Answered step by step

Verified Expert Solution

Question

1 Approved Answer

added a picture of previous transactions B) The following additional information is available to enable you to prepare adjusting accounts in the unadjusted trial balance

added a picture of previous transactions

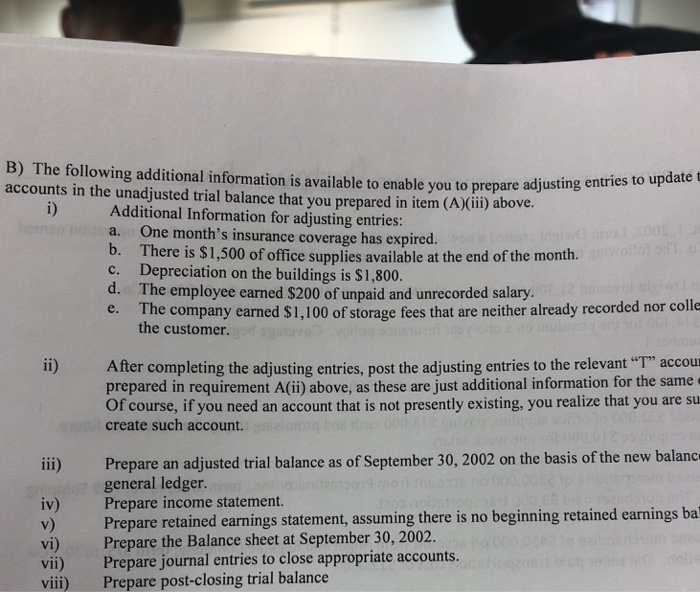

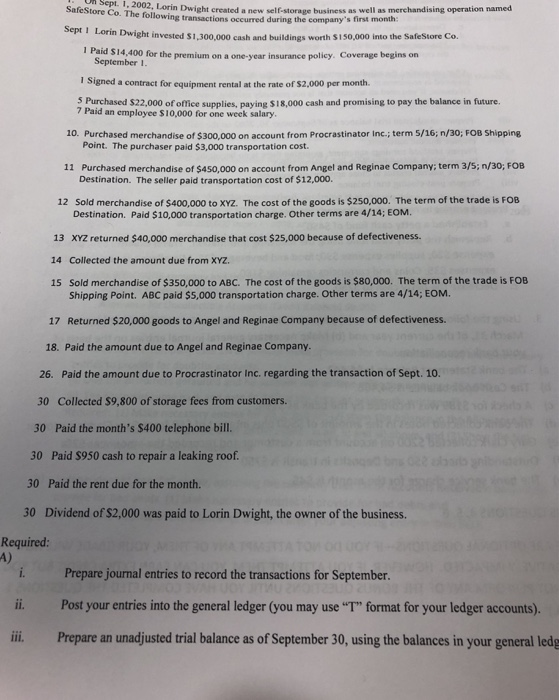

B) The following additional information is available to enable you to prepare adjusting accounts in the unadjusted trial balance that you prepared in item (A)(ii)i above. i) Additional Information for adjusting entries: a. One month's insurance coverage has expired. ere is $1,500 of office supplies available at the end of the month. c. Depreciation on the buildings is $1,800. C. d. The employee earned S200 of unpaid and unrecorded salary. e. The company earned S1,100 of storage fees that are neither already recorded nor colle the customer. i) After completing the adjusting entries, post the adjusting entries to the relevant "T" accou prepared in requirement A(ii) above, as these are just additional information for the same Of course, if you need an account that is not presently existing, you realize that you are su create such account. Prepare an adjusted trial balance as of September 30, 2002 on the basis of the new balanc general ledger. iii) iv) Prepare income statement. v) Prepare retained earnings statement, assuming there vi) Prepare the Balance sheet at September 30, 2002. vii) Prepare journal entries to close appropriate accounts viii) Prepare post-closing trial balance Prepurertsine caringeinhrei no beginming retained camings ba no 2002, Lorin Dwight created a new self-storage business as well as merchandising operation named SafeStore Co. The following transactions occurred during the company's first mo invested $1,300,000 cash and buildings worth $150,000 into the SafeStore Co I Paid $14,400 for the premium on a one-year insurance policy. Coverage begins on September 1 I Signed a contract for equipment rental at the rate of $2,000 per month 5 Purchased $22,000 of office supplies, paying $18,000 cash and promising to pay the balance in future. 7 Paid an employee $10,000 for one week salary Point. The purchaser paid $3,000 transportation cost. Purchased merchandise of $450,000 on account from Angel and Reginae Company; term 3/5; n/30; FOB 10. Purchased merchandise of $300,000 on account from Procrastinator inc.; term 5/16; n/30; FOB Shipping 11 Destination. The seller paid transportation cost of $12,000. 12 Sold merchandise of $400,000 to XYZ. The cost of the goods is $250,000. The term of the trade is FOB Destination. Paid $10,000 transportation charge. Other terms are 4/14; EOM. XYZ returned $40,000 merchandise that cost $25,000 because of defectiveness. 13 14 Collected the amount due from XYZ. 15 Sold merchandise of $350,000 to ABC. The cost of the goods is $80,000. The term of the trade is FOB Shipping Point. ABC paid $5,000 transportation charge. Other terms are 4/14; EOM. Returned $20,000 goods to Angel and Reginae Company because of defectiveness 17 18. Paid the amount due to Angel and Reginae Company. 26. Paid the amount due to Procrastinator Inc. regarding the transaction of Sept. 10. 30 Collected $9,800 of storage fees from customers. 30 Paid the month's $400 telephone bill 30 Paid S950 cash to repair a leaking roof. 30 30 Required: Paid the rent due for the month. Dividend of $2,000 was paid to Lorin Dwight, the owner of the business. i. Prepare journal entries to record the transactions for September ii. Post your entries into the general ledger (you may use "T" format for your ledger accounts). ii Prepare an unadjusted trial balance as of September 30, using the balances in your general ledg Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started