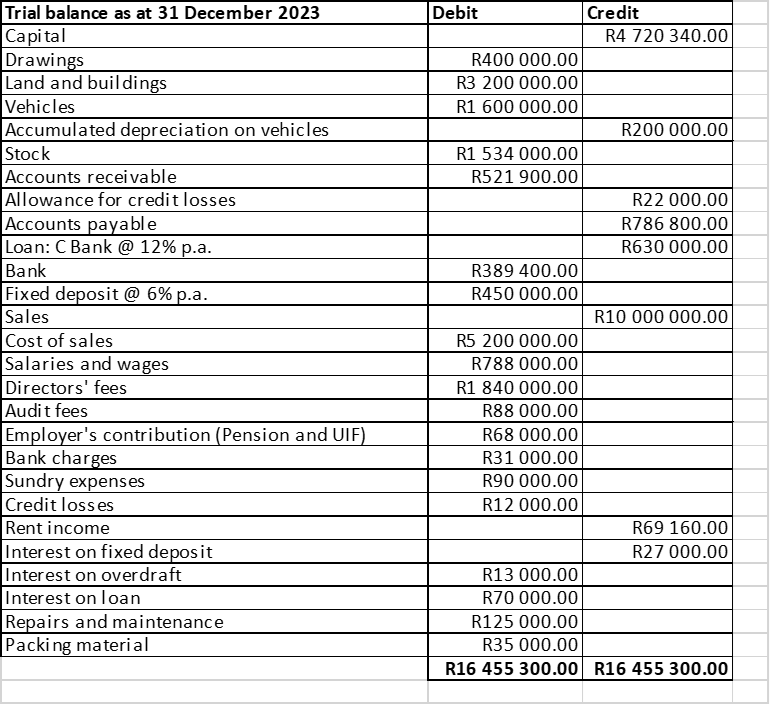

Question

Additional information 1. Packing material to the value of R31 000 was used for the year ended 31 December 2023. 2. The allowance for credit

Additional information 1. Packing material to the value of R31 000 was used for the year ended 31 December 2023. 2. The allowance for credit losses must be adjusted to 4% of outstanding debtors. 3. Aldridge Builders was paid R105 000 for: The construction of a storeroom: R80 000 Repairs to paving: R25 000 The entire amount was debited to Land and buildings in error. 4. Rent income with an amount of R5 720 for January 2024 has already been received. 5. Interest on a loan of R5 600 is yet to be paid for the 2023 financial year. 6. Depreciation Depreciation on vehicles is at 10% per annum on diminishing balance. Note: A new vehicle was acquired at a cost of R600 000 on 2 June 2023. This purchase has already been recorded. You are required to: a) Prepare the Statement of profit or loss and other comprehensive income of SS Ltd for the year ended 31 December 2023. (25) b) Prepare the Statement of financial position of SS Ltd as at 31 December 2023. (25) - Notes are required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started