepare the w h o Soutom, decides to prepare t are dhe the flowing financial ) ent of cash flows for her artier chapter, we will Met 31, 2018 Dec 31, 2017 $48,372 07 2017 Arc BUSINESS SOLUTIONS Computer services revenue... Net ses Total Office ......... Acadere . Computer 4000 $14.052 Com Cast fo od........ Deprec Office .... Depreciation expen Computer e nt..... Wages expense. Totalcar s ........ Computers Advertising expense Mileageexpe .. . Repales expense-Computer Equity Common och 25 73.000 7.360 SE360 de ... MacBook Pro Uop 2 BN MET Rendearings ande W Required Prepare a statement of cash flows for Business Solutions using the Indirect method for the three months ended March 31, 2018. Recall that owner Santana Rey contributed $25,000 to the business in exchange for additional stock in the first quarter of 2018 and has received $4,800 in cash dividends. on 51515 GENERAL LEDGER PROBLEM ilable only in nect connect The following General Ledger assignments highlight the impact, or lack thereof, on the statement of cash flows from summary journal entries derived from consecutive trial balances. Prepare summary journal entries reflecting changes in consecutive trial balances. The prepare the statement of cash flows (direct method) from those entries. Finally, prepare the reconciliation to the indirect method for net cash provided (used) by operating activities GL 12-1 General Ledger assignment based on Exercise 12-11 GL 12-2 General Ledger assignment based on Problem 12-1 GL 12-3 General Ledger assignment based on Problem 12-6 MacBook Pro H BNM command option Chapter 12 Reporting Cashow SERIAL PROBLEM Business Solo P1 P2 P3 This serial problem began in Chapter I and cont completed the problem can be r ol most of the book post) a SP 12 Santa Rey, owner of Business Solutions, decides to prep business. Although the serial problem allowed for varios webp changes in prepare the statement of cash flows using the following financial data) flows for her chapters, we will BUSINESS SOLUTIONS Comece December 31, 2017 March 2010 31, 2010 Dec. 11. 2017 BUSINESS SOLUTIONS income Statement For Three Month Ended March 31, 2013 Com Preise Pregradert $25.300 Conservice Net Office Rounted depreciation ent Computer Accumulated depreciation Computer $14.052 Cast of goods sold. Depreciatio n s Office Depreciation expens Computer u t Wages expense.. wance expenses **!!919 1998 .. . 3250 Rele 2.425 Une course Totalcune Compute r Advertisingepen Mileage Repairs Complet 320 960 2360 Nutcome $18.833 Total $120240 Required Prepare a statement of cash flows for Business Solutions in the indic a dore s ended March 31, 2018 Recall that werSantana Rey contributed $25.000 the be i nah additional stock in the first quarter of 2018 and has moved 54,800 in cash dividende e for Check Chows used by to 5518 GENERAL GI LEDGER PROBLEM Available only in Connect connect The following General Ledger assignments highlight the impact or lack of them cash flows from summary journal entries derived fru c tive tra c es Prepare journal entries reflecting changes in consecutive al haces. The prepared to cash flows (direct method from those catrics. Hay prepare the recen t h t hed for et cash provided (used) by operating activities GL 12-1 General Ledger assignment based on Exercise 12-11 GL 12-2 Genl Ledger assignment based on Problem 12-1 GL 12-3 General Ledger assignment based on Problem 126