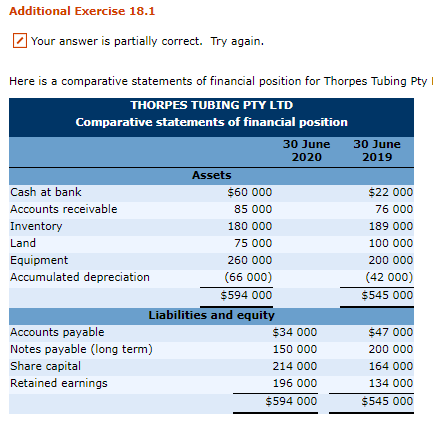

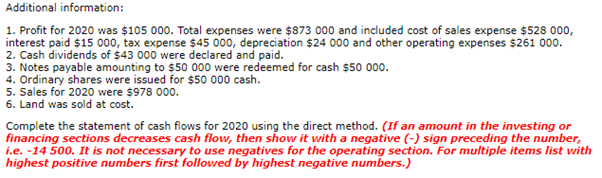

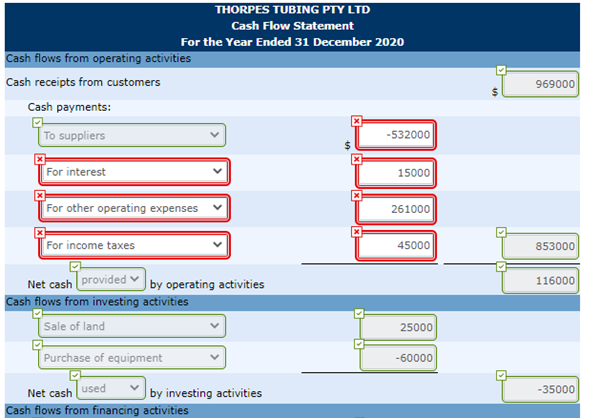

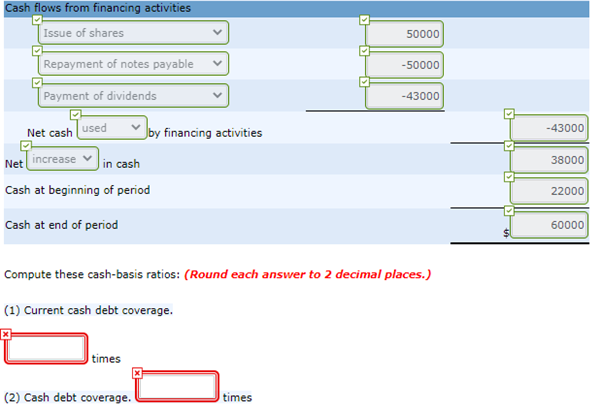

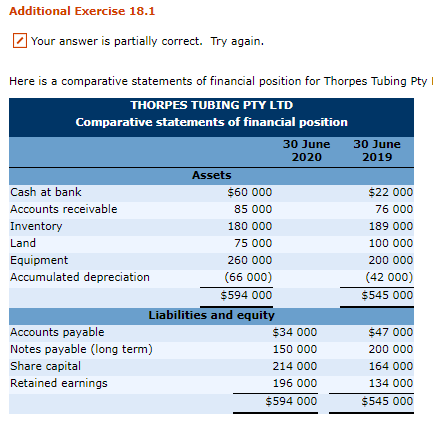

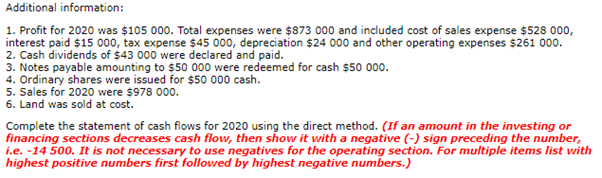

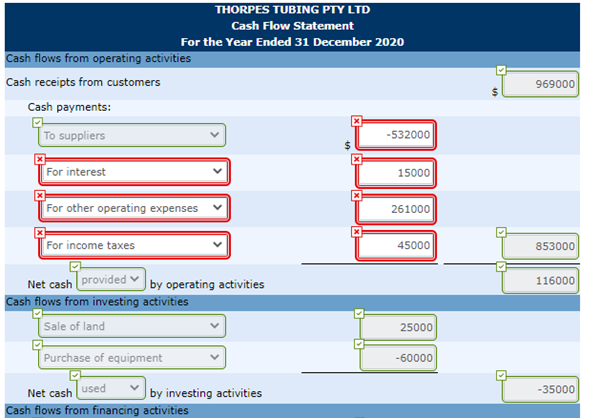

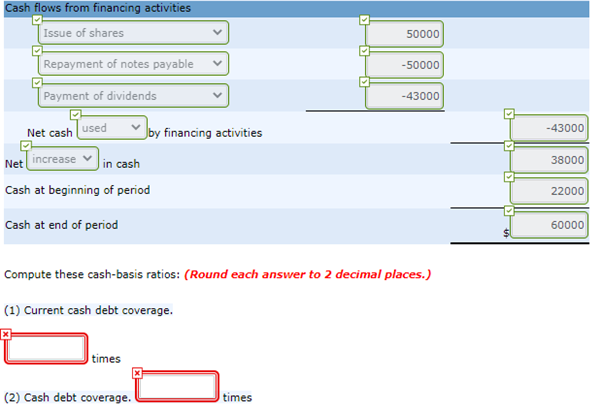

Additional Exercise 18.1 Your answer is partially correct. Try again. Here is a comparative statements of financial position for Thorpes Tubing Pty THORPES TUBING PTY LTD Comparative statements of financial position 30 June 30 June 2020 2019 Assets Cash at bank $60 000 $22 000 Accounts receivable 85 000 76 000 Inventory 180 000 189 000 Land 75 000 100 000 Equipment 260 000 200 000 Accumulated depreciation (66 000) (42 000) $594 000 $545 000 Liabilities and equity Accounts payable $34 000 $47 000 Notes payable (long term) 150 000 200 000 Share capital 214 000 164 000 Retained earnings 196 000 134 000 $594 000 $545 000 Additional information: 1. Profit for 2020 was $105 000. Total expenses were $873 000 and included cost of sales expense $528 000, interest paid $15 000, tax expense $45 000, depreciation $24 000 and other operating expenses $261 000. 2. Cash dividends of $43 000 were declared and paid. 3. Notes payable amounting to $50 000 were redeemed for cash $50 000. 4. Ordinary shares were issued for $50 000 cash. 5. Sales for 2020 were $978 000. 6. Land was sold at cost. Complete the statement of cash flows for 2020 using the direct method. (If an amount in the investing or financing sections decreases cash flow, then show it with a negative (-) sign preceding the number, 1.e. -14 500. It is not necessary to use negatives for the operating section. For multiple items list with highest positive numbers first followed by highest negative numbers.) THORPES TUBING PTY LTD Cash Flow Statement For the Year Ended 31 December 2020 Cash flows from operating activities Cash receipts from customers Cash payments: $ 969000 To suppliers -532000 For interest 15000 X X For other operating expenses 261000 x For income taxes 45000 853000 Net cash provided 116000 by operating activities Cash flows from investing activities Sale of land 25000 Purchase of equipment -60000 -35000 Net cash used by investing activities Cash flows from financing activities Cash flows from financing activities Issue of shares 50000 Repayment of notes payable -50000 Payment of dividends -43000 -43000 Net cash used Jby financing activities Net increase in cash Cash at beginning of period 38000 22000 Cash at end of period 60000 Compute these cash-basis ratios: (Round each answer to 2 decimal places.) (1) Current cash debt coverage. times (2) Cash debt coverage. times