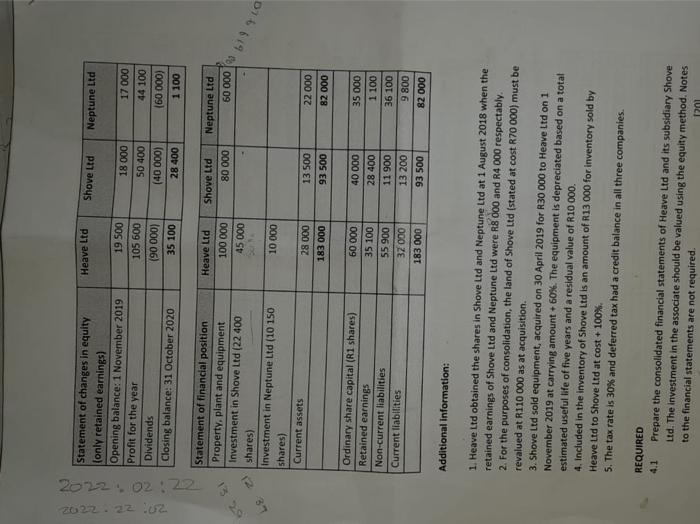

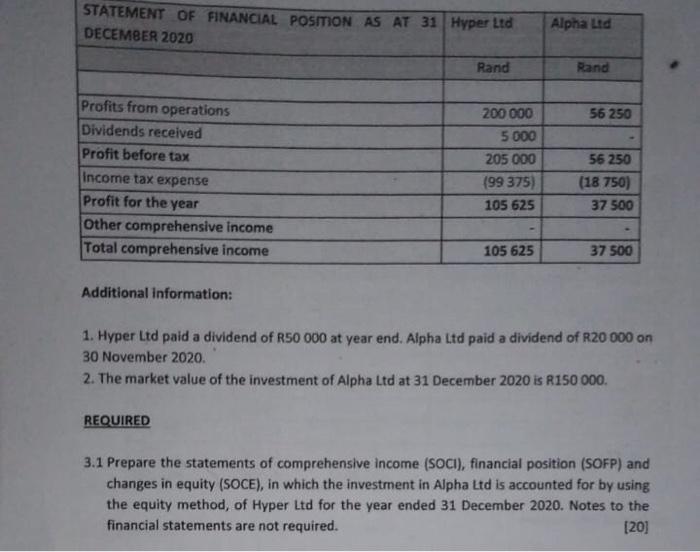

Additional information: 1. Heave Ltd obtained the shares in Shove Ltd and Neptune Ltd at 1 August 2018 when the retained earnings of Shove Ltd and Neptune Ltd were R8 000 and R4 000 respectably. 2. For the purposes of consolidation, the land of Shove Ltd (stated at cost R70 000) must be revalued at R110 000 as at acquisition. 3. Shove Ltd sold equipment, acquired on 30 April 2019 for R30 000 to Heave ttd on 1 November 2019 at carrying amount +603. The equipment is depreciated based on a total estimated useful life of five years and a residual value of R10000. 4. Included in the inventory of Shove Ltd is an amount of fl13000 for inventory sold by Heave Ltd to Shove t.td at cost +100%. 5. The tax rate is 30% and deferred tax had a credit balance in all three companies. REQUIRED 4.1 Prepare the consolidated financial statements of Heave Ltd and its subsidiary Shove Ld. The investment in the associate should be valued using the equity method. Notes to the financial statements are not required. Additional information: 1. Hyper Ltd paid a dividend of R50 000 at year end. Alpha Ltd paid a dividend of R20 000 on 30 November 2020. 2. The market value of the investment of Alpha Ltd at 31 December 2020 is R150 000 . REQUIRED 3.1 Prepare the statements of comprehensive income (SOCI), financial position (SOFP) and changes in equity (SOCE), in which the investment in Alpha Ltd is accounted for by using the equity method, of Hyper Ltd for the year ended 31 December 2020. Notes to the financial statements are not required. [20] Additional information: 1. Heave Ltd obtained the shares in Shove Ltd and Neptune Ltd at 1 August 2018 when the retained earnings of Shove Ltd and Neptune Ltd were R8 000 and R4 000 respectably. 2. For the purposes of consolidation, the land of Shove Ltd (stated at cost R70 000) must be revalued at R110 000 as at acquisition. 3. Shove Ltd sold equipment, acquired on 30 April 2019 for R30 000 to Heave ttd on 1 November 2019 at carrying amount +603. The equipment is depreciated based on a total estimated useful life of five years and a residual value of R10000. 4. Included in the inventory of Shove Ltd is an amount of fl13000 for inventory sold by Heave Ltd to Shove t.td at cost +100%. 5. The tax rate is 30% and deferred tax had a credit balance in all three companies. REQUIRED 4.1 Prepare the consolidated financial statements of Heave Ltd and its subsidiary Shove Ld. The investment in the associate should be valued using the equity method. Notes to the financial statements are not required. Additional information: 1. Hyper Ltd paid a dividend of R50 000 at year end. Alpha Ltd paid a dividend of R20 000 on 30 November 2020. 2. The market value of the investment of Alpha Ltd at 31 December 2020 is R150 000 . REQUIRED 3.1 Prepare the statements of comprehensive income (SOCI), financial position (SOFP) and changes in equity (SOCE), in which the investment in Alpha Ltd is accounted for by using the equity method, of Hyper Ltd for the year ended 31 December 2020. Notes to the financial statements are not required. [20]