Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional Information: 1. Prepaid insurance amount paid above covers the period from 1 July 2022 till 30 June 2024. 2. Stationeries received and used during

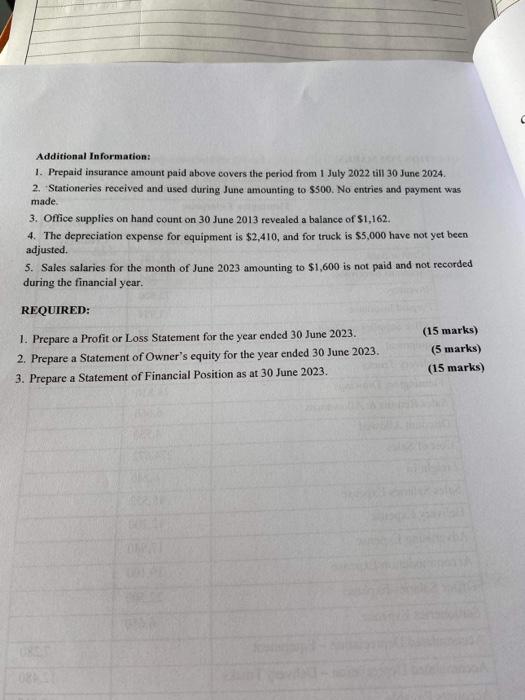

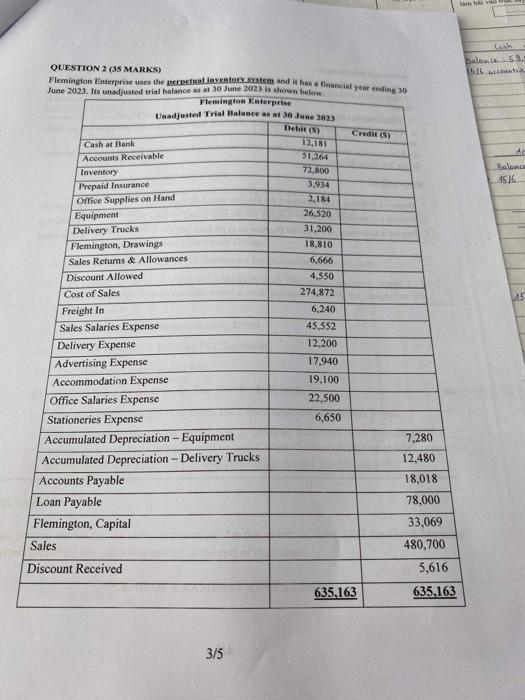

Additional Information: 1. Prepaid insurance amount paid above covers the period from 1 July 2022 till 30 June 2024. 2. Stationeries received and used during June amounting to $500. No entries and payment was made. 3. Office supplies on hand count on 30 June 2013 revealed a balance of $1,162. 4. The depreciation expense for equipment is $2,410, and for truck is $5,000 have not yet been adjusted. 5. Sales salaries for the month of June 2023 amounting to $1,600 is not paid and not recorded during the financial year. REQUIRED: Qui 1. Prepare a Profit or Loss Statement for the year ended 30 June 2023. 2. Prepare a Statement of Owner's equity for the year ended 30 June 2023. 3. Prepare a Statement of Financial Position as at 30 June 2023. DAS (15 marks) (5 marks) (15 marks) C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started