Answered step by step

Verified Expert Solution

Question

1 Approved Answer

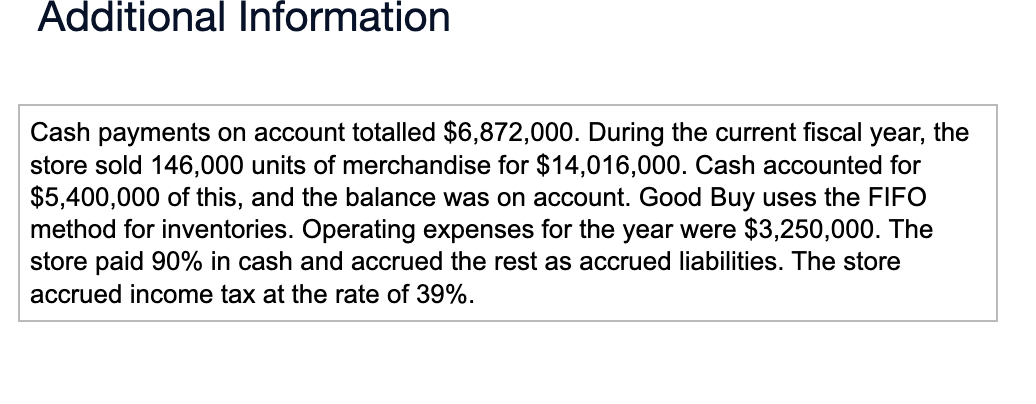

Additional Information Cash payments on account totalled $6,872,000. During the current fiscal year, the store sold 146,000 units of merchandise for $14,016,000. Cash accounted for

