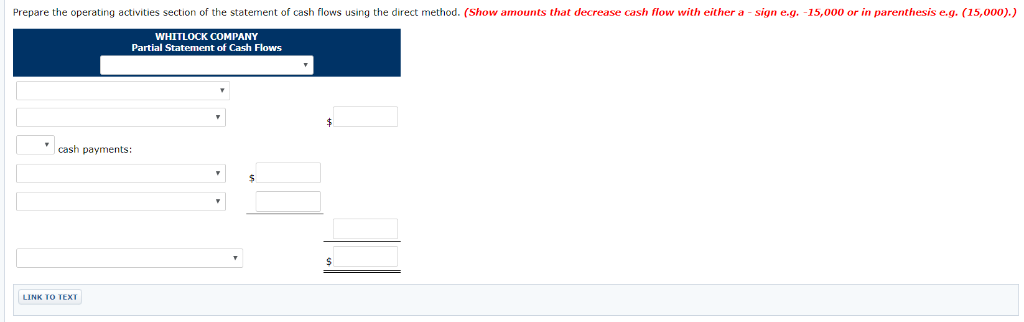

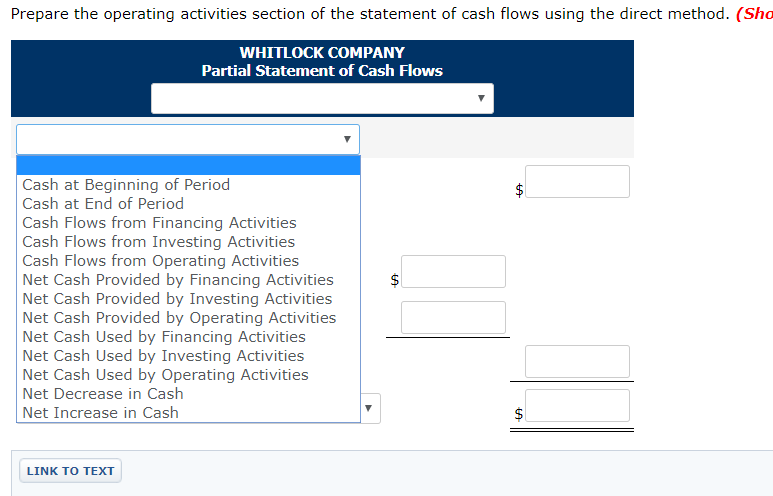

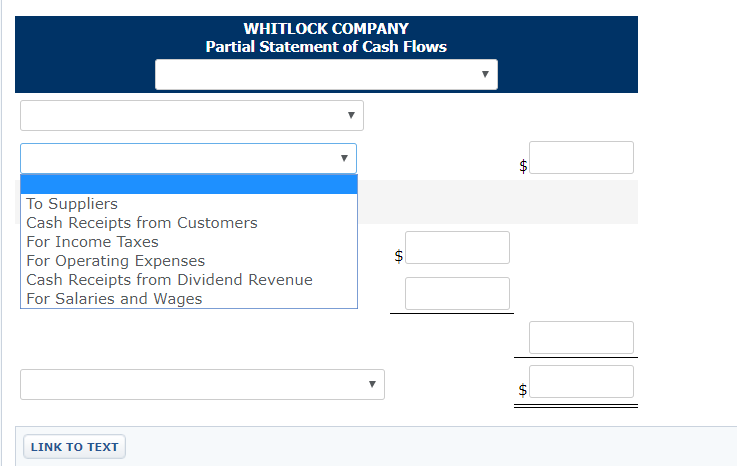

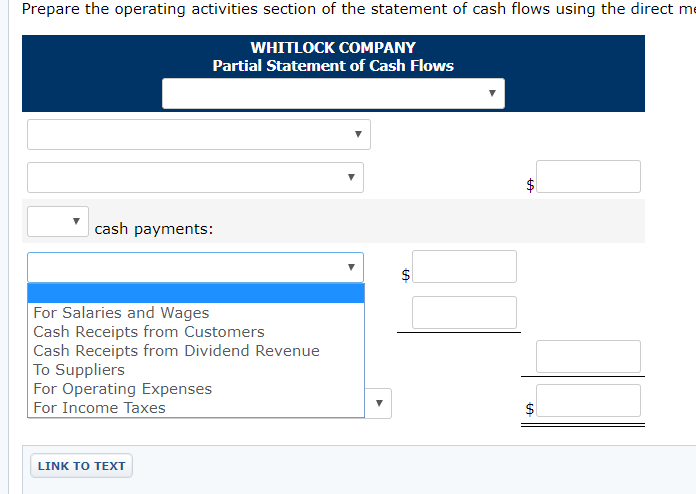

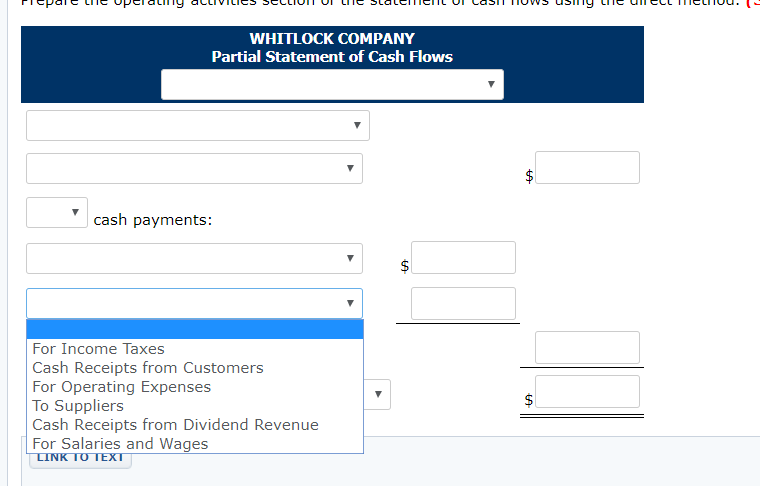

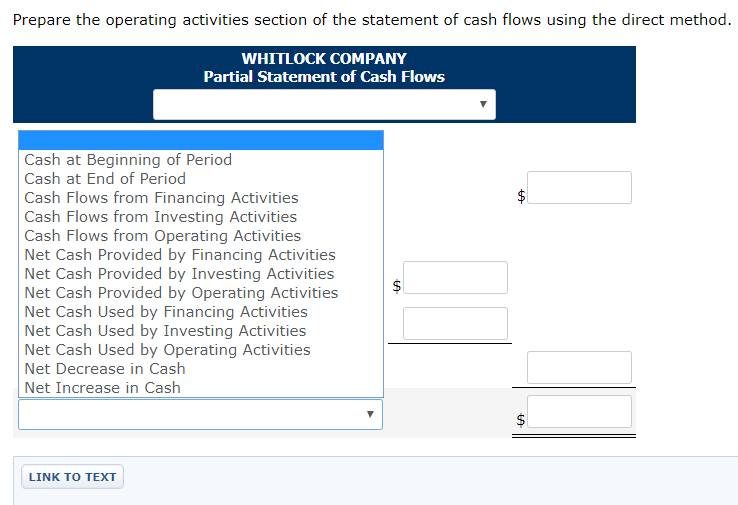

Added the drop downs

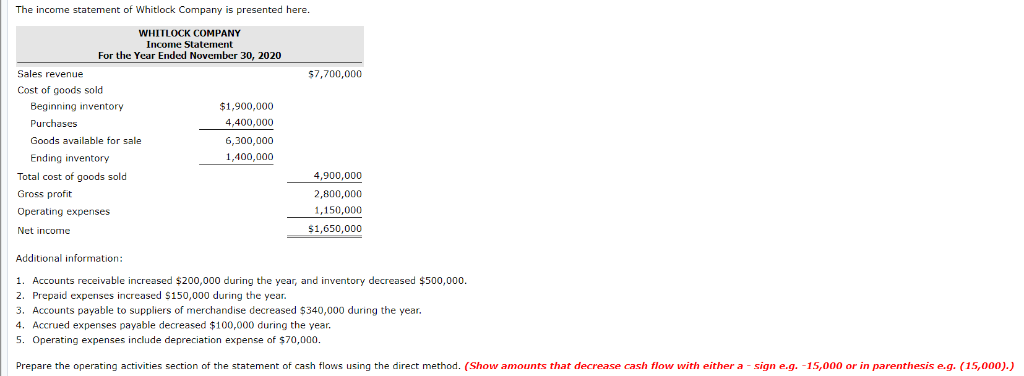

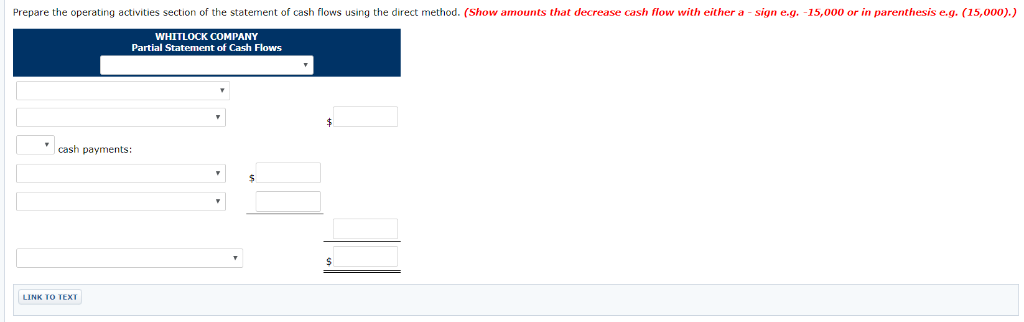

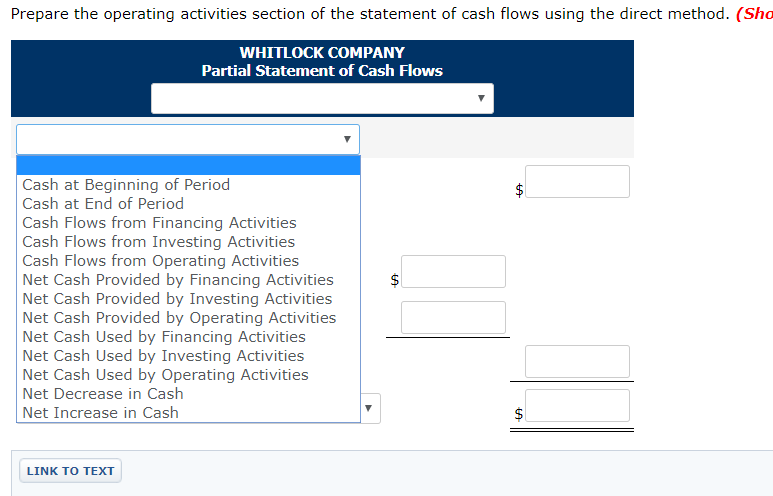

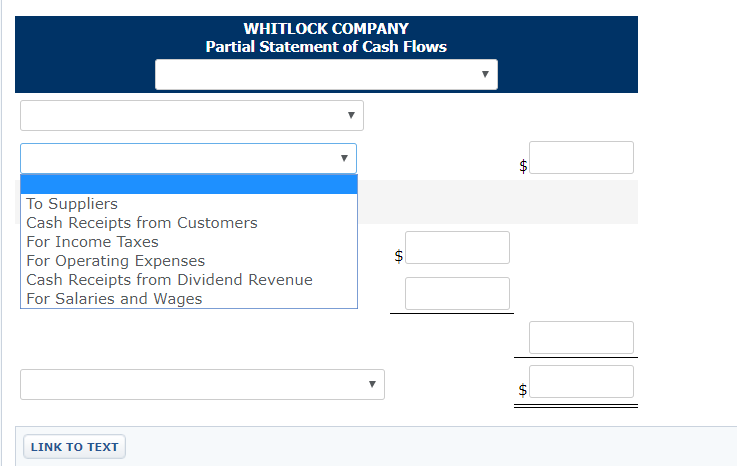

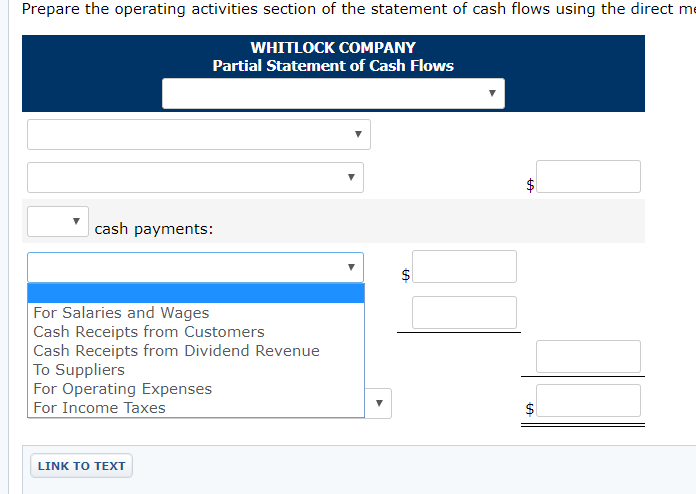

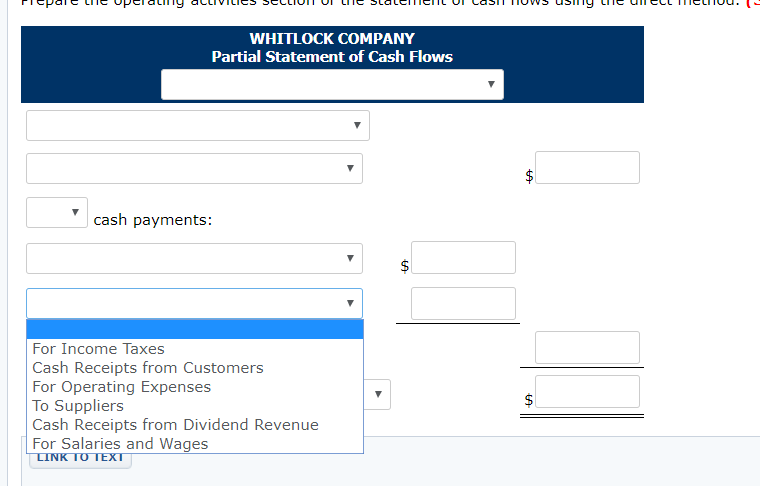

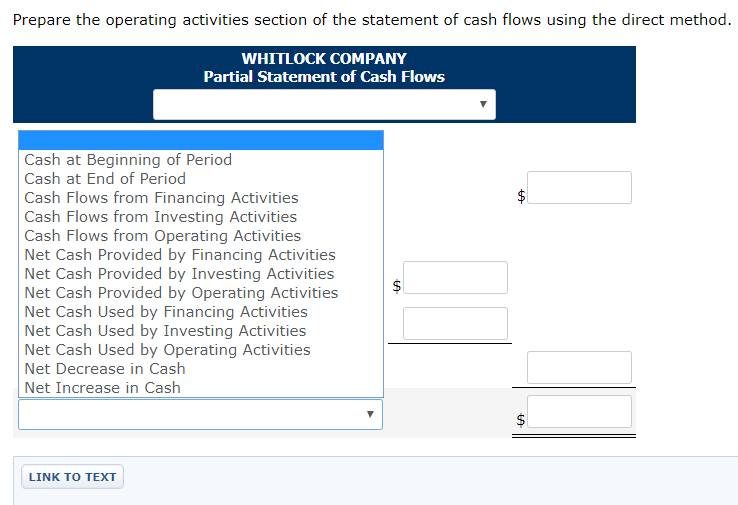

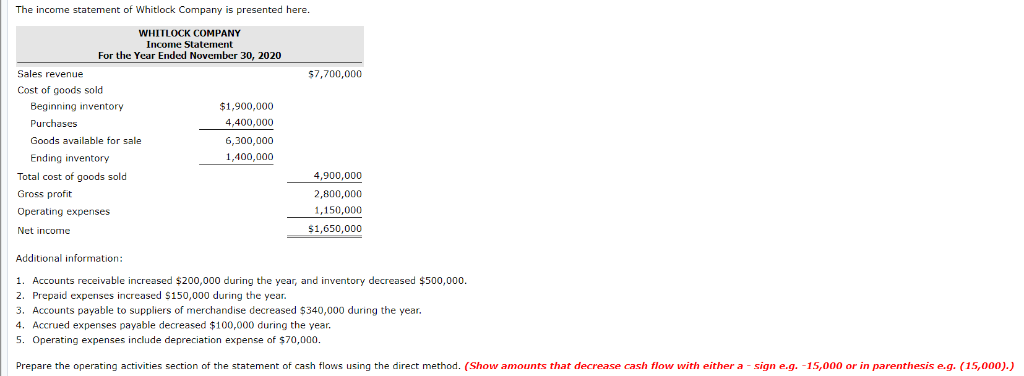

