Question

Additional information: 1. Number of ordinary shares of each company: Pink Bhd 200 million Panther Bhd 120 million Minions Bhd 60 million 2. Investment in

Additional information:

1. Number of ordinary shares of each company: Pink Bhd 200 million Panther Bhd 120 million Minions Bhd 60 million

2. Investment in subsidiaries and associate: a. Pink Bhd acquired 80% of Panther Bhds ordinary shares on 1 July 2018. Retained profit of Panther Bhd on the acquisition date was reported at RM30,100,000. The fair value of nondepreciable asset of Panther Bhd was RM2,000,000 exceed its carrying value. No adjustment has been made by Panther Bhd as to account for the value. b. Pink Bhd acquired 30% of the issued ordinary shares of Minions Bhd on 1 January 209. On this date, the retained profit of Minions was RM42,000,000.

3. Pink Bhd also have joint control in another company, Green Bhd 1 June 2019 at 45%. Green Bhd reporting a balance of retained profit on 1 June 2019 at RM2,000,000. As at 31 December 2021, the retained profit of Green Bhd amounted to RM3,500,000.

4. On June 2021, Pink Bhd sold a machine to Panther Bhd. The machine carrying amount was RM280,000,000 and sold at RM300,000,000. On this date, the remaining useful life of the plant was five years. It is the group policy to depreciate its non- current assets on a straight line method with a full years depreciation provided in the year of purchase and none in the year of disposal.

5. During the year, Minions Bhd sold goods costing RM1,000,000 to Pink Bhd for RM1,200,000 at a mark-up of 20%. As at the year-end, 30% of these goods are remained unsold.

6. Included in the trade receivable of Pink Bhd is RM2,000,000 due from Panther Bhd. Panther Bhd recorded it as trade payable amounted to only RM1,000,000 since another RM1,000,000 was remitted to Pink Bhd but yet received as at 31 December 2021. 4

7. It is the groups policy to measure the non-controlling interest at the proportionate interest in the fair values of the net assets of the subsidiary on the date of acquisition.

Required: Prepare the Consolidated Statement of Financial Position of Pink Bhd and its group of companies as at 31 December 2021. Disclose all relevant workings

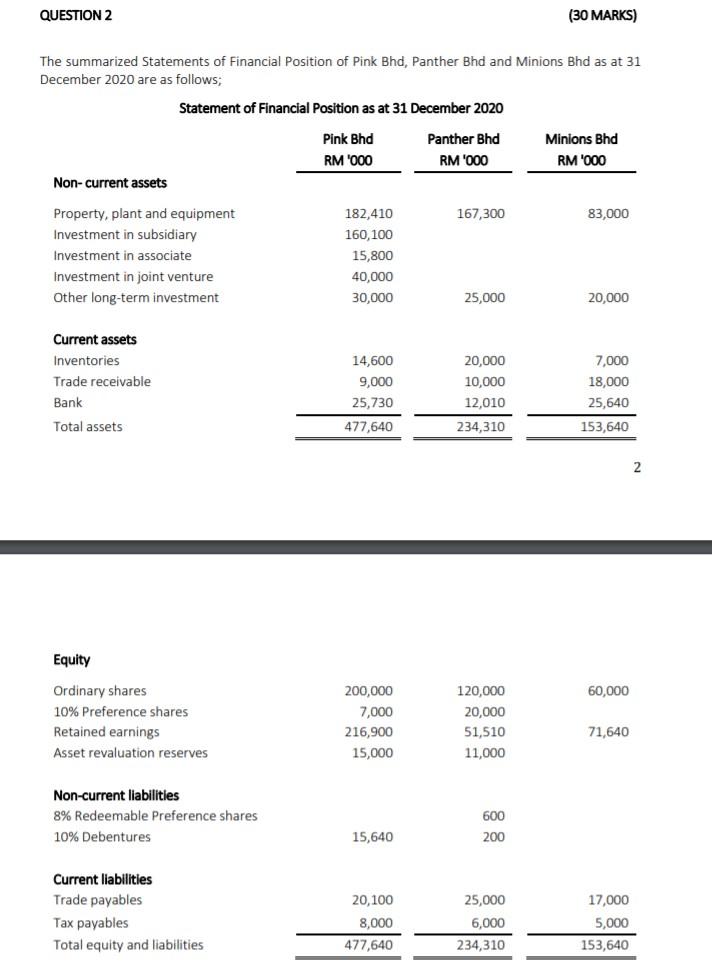

QUESTION 2 (30 MARKS) The summarized Statements of Financial Position of Pink Bhd, Panther Bhd and Minions Bhd as at 31 December 2020 are as follows; Statement of Financial Position as at 31 December 2020 Pink Bhd RM 1000 Panther Bhd RM 1000 Minions Bhd RM 1000 Non-current assets 167,300 83,000 Property, plant and equipment Investment in subsidiary Investment in associate Investment in joint venture Other long-term investment 182,410 160,100 15,800 40,000 30,000 25,000 20,000 Current assets Inventories Trade receivable Bank 14,600 9,000 25,730 477,640 20,000 10,000 12,010 7,000 18,000 25,640 153,640 Total assets 234,310 2 Equity 60,000 Ordinary shares 10% Preference shares Retained earnings Asset revaluation reserves 200,000 7,000 216,900 15,000 120,000 20,000 51,510 11,000 71,640 Non-current liabilities 8% Redeemable Preference shares 10% Debentures 600 200 15,640 Current liabilities Trade payables Tax payables Total equity and liabilities 20,100 8,000 477,640 25,000 6,000 234,310 17,000 5,000 153,640Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started