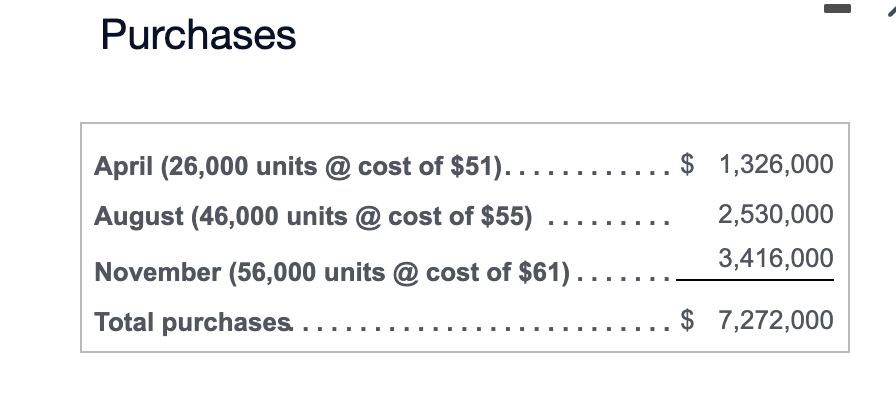

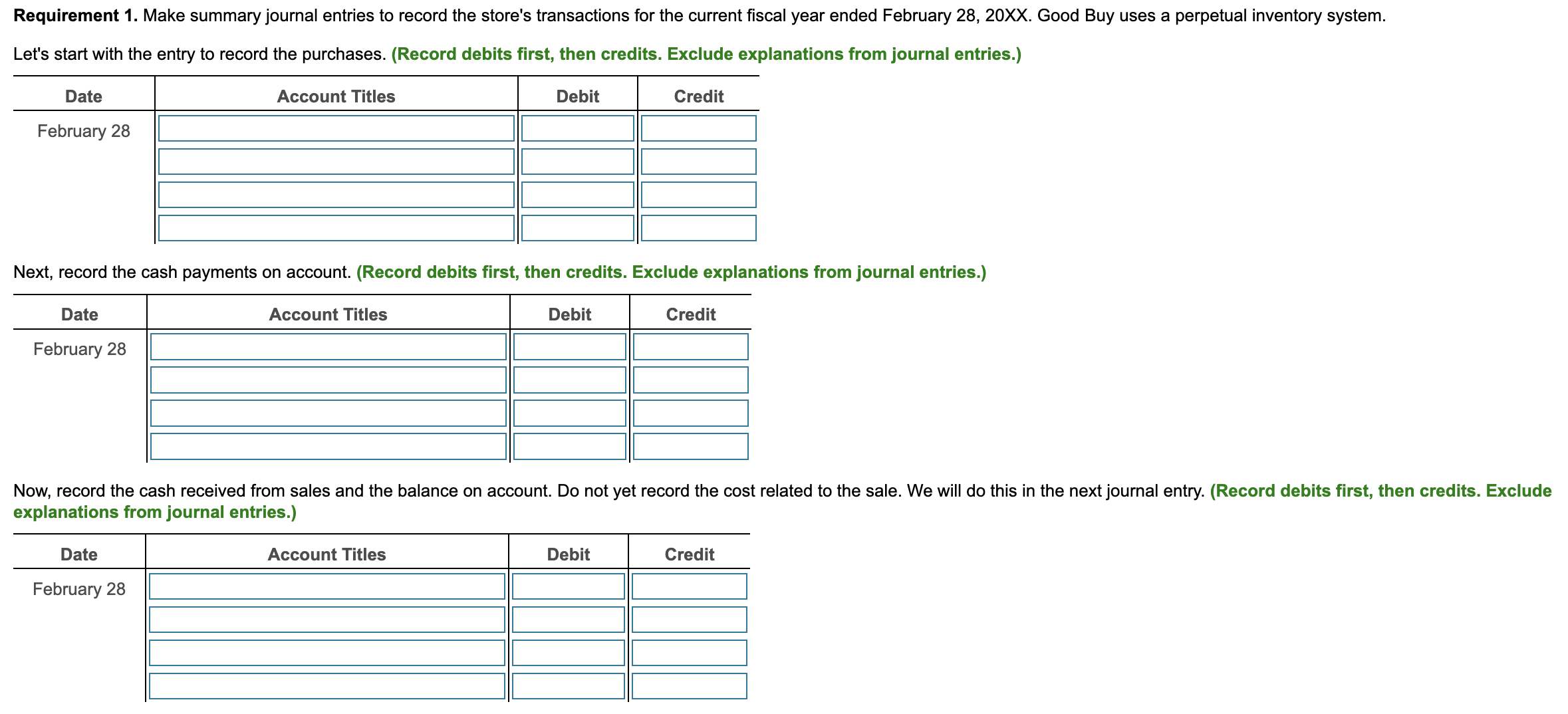

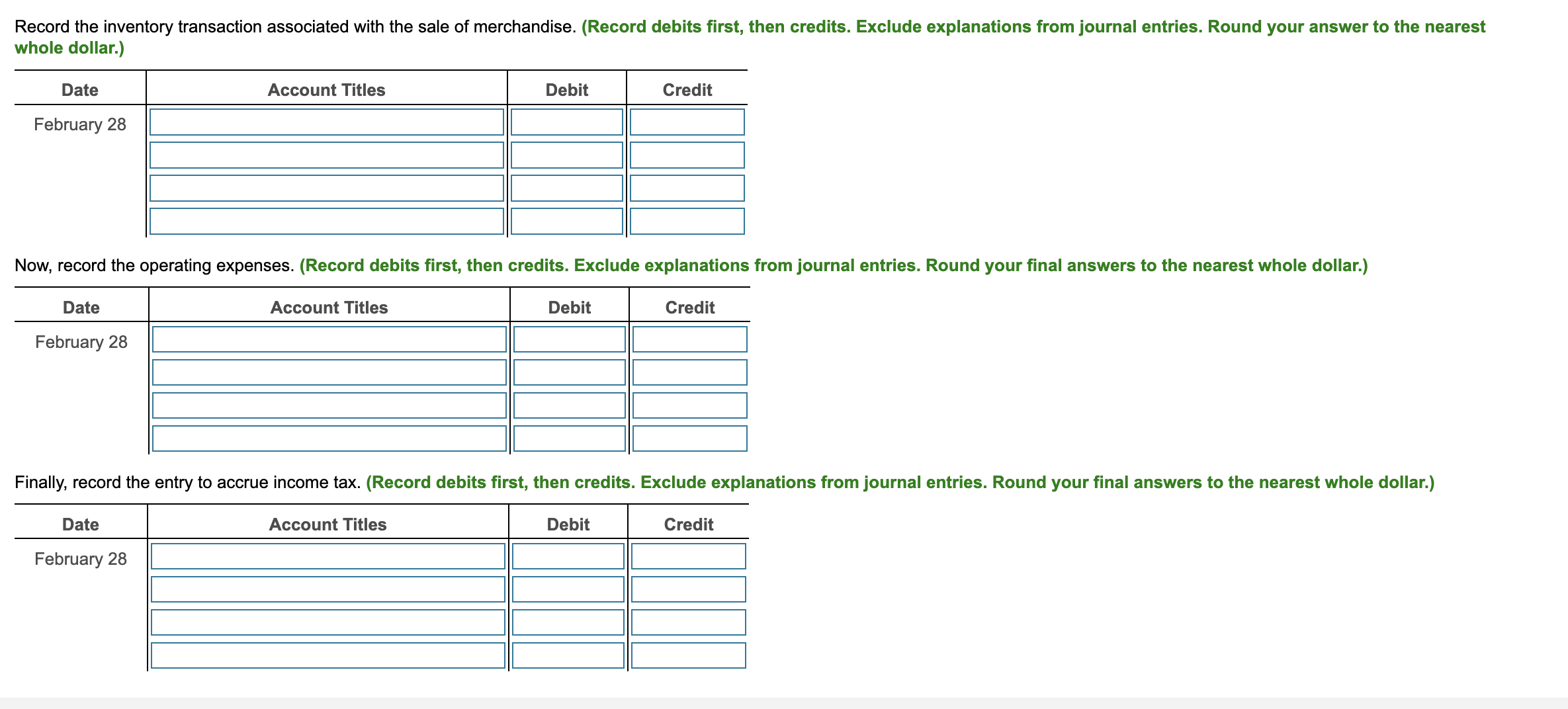

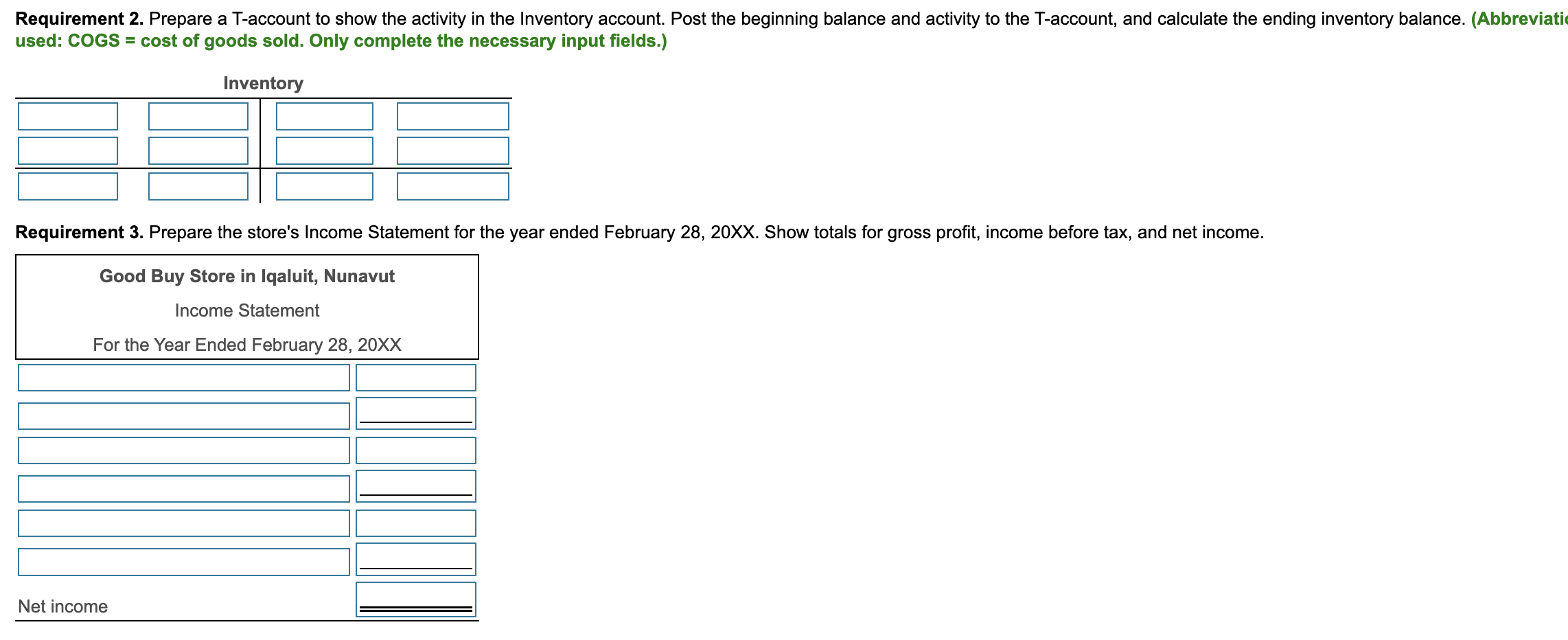

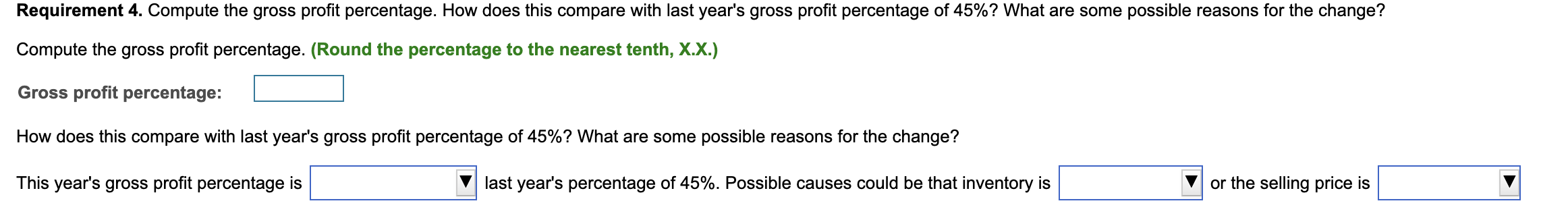

Additional Information Cash payments on account totalled $6,872,000. During the current fiscal year, the store sold 146,000 units of merchandise for $14,016,000. Cash accounted for $5,400,000 of this, and the balance was on account. Good Buy uses the FIFO method for inventories. Operating expenses for the year were $3,250,000. The store paid 90% in cash and accrued the rest as accrued liabilities. The store accrued income tax at the rate of 39%. Compute the gross profit percentage. (Round the percentage to the nearest tenth, X.X.) Gross profit percentage: How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? This year's gross profit percentage is last year's percentage of 45%. Possible causes could be that inventory is or the selling price is used: COGS = cost of goods sold. Only complete the necessary input fields.) Inventory \begin{tabular}{ll|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Requirement 3. Prepare the store's Income Statement for the year ended February 28, 20XX. Show totals for gross profit, income before tax, and net income. Purchases whole dollar.) \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Requirement 1. Make summary journal entries to record the store's transactions for the current fiscal year ended February 28,20XX. Good Buy uses a perpetual inventory system. Let's start with the entry to record the purchases. (Record debits first, then credits. Exclude explanations from journal entries.) Additional Information Cash payments on account totalled $6,872,000. During the current fiscal year, the store sold 146,000 units of merchandise for $14,016,000. Cash accounted for $5,400,000 of this, and the balance was on account. Good Buy uses the FIFO method for inventories. Operating expenses for the year were $3,250,000. The store paid 90% in cash and accrued the rest as accrued liabilities. The