The income statement of Whitlock Company is presented here. WHITLOCK COMPANY Income Statement For the Year Ended November 30, 2020 Sales revenue 7,700,000 Cost of goods sold Beginning inventory $1,900,000 4,400,000 6,300,000 1,400,000 Goods available for sale Ending inventory Total cost of goods sold Gross profit Operating expenses Net income 4,900,000 2,800,000 1,150,000 51,650,000 Additional information: 1. Accounts receivable increased $200,000 during the year, and inventory decreased $500,000. 2. Prepaid expenses increased S150,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $340,000 during the year 4. Accrued expenses payable decreased $100,000 during the year. 5. Operating expenses include depreciation expense of $70,000. Prepare the operating activities section of the statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a sign e.g.-15,000 or in parenthesis e.g. (15,000).) Prepare the operating activities section of the statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) WHITLOCK COMPANY Partial Statement of Cash Flows cash payments: LINK TO IEXI Prepare the operating activities section of the statement of cash flows using the direct method. (Sho WHITLOCK COMPANY Partial Statement of Cash Flows Cash at Beginning of Period Cash at End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used by Financing Activities Net Cash Used by Investing Activities Net Cash Used by Operating Activities Net Decrease in Cash Net Increase in Cash LINK TO TEXT WHITLOCK COMPANY Partial Statement of Cash Flows To Suppliers Cash Receipts from Customers For Income Taxes For Operating Expenses Cash Receipts from Dividend Revenue For Salaries and Wages LINK TO TEXT Prepare the operating activities section of the statement of cash flows using the direct m WHITLOCK COMPANY Partial Statement of Cash Flows cash payments: ari a Wi; Cash Receipts from Customers Cash Receipts from Dividend Revenue To Suppliers For Operating Expenses For Income Taxes LINK TO TEXT WHITLOCK COMPANY Partial Statement of Cash Flows cash payments: For Income Taxes Cash Receipts from Customers For Operating Expenses To Suppliers Cash Receipts from Dividend Revenue For Salaries and Wages LINK TO TEXT Prepare the operating activities section of the statement of cash flows using the direct method WHITLOCK COMPANY Partial Statement of Cash Flows Cash at Beginning of Period Cash at End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used by Financing Activities Net Cash Used by Investing Activities Net Cash Used by Operating Activities Net Decrease in Cash Net Increase in Cash LINK TO TEXT