Question

Additional information during the year: All sales were on credit and the company purchased all inventory on credit. The company sold some land for cash.

Additional information during the year:

- All sales were on credit and the company purchased all inventory on credit.

- The company sold some land for cash.

- The company sold an equipment (carrying value of $36,000 and an original cost of $41,000).

- The company did not sell any buildings during the financial year.

- The company did not purchase any new land during the financial year.

- The company revalued their land upwards this year. The company did not revalue any other non-current assets.

- The company issued $10,000 worth of bonus shares out of revaluation reserves.

Question 21

Question text

How much is the depreciation expense for buildings for the year ended 30 June 2020?

Select one:

a. $11,000

b. $5,000

c. $23,000

d. $21,000

e. $10,000

Question 22

Question text

How much is the amount of cash proceeds from sale of equipment for the year ended 30 June 2020?

Select one:

a. $34,000

b. $2,000

c. $41,000

d. $5,000

e. $48,000

Question 23

Question text

How much is the cash payment amount for interest for the year ended 30 June 2020?

Select one:

a. $21,000

b. $0

c. $23,000

d. $20,000

e. $3,000

Question 24

Question text

Which of the following statement is correct about the indirect method?

Select one:

a. Net profit is calculated using accrual accounting, and therefore needs to be adjusted for permanent and timing differences to derive the cash flows from operation.

b. Loss on sale of equipment is a timing difference which will reverse over time.

c. Any increase in the allowance for doubtful debts should be deducted from net profit in the indirect method.

d. The indirect method reconciles the net profit to the cash flows from financing.

e. The amount of cash flow from investing activities will be different under direct and indirect method.

Question 25

Question text

Which of the following is incorrect for the year ended 30 June 2020?

Select one:

a. The company transferred $15,000 from Retained profits to General reserve

b. Cash received from interest is $1,000

c. Cash payment for wages and salaries is $65,400

d. $194,600 net profit after tax is included on the debit side of Retained profits T-account.

e. Cash received from dividends is $0.

Question 26

Question text

How much is the cash payment amount for tax for the year ended 30 June 2020?

Select one:

a. $68,200

b. $65,000

c. $67,200

d. $15,000

e. $11,800

Question 27

Question text

Which of the following would be added back to profit in ABCs indirect method to calculate cash flows from operations:

Select one:

a. Decrease on short-term loan 55,000

b. Increase in Accounts receivable 40,500

c. Gain on sale of land 5,000

d. Loss on sale of equipment 2,000

e. Decrease in tax payable 2,200

Question 28

Question text

How much is the amount of cash proceeds from share issue for the year ended 30 June 2020?

Select one:

a. $220,000

b. $280,000

c. $60,000

d. $160,000

e. $150,000

Question 29

Question text

How much is the amount of cash payment for the purchase of equipment for the year ended 30 June 2020?

Select one:

a. $166,000

b. $68,000

c. $41,000

d. $165,000

e. $124,000

Question 30

Question text

What is the value of inventory bought on credit for the year ended 30 June 2020?

Select one:

a. $465,000

b. $489,800

c. $509,000

d. $75,200

e. $508,000

Question 31

Question text

What is the depreciation expense for equipment for the year ended 30 June 2020?

Select one:

