Question

Additional information: a.Depreciation for the financial year ending 31 December 2018 for property, plant and equipment have been charged and included in the accumulated depreciation

Additional information:

a.Depreciation for the financial year ending 31 December 2018 for property, plant and equipment have been charged and included in the accumulated depreciation account in the trial balance.

b.The company received a grant worth RM6,000 on 15 December 2018. It was an incentive by the government for retraining a group of its employees. The three-month training started in December 2018 has a cost of RM10,000 a month.None of the transactions related to the above has been recorded.

c.Included in the long-termloans is a loan worth RM4,000,000 at 5% annual interest, granted by a local bank on 1 August 2018, for five-year period. Instalment for the month of December 2018 has not been paid yet and the related interest for the instalment was RM15,200.None of thetransactions related to the above has been recorded.

d.The intangible asset was capitalised from the cost of research and development made by the company between 2016 and 2017, recognised in December 2017. The asset that resulted from the research and development process will last for 60 years and it is the companys policy to amortise the intangible assets over 10 years.No record has been made in relation to the amortisation for the financial year 2018.

e.Kindex Berhad is in the middle of a court case with Kinoyu Berhad. Kindex Berhad refused to accept a batch of goods delivered to it in January 2018 due to its misspecification. Consequently, Kinoyu Berhad is suing Kindex Berhad in August 2018 and asking for a compensation of RM3,000,000 for breaking their trade contract. At the end of December 2018, the lawyers that represent Kindex Berhad gives a 50-50 percent chance to win.

f.Stocktake as at 31 December 2018 revealed inventory cost amount of RM80,600,000. However, one batch of the inventory was damaged and need to be repackaged. The cost of repackaging was RM5,000 to enable it to be sold at RM110,000. The cost for the batch was RM100,000.

Required:

(i)Show the necessary adjusting journal entries for the additional information above. (20marks)

(ii)Prepare Statement of Profit or Loss and Other Comprehensive Income for financial year ended 31 December 2018 for Kindex Berhad. (10marks)

(iii)Prepare Statement of Financial Position as at 31 December 2018 for Kindex Berhad. (10 marks )

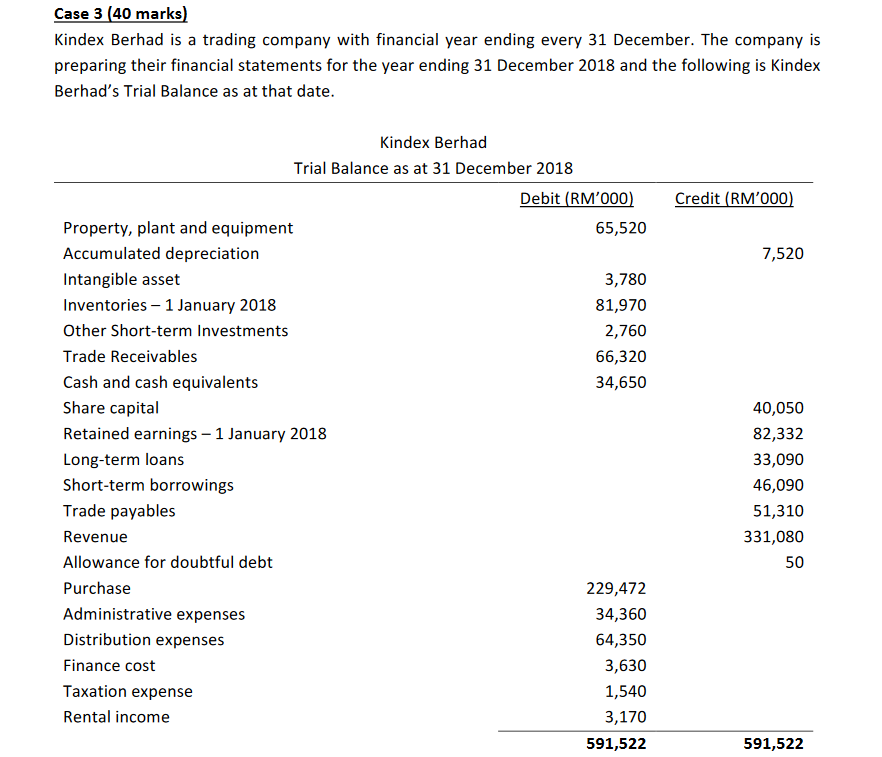

Case 3 (40 marks) Kindex Berhad is a trading company with financial year ending every 31 December. The company is preparing their financial statements for the year ending 31 December 2018 and the following is Kindex Berhad's Trial Balance as at that date. Credit (RM'000) 7,520 Kindex Berhad Trial Balance as at 31 December 2018 Debit (RM'000) Property, plant and equipment 65,520 Accumulated depreciation Intangible asset 3,780 Inventories 1 January 2018 81,970 Other Short-term Investments 2,760 Trade Receivables 66,320 Cash and cash equivalents 34,650 Share capital Retained earnings - 1 January 2018 Long-term loans Short-term borrowings Trade payables Revenue Allowance for doubtful debt Purchase 229,472 Administrative expenses 34,360 Distribution expenses 64,350 Finance cost 3,630 Taxation expense 1,540 Rental income 3,170 591,522 40,050 82,332 33,090 46,090 51,310 331,080 50 591,522 Case 3 (40 marks) Kindex Berhad is a trading company with financial year ending every 31 December. The company is preparing their financial statements for the year ending 31 December 2018 and the following is Kindex Berhad's Trial Balance as at that date. Credit (RM'000) 7,520 Kindex Berhad Trial Balance as at 31 December 2018 Debit (RM'000) Property, plant and equipment 65,520 Accumulated depreciation Intangible asset 3,780 Inventories 1 January 2018 81,970 Other Short-term Investments 2,760 Trade Receivables 66,320 Cash and cash equivalents 34,650 Share capital Retained earnings - 1 January 2018 Long-term loans Short-term borrowings Trade payables Revenue Allowance for doubtful debt Purchase 229,472 Administrative expenses 34,360 Distribution expenses 64,350 Finance cost 3,630 Taxation expense 1,540 Rental income 3,170 591,522 40,050 82,332 33,090 46,090 51,310 331,080 50 591,522Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started