store accrued income tax at the rate of 39%. Compute the gross profit percentage. (Round the percentage to the nearest tenth, X.X.) Gross profit percentage: How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? This year's gross profit percentage is last year's percentage of 45%. Possible causes could be that inventory is or the selling price is used: COGS = cost of goods sold. Only complete the necessary input fields.) Inventory \begin{tabular}{ll|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Requirement 3. Prepare the store's Income Statement for the year ended February 28, 20XX. Show totals for gross profit, income before tax, and net income. Purchases whole dollar.) \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Requirement 1. Make summary journal entries to record the store's transactions for the current fiscal year ended February 28,20XX. Good Buy uses a perpetual inventory system. Let's start with the entry to record the purchases. (Record debits first, then credits. Exclude explanations from journal entries.)

Additional Information Cash payments on account totalled $6,872,000. During the current fiscal year, the store sold 146,000 units of merchandise for $14,016,000. Cash accounted for $5,400,000 of this, and the balance was on account. Good Buy uses the FIFO method for inventories. Operating expenses for the year were $3,250,000. The store paid 90% in cash and accrued the rest as accrued liabilities. The store accrued income tax at the rate of 39%. Compute the gross profit percentage. (Round the percentage to the nearest tenth, X.X.) Gross profit percentage: How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? This year's gross profit percentage is last year's percentage of 45%. Possible causes could be that inventory is or the selling price is used: COGS = cost of goods sold. Only complete the necessary input fields.) Inventory \begin{tabular}{ll|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Requirement 3. Prepare the store's Income Statement for the year ended February 28, 20XX. Show totals