a. $28,000

b. $23,000

c. $5,000

d. $10,000

e. $33,000

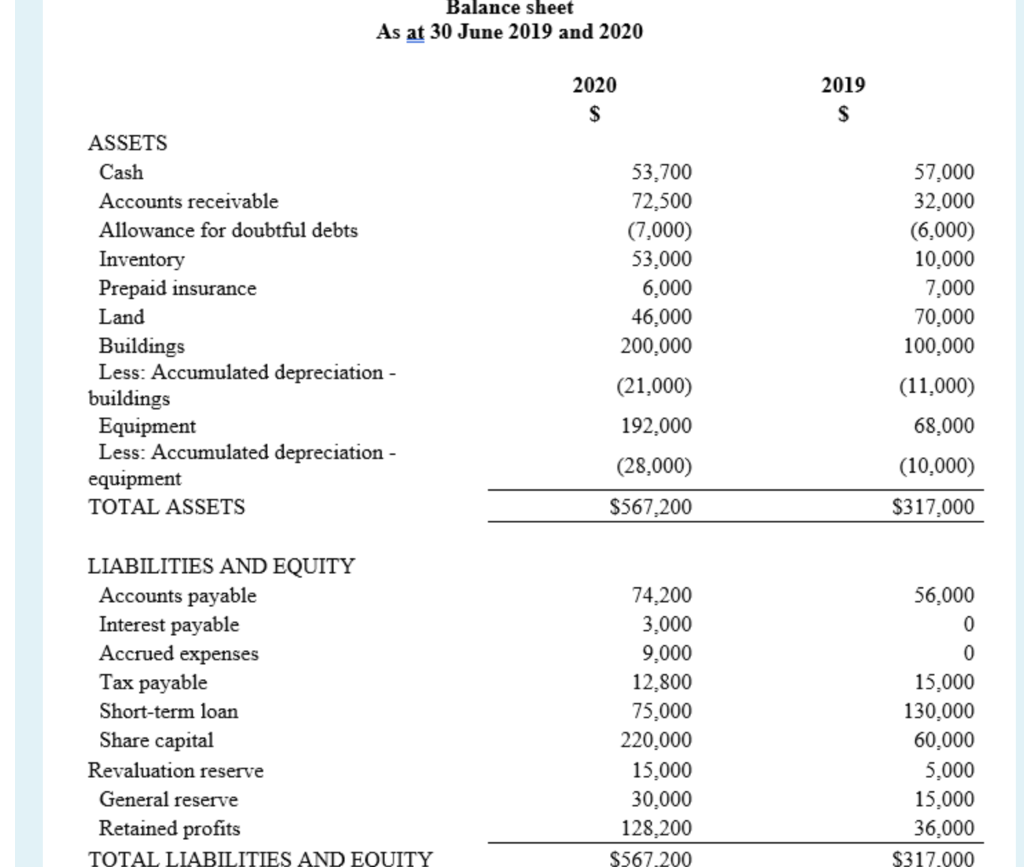

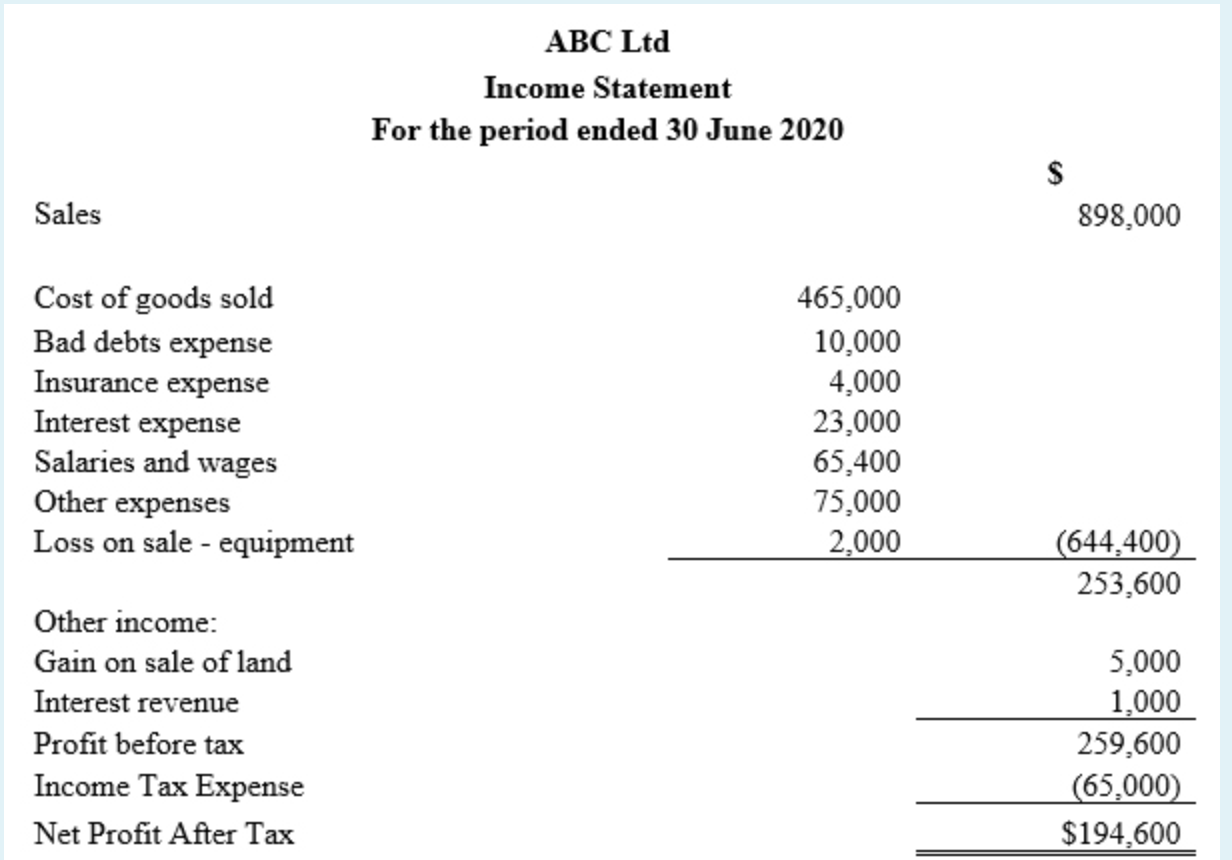

Balance sheet As at 30 June 2019 and 2020 2020 $ 2019 $ ASSETS Cash Accounts receivable Allowance for doubtful debts Inventory Prepaid insurance Land Buildings Less: Accumulated depreciation - buildings Equipment Less: Accumulated depreciation - equipment TOTAL ASSETS 53,700 72,500 (7,000) 53,000 6,000 46,000 200,000 (21,000) 192,000 (28,000) 57,000 32,000 (6.000) 10,000 7,000 70,000 100,000 (11,000) 68,000 (10,000) $567,200 $317,000 LIABILITIES AND EQUITY Accounts payable Interest payable Accrued expenses Tax payable Short-term loan Share capital Revaluation reserve General reserve Retained profits TOTAL LIABILITIES AND EQUITY 74.200 3,000 9,000 12,800 75,000 220,000 15,000 30,000 128,200 $567.200 56,000 0 0 15,000 130,000 60,000 5,000 15,000 36,000 $317.000 ABC Ltd Income Statement For the period ended 30 June 2020 $ 898,000 Sales Cost of goods sold Bad debts expense Insurance expense Interest expense Salaries and wages Other expenses Loss on sale - equipment 465,000 10,000 4,000 23,000 65,400 75,000 2,000 (644,400) 253,600 Other income: Gain on sale of land Interest revenue Profit before tax Income Tax Expense Net Profit After Tax 5,000 1,000 259,600 (65,000) $194,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started