Answered step by step

Verified Expert Solution

Question

1 Approved Answer

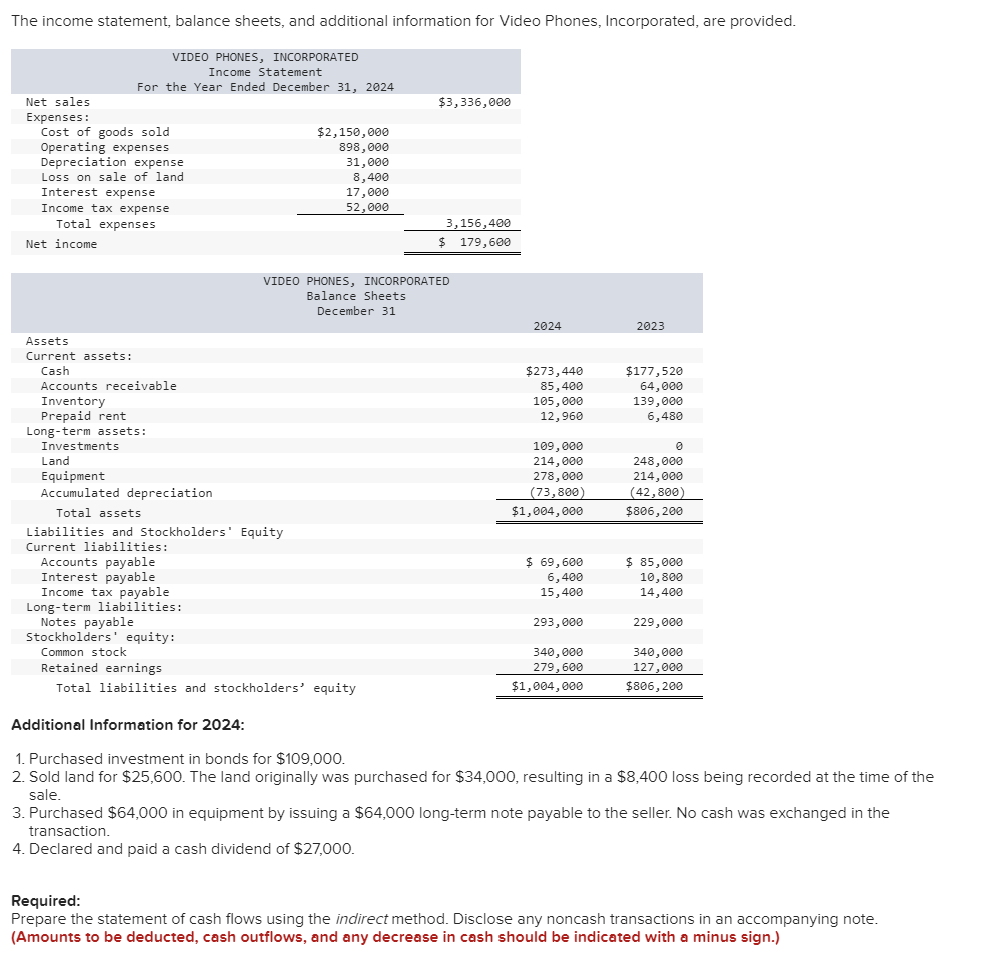

Additional Information for 2024 : 1. Purchased investment in bonds for $109,000. 2. Sold land for $25,600. The land originally was purchased for $34,000, resulting

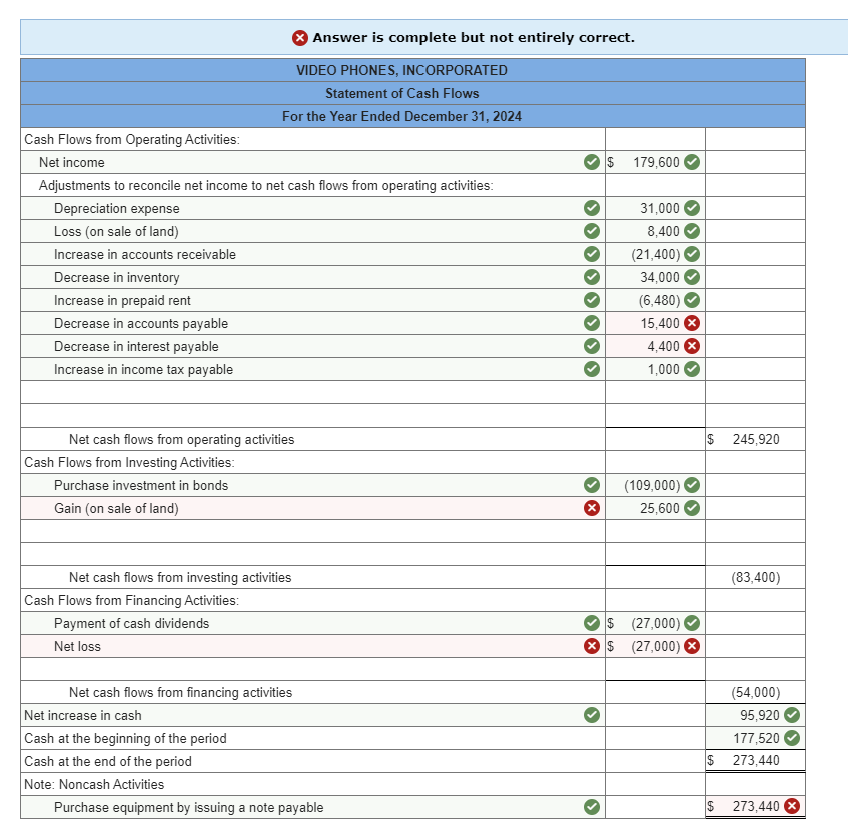

Additional Information for 2024 : 1. Purchased investment in bonds for $109,000. 2. Sold land for $25,600. The land originally was purchased for $34,000, resulting in a $8,400 loss being recorded at the time of the sale. 3. Purchased $64,000 in equipment by issuing a $64,000 long-term note payable to the seller. No cash was exchanged in the transaction. 4. Declared and paid a cash dividend of $27,000. Required: Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying note. (Amounts to be deducted, cash outflows, and any decrease in cash should be indicated with a minus sign.) Answer is complete but not entirely correct. VIDEO PHONES, INCORPORATED Statement of Cash Flows For the Year Ended December 31, 2024 Cash Flows from Operating Activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started