for gross profit, income before tax, and net income. Purchases whole dollar.) \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Requirement 1. Make summary journal entries to record the store's transactions for the current fiscal year ended February 28,20XX. Good Buy uses a perpetual inventory system. Let's start with the entry to record the purchases. (Record debits first, then credits. Exclude explanations from journal entries.) Additional Information Cash payments on account totalled $6,872,000. During the current fiscal year, the store sold 146,000 units of merchandise for $14,016,000. Cash accounted for $5,400,000 of this, and the balance was on account. Good Buy uses the FIFO method for inventories. Operating expenses for the year were $3,250,000. The store paid 90% in cash and accrued the rest as accrued liabilities. The store accrued income tax at the rate of 39%. Compute the gross profit percentage. (Round the percentage to the nearest tenth, X.X.) Gross profit percentage: How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? This year's gross profit percentage is last year's percentage of 45%. Possible causes could be that inventory is or the selling price is used: COGS = cost of goods sold. Only complete the necessary input fields.) Inventory \begin{tabular}{ll|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Requirement 3. Prepare the store's Income Statement for the year ended February 28, 20XX. Show totals for gross profit, income before tax, and net income. Purchases whole dollar.) \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles & Debit & Credit \\ \hline \multicolumn{4}{|c|}{ February 28} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Requirement 1. Make summary journal entries to record the store's transactions for the current fiscal year ended February 28,20XX. Good Buy uses a perpetual inventory system. Let's start with the entry to record the purchases. (Record debits first, then credits. Exclude explanations from journal